Find out about the thresholds and penalties for the mandatory carbon footprint (BEGES) in 2026. Who is affected? What are the obligations for SMEs?

2026 Finance Bill: Find out what's new in the parliamentary debates on the CIR, JEI, CICo, and the creation of the JEI à impact.

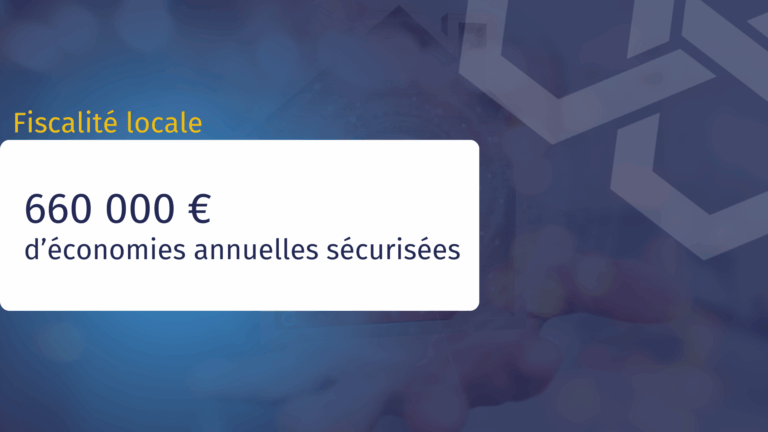

Analysis of more than 80 administrative court rulings (May-June 2025) on local taxation. Assessment principles, exemptions (CGI 1382, 11°), and procedural guarantees to secure your taxes.

HR/Payroll teams: Get up to speed on the key developments for 2026. Prioritize short-term actions and anticipate the impact on your payroll in 45 minutes.

Discover new IP Box case law on reporting rules

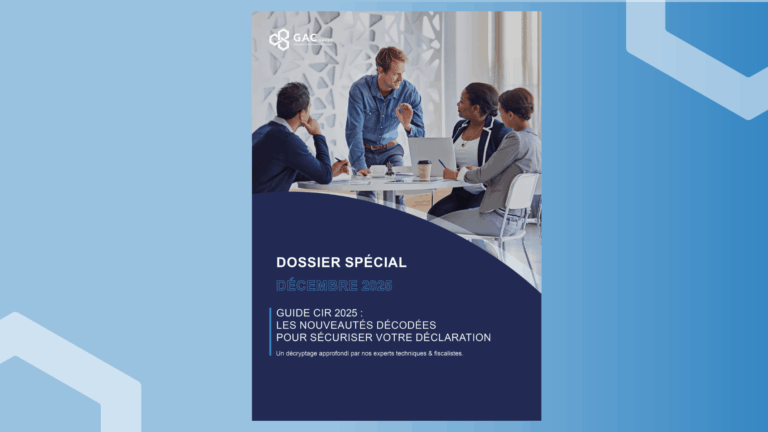

Decipher the 2025 CIR Guide and secure your declaration. Our expert analysis details the changes, formalities (approvals, technical file), and concrete impacts on your CIR. Download our file!

Since 2023, the DSN has been synonymous with CRM corrections to be processed and time spent “catching up” on errors to avoid substitute DSNs. This model is on its last legs: correcting the DSN means you're already behind. True performance now means anticipating, by making the DSN more reliable at every stage of the payroll cycle.

Discover the Carbon Footprint method, the six key steps, Scopes 1-2-3, and the tools for calculating GHG emissions and structuring your climate strategy.

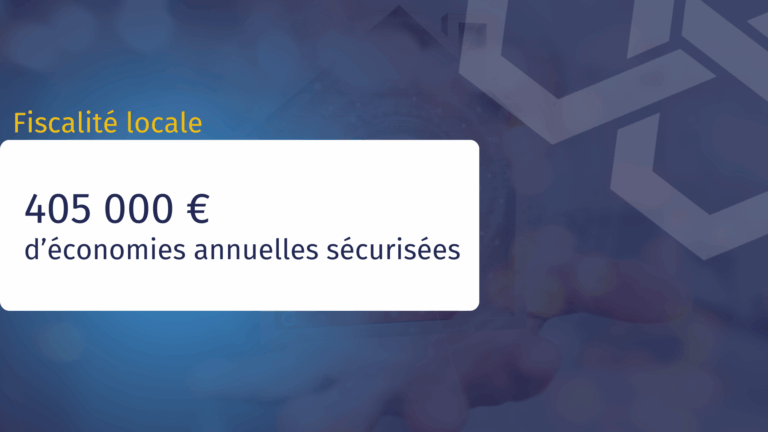

Discover the full case study of a large retail real estate investment company facing a €480,000 tax adjustment. Our experts applied Article 151A to secure €405,000 in annual savings.

Discover the full case study of a large retail real estate investment company facing a €480,000 tax adjustment. Our experts applied Article 151A to secure €405,000 in annual savings.

Faced with budgetary uncertainty in 2026, discover the four levers that CFOs can use: public aid, tax financing (CIR/CII), local tax audits, and HR optimization to generate cash quickly.

Optimize your payroll taxes and your DSN (Déclaration Sociale Nominative) with a structured audit. Secure your budget, anticipate URSSAF (French social security) audits, and finance your priority HR projects.

2026 Social Security Financing Bill: adoption schedule, role of the National Assembly/Senate, risks of delays, and key measures impacting employers and payroll

Services

Sectors