On March 13, 2024, the decree specifying the entry into force of the green industry investment tax credit (hereinafter referred to as the "C3IV") was published on the official gazette website.

As a reminder, in the event of a request for approval, the administration undertakes to respond within three months following receipt of the complete file.

In particular, the decree provides for a three-year period for the authorities to verify that approval has been granted for the planned work.

The text also stipulates that for approval applications submitted after September 27, 2023, the three-month response period will run from the date of entry into force of this decree.

In addition, a "establishing the list of equipment, essential components and raw materials used". was published on the JO website on March 13, 2024.

This order lists elements that can be taken into account for C3IV expenses.

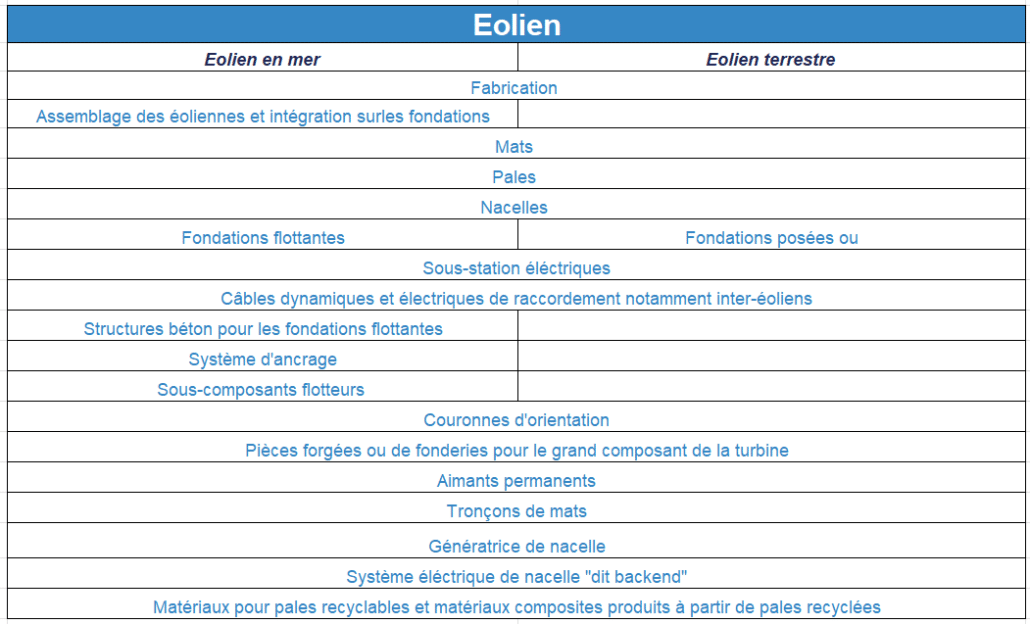

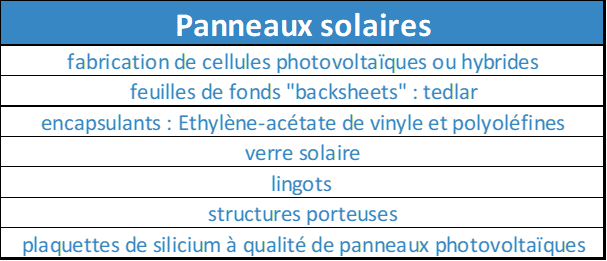

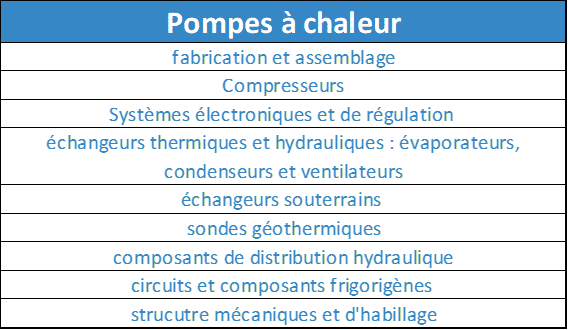

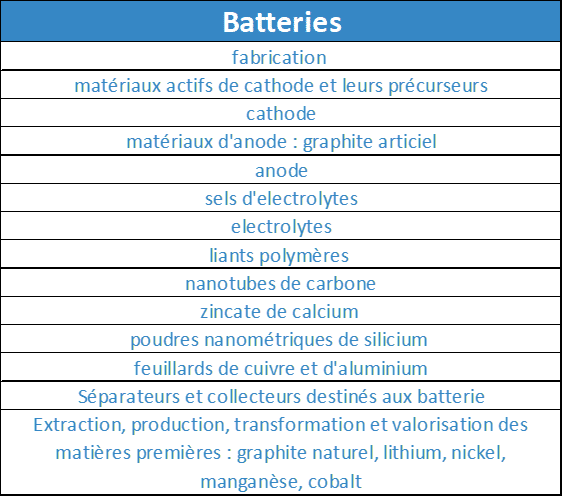

In particular, we remind you of four target areas: solar panels, wind turbines, heat pumps and battery production.

List of eligible offshore and onshore wind energy components:

List of eligible components for solar panels :

List of eligible heat pump components :

List of eligible battery components :

Would you like to find out more about C3IV and determine your eligibility?

Discover our dedicated support for securing your tax credit (CIR, CII, CICo, C3IV) or your application for JEI status.

Newsletter

Keep up to date with the latest innovation tax news.

Subscribe to our newsletter.