Discover the key measures of the 2026 draft finance bill and their impact on the CIR, CII, JEI, etc.

Temporary employment AT/MP reform: what impact will Decree 2024 have? Take part in the webinar on November 18 and anticipate your obligations and costs.

SEEPH 2025: we offer actions that enable you to get the collective on board and anchor knowledge beyond SEEPH...Ready?

By decree of July 5, 2024, the distribution of charges for temporary workers' compensation has been modified, and we explain this in detail.

Discover the challenges of the 2026 draft finance bill and the debates surrounding the CIR (research tax credit)

Discover the testimonial of Florent LACOCHE, Head of Shared Services EMEA at Kering

Discover the advantages of IP Box and our tips for securing your tax return

2026 Social Security Financing Bill and developments during the week of October 27, 2025: Following the committee stage in the Social Affairs Committee, certain measures were amended, deleted, or added.

2026 Social Security Financing Bill: what will change for payroll and total labor costs in a context of budgetary constraints and the pursuit of social efficiency

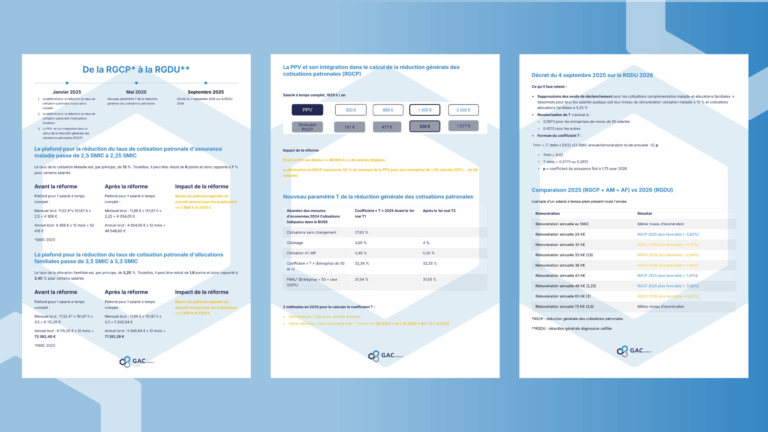

AM/AF ceilings, T 2025 parameter, PPV, and decree of September 4, 2025: understand the transition from RGCP to RGDU 2026 and secure your employer costs.

Analysis of more than 80 administrative court rulings (May-June 2025) on local taxation. Assessment principles, exemptions (CGI 1382, 11°), and procedural guarantees to secure your taxes.

Discover the CPO's conclusions on the impact of tax policies on innovation.

Discover how AI contributes to decarbonization

Discover the CPO's conclusions on the impact of tax policies on innovation.

Services

Sectors