Companies don't always reflexively carry out a payroll and social security audit, but are delighted when it's over.

Performing an audit is essential for a number of reasons, which we'll explain in detail below.

The first reason to carry out a payroll and social security audit: the 2024 URSSAF audit results

URSSAF's annual activity report, for the year 2024published in August 2025 gives the following assessment of the controls carried out:

- URSSAF controls have led to the regularization of 890 million euros (+11 % compared with 2023),

- including 734 million euros in reassessments owed by companies,

- and 156 million euros in refunds to companies that had overpaid Urssaf.

Faced with these very high amounts of reassessments, increased vigilance in the application of laws and regulations is imperative, but payroll teams don't always have the time for this.

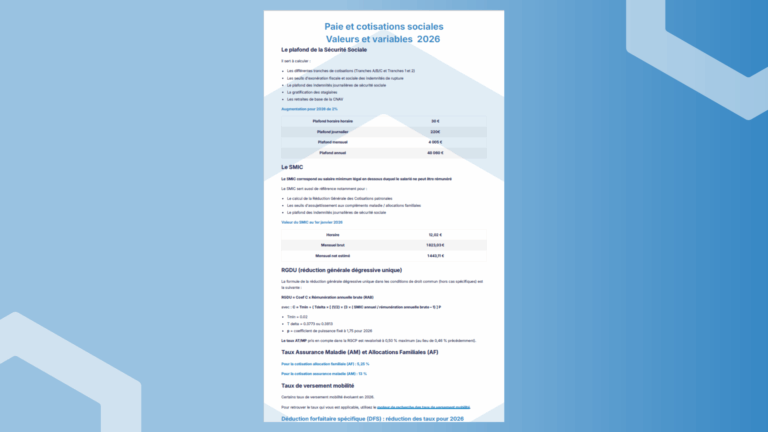

Second reason to carry out a payroll and social security audit: the regulatory context

As you intuitively know, France's normative activity is dense. A report by Senators DEVINAZ, MOGA and RIETMANN in 2023 on "Normative sobriety to strengthen the competitiveness of companies". confirmed this intuition with factual elements:

- France has 400,000 applicable standards,

- 1,786 regulatory decrees were passed in 2022,

- The number of words per law between 2002 and 2021 rose from 322,639 to 591,595 (an increase of 83 %).

Faced with this normative context, according to our estimates, payroll departments would have to spend 600 hours a year reading the news!

Third reason to carry out a payroll and social security audit: the context of payroll teams

The payroll department is at the heart of the company's reactor and plays a strategic role. What would a company do without a payroll team, or with one that was failing? Incorrect DSNs, unpaid or incorrectly paid wages...

In spite of everything, the payroll teams are present and committed, whatever the cost. These payroll teams whose role is not "simply" to press a button!

Payroll teams are therefore highly sensitive within an organization. The day-to-day work of these teams, combined with the vagaries of replacements, stoppages, entries/exits, etc., makes updating knowledge and practices a complex task.

This is precisely why a payroll audit is so useful. This analysis highlights good practices and those that need to be improved, in order to limit the risk of adjustments or even better receive reimbursements of contributions.

Find out more about our methodology, you can click here or contact our experts for a chat.