In this article, we summarize the key points of the "Green Industry" bill to promote the decarbonization of industry: its potential impact on corporate taxation, the Research Tax Credit and the future of the green CIR. Our innovation tax experts have deciphered this bill for you.

The "Green Industry" bill: the main points

As part of the reindustrialization policyAt the start of 2023, Bruno Lemaire (French Minister of the Economy, Finance, Industrial Sovereignty and Digital Affairs) is calling for a green industry bill. This project must be "It's simple, short and effective, and will be a game-changer for green industry. says the Minister.

It provides for the project to be "At constant cost to public spending". As a result, the subject can have an impact on other sectors, notably tax, and the CIR could undergo some readjustmentsdownwards. Against this backdrop, working groups have been set up by ministers Bruno Lemaire and Roland Lescure, with the aim ofstudy different ways of decarbonizing French industry.

Several projects have been launched:

- Project 1: Transforming taxation to help green industry grow;

- Task 2: Open factories, rehabilitate wasteland, make land available ;

- Task 3: Produce, order and buy in France ;

- Area 4: Financing France's green industry ;

- Project 5: Training for jobs in green industry.

The "Green Industry" bill: what impact could it have on the CIR?

The Research Tax Credit (Crédit Impôt Recherche - CIR) is discussed in Workstream 4: "Financing France's green industryin a section "Financing the measures announced. The measurements are presented as measures that "This will make it possible to reallocate part of the budgetary and fiscal effort to the development of low-carbon industry.. The press release explains that "the financing of the measures presented here must be ensured by budgetary and fiscal compensation measures". The same press release proposes the following solution "to act on several levers.

What levers are envisaged to finance Green Industry?

It is suggested to :

- Increase certain reduced rates of the domestic consumption tax on energy products ("TICPE");

- Act on the automobile bonus/malus system, for example by increasing the malus on the most polluting vehicles;

- The tax on company vehicles (TVS) could also be "reinforced";

- Certain benefits attached to the CIR could be "re-interrogated". Examples include "Double the CIR for young doctors or take into account technology watch expenses"..

The green CIR: what happens to it?

No reference is made to the green CIR, the trail of a "greening For the time being, therefore, the "Research Tax Credit" seems to have been abandoned..

However, one of the avenues suggested by worksite 1 "Transforming taxation to boost green industry is "Supporting green production with tax credits.

The production of key technologies: Batteries & Metals, Electrolysers, Heat Pumps, New Generation Nuclear, Photovoltaics & Wind, Carbon Capture, Utilization & Storage, Semiconductors, Power Grids, would thus result in producer's right to "a tax credit or subsidy depending on the amount of the investment or, if possible, the quantity of products manufactured in France".. This aid would be provided rapidly: pre-financing, early payment or even mechanisms for additional depreciation are all mentioned.

Towards a tax credit for green industry?

It should also be noted that a "Concertation Industrie Verte is open until April 24, 2023, one of the proposed themes specifically concerned the creation of a tax credit "for all cutting-edge technologies for green industry"..

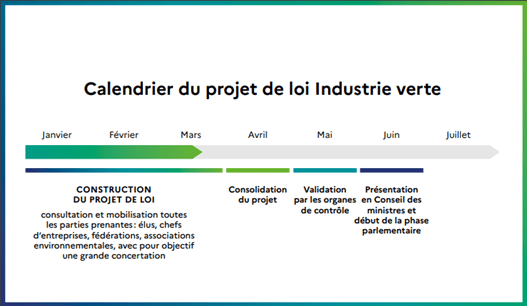

For the time being, the bill is still under consultation. It will be consolidated over the coming months, validated by the supervisory bodies in May, and presented to the Council of Ministers and parliamentarians in the summer of 2023.

Source: https://www.economie.gouv.fr/

To find out more, read the consultation report "Green Industry Bill

Any doubts about how to manage your CIR?

Make an appointment for a free audit

Newsletter

Receive all our expert news by e-mail.

Subscribe to our newsletter.