Law no. 2025-127 of February 14, 2025, known as the "Finance Law for 2025", has just been published in the French Official Journal. Official Journal of February 15, 2025. Below is a brief commentary on the main measures relating to local and property taxation.

Postponement of the abolition of the CVAE and creation of an additional contribution (art. 62)

In order to support public finances, the abolition of the CVAE tax, initially scheduled for 2024 but postponed to 2027 by the Finance Act for 2024, has been postponed by a further three years, and will finally take effect in 2030. However, given the late entry into force of the Finance Act for 2025, the rate reduction initially scheduled for 2025 came into effect on January 1.er last January.

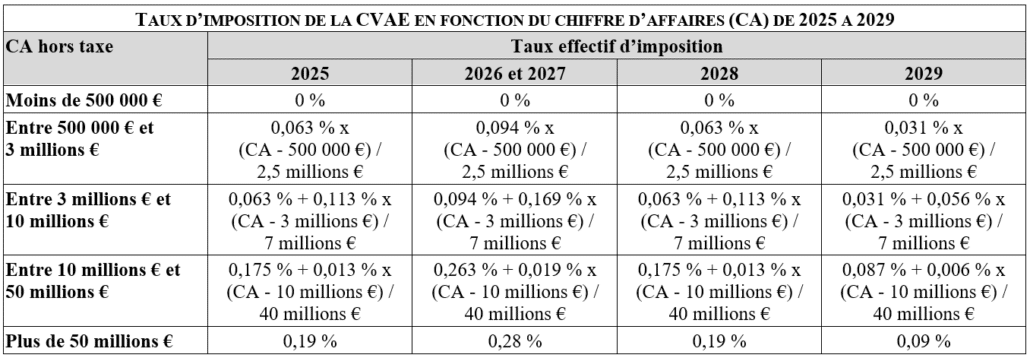

The CVAE rate applicable to taxes due for the years 2025 to 2029 will therefore be calculated as shown in the following table:

Please note: for companies with pre-tax sales in excess of €50 million, this additional contribution is equivalent to an overall tax rate of: 0.19 % + (0.19 % x 47.4 %) = 0.28 %, i.e. the same effective tax rate as in 2026 and 2027 (but also in 2024). The additional CVAE contribution therefore results in a rate freeze over the 2024-2027 period.

Example: a company with a December 31 year-end has paid a CVAE of €50,000 for 2024.

The additional CVAE contribution, to be paid in a single instalment before September 15, 2025, will be equal to : €50,000 x 47.4 % = €23,700.

If the CVAE due for 2025 is finally €70,000, the final additional contribution will be : 70,000 € x 47.4 % = 33,180 €.

The difference between the latter and the one-off advance payment, i.e. €9,480 (€33,180 - €23,700), must be paid by May 5, 2026 at the latest.

Consequences of postponing the abolition of the CVAE tax

Fixing the "planchonnement" system for business premises (art. 63)

To counter a recent ruling by the Conseil d'Etat (CE, QPC, November 13, 2023, nbones 474 735, 474 736 and 474 757), article 63 of the Finance Act for 2025 stipulates that, unless a claim is lodged before October 10, 2024, the taxes assessed for 2023 and 2024 using a fixed staggered rate of 1er January 2017 are validated. It should be noted that article 63 does not provide any details on the application of the measure to taxes levied in respect of 2025 (the last year of application of the planchonnement mechanism).

On this measure, also proposed by the previous government, see our comment published on November 15, 2024.

Example: a business premises has a revised rental value of €10,000, whereas its unrevised rental value is €5,000.

The 2017 schedule rental value was : 10 000 € - [(10 000 € - 5 000 €) / 2] = 7 500 €. i.e. an adjustment of - €2,500.

Assuming that a location coefficient of 1.3 is applicable from 2018, the rental value of this premises, according to the Conseil d'Etat ruling of November 13, 2023, would have been equal to : (€10,000 x 1.3) - [[(€10,000 x 1.3) - €5,000] / 2] = 9 000 €.

In view of the legalization measure excluding the location coefficient from the calculation of the "planchonnement", this rental value will be : (€10,000 x 1.3) - €2,500 (fixed at the level calculated in 2017) = €1,500 (fixed at the level calculated in 2017) 10 500 €.

Maintenance of CFE on ICPE-classified establishments after cessation of activity (art. 89)

In order to help free up industrial land as quickly as possible, article 89 of the Finance Act for 2025 excludes the benefit of the rebate provided for under second paragraph of article 1478, I of the General Tax Code cessation of activity in a facility classified for environmental protection (ICPE) whose dismantling and decontamination of the site on which the activity was carried out are made compulsory under the French Environmental Protection Act.article R. 512-75-1 of the French Environment Code. In the latter case, the taxpayer remains liable for the cotisation foncière des entreprises (CFE) until the site is rehabilitated or restored, as defined in VI of the same article R. 512-75-1.

However, the new measure does not apply to the following companies by a safeguard, receivership or compulsory liquidation procedure. In the absence of any specific provision, this provision applies from February 16, 2025.

Example: a company covered by the ICPE nomenclature ceases operations on February 16, 2025, but does not restore the site on which it was operating until January 2, 2026. Unless it is the subject of insolvency proceedings:

- it will not be able to claim the business cessation rebate for CFE due in 2025; and

- it will remain liable for CFE for the full year in 2026.

Exemption from annual office tax, but premises converted to residential use subject to development tax (art. 111)

Article 111 of the Finance Act for 2025 introduces a new exemption from the annual tax on offices, commercial premises and storage premises located in the Ile-de-France region and in the Alpes-Maritimes, Bouches-du-Rhône and Var départements, for premises vacant on January 1.er The tax exemption applies to all premises built on or after 1 January that are subject to a commitment to convert to residential use, and for which a prior declaration or building permit application has been filed during the calendar year preceding the tax declaration. Application of the exemption is subject to the condition that the taxpayer undertakes to convert the premises concerned into residential use within four years of the date of issue of the planning permission (prior declaration or building permit application).

Conversely, the same article makes operations subject to prior declaration or building permit that result in the conversion of premises not intended for residential use into residential premises (for example, the conversion of offices into housing) subject to the communal or inter-communal share of the development tax, unless a decision is taken to the contrary. This measure should enable local authorities to finance the facilities required for the arrival of new occupants.

Other measures

The Finance Act for 2025 provides for other measures affecting direct local and similar taxes. These include

- the introduction, starting with taxes levied in respect of 2028, of a ceiling on the rate to be applied to the market value for the valuation of historic monuments of an exceptional nature (art. 121);

- refocusing the taxe d'habitation on second homes only (art. 110);

- the extension and adaptation of various measures specific to properties located in a priority urban development district (art. 47, 100 and 114);

- the introduction of new obligations concerning the declaration of occupancy of residential premises via the "Manage my property" service (art. 115);

- an increase in the property tax exemption rate for agricultural land (art. 66).

Aymeric GIVORD - Expert in local taxation

A consultant since 2002, Aymeric has worked with renowned experts to develop case law in favor of taxpayers. With his teams, he is notably behind the Plénière fiscale ruling "SA GKN Driveline" (CE, December 11, 2020, n°422 418). He analyzes the taxation of industrial establishments, business premises and certain residential premises, proposing optimizations and assisting his clients with the necessary steps, including litigation.

Newsletter

Receive all our expert news by e-mail.

Subscribe to our newsletter.