The Finance Act and Social Security Financing Act (LFSS) have been promulgated. They were published in the JO on February 15 and 28, 2025 respectively.

Adopted against a backdrop of severe budget constraints, the aim is twofold: to control expenditure and diversify sources of financing.

This context requires companies and employees to adapt quickly to the new rules.

Let's decipher these new measures and their impact on payroll.

Apprenticeship contracts signed on or after March 1, 2025

Apprentices are now paid subject to CSG / CRDS ; however, the partial exemption from employee contributions applies.

The exemption limit for employee contributions is raised from 79 % to 50 % of minimum wage (i.e. from €1,423.45 to €900.92).

As a result, the net salary received by the apprentice employee will be reduced.

Aid for apprentices

The Decree of February 23, 2025 modified the amount of aid for contracts signed on or after February 24, 2025 (for the 1time year of study) :

- 5,000 maximum for companies with fewer than 250 employees (instead of €6,000)

- 2,000 maximum for companies with more than 250 employees6,000 from 2023 to 2024 and from €1 to €0.er January to February 23, 2025)

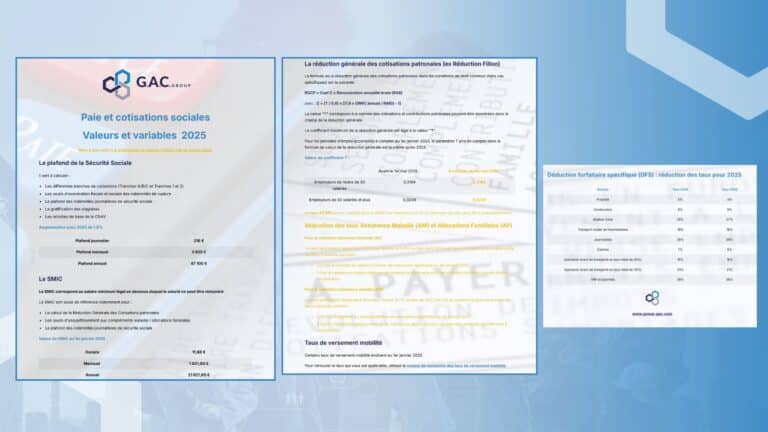

Reconfiguration of reductions in employer contributions

A reform of tax relief is planned in two stages (2025 and 2026). It concerns the general reduction in employers' contributions (RGCP), as well as the reduced rates of employers' health insurance and family allowance contributions.

In 2025

1/ Lower remuneration thresholds for reduced health insurance and family allowance rates :

- Health InsuranceReduced rate to 7 % (instead of 13 %) for remuneration below 2.25 SMIC, compared with 2.5 SMIC previously

- Family allowancesReduced rate to 3.45 % (instead of 5.25 %) for remuneration below 3.3 SMICcompared with 3.5 SMIC previously

2/ Integration of the Value Sharing Bonus (PPV) in the formula for calculating the RGCP coefficient and base.

- AttentionThe first part of this reform is due to take effect retroactively from 1 January.er January 2025: payroll software will need to be able to recalculate and regularize the tax breaks initially declared in January and February 2025. However, exceptions may be made for employees who leave the company during this period.

- To date, the SMIC rate to be taken into account remains unknown. The decrees implementing the LFSS should specify it at a later date.

- This will automatically increase employer contributions for employers eligible for these schemes.

In 2026

The various schemes are to be merged into a single general reduction.

Reduced rates for health insurance and family allowances will be abolished, and the RGCP will be reconfigured. in order to achieve degressivity up to 3 SMIC.

The impact on employers' contributions will be negative overall, but will depend on the pay levels usually applied.

The Bulletin Officiel de la Sécurité Sociale (BOSS) should provide important details on the practical application of this reform in a few weeks' time.

Lowering of the ceiling for Indemnités Journalières paid by Social Security (IJSS) as of April 1, 2025

The reference salary used to calculate the IJSS will be capped at 1.4 SMIC instead of 1.8 SMIC (i.e. €2,522.52 compared with €3,243.24 previously).

If the employer is subject to a salary maintenance obligation, the additional salary paid to compensate for the reduction in IJSS will be higher. In addition, complementary health insurance companies may increase their contributions.

This will lead to an increase in social security contributions, and more generally, an impact on absenteeism.

Increase in specific employer contribution on bonus shares from 20% to 30% as of March 1, 2025

The Finance Act 2025 provides for an extension of the mobility payment to the regions (except Ile-de-France) for employers with at least 11 employees, to finance transport infrastructure.

From 2026 onwards, organizations will be able to introduce a mobility payment rate. capped at 0.15%, which will be added to the existing mobility payment.

Reinforced control systems

The fight against social fraud is being stepped up, with stricter controls. Companies will have to be even more vigilant in managing their files.

These measures, designed to strengthen the financing of Social Security in particular, are actually increasing the financial burden on companies.

Nevertheless, certain sectors and players benefit from specific support measures:

TO-DE exemption for the agricultural sector extended and strengthened

Under this scheme, employers hiring seasonal agricultural workers are exempt from employer contributions up to 1.6 SMIC.

This exemption was due to expire on December 31, 2025. finally becomes perennial with a compensation ceiling raised by 1.20 SMIC to 1.25 SMIC for total exemption (i.e. from €2,162.21 to €2,252.30), retroactive to 1er May 2024.

The LFSS extends the benefit of this scheme to :

- agricultural machinery cooperatives (CUMA)

- fruit and vegetable packing cooperatives

Young Innovative Companies (JEI)

Exemption from employer contributions for employees involved in research and innovation are maintained.

However, the LFSS 2025 raises the threshold for research and development expenditure from 1 January onwards.er March 2025.

To qualify for JEI status, the company must carry out the following activities expenses representing at least 20% of its expenses instead of 15%.

The exemption from employer contributions for companies located in a BER (Bassin d'Emploi à Redynamiser) zone has been extended until December 31, 2027.

This exemption lasts for 5 years on remuneration. up to 1.4 SMIC.

LFSS 2025 extends the scope of circulars' enforceability to all collection agencies, notably the AGIRC-ARRCO supplementary pension fund and the MSA.

Until now, only Social Security circulars were enforceable against URSSAF, thus preventing any reassessment if an employer applied the legislation in accordance with these directives. From now on, this guarantee extends to the other bodies concerned, offering employers greater legal certainty.

In conclusion

The Finance Law and the Social Security Financing Law 2025 mark a turning point for employers with major adjustments to contributions and exemptions, implying an increase in social charges.

Faced with these developments, it is essential for HR and payroll managers to adapt their social security management strategy now, in order to optimize their costs and avoid any possible reassessments.

The support of payroll experts can be an invaluable asset in ensuring compliance and benefiting from existing schemes.

How does your company plan to anticipate these changes? Feel free to share your feedback and questions here.