Since 2022, the main part of the apprenticeship tax at the rate of 0.68% has been declared each month via DSN. However, the balance of the taxe d'apprentissage remains payable annually.

What does this mean in concrete terms?

Apprenticeship tax, declaration and payment to URSSAF

In 2024, the balance at 0.09% is :

- Due in respect of 2023 ;

- Based on the same base as the main portion (2023 earnings)

- Due and declared on the DSN April 2024 (due on May 6 or May 15, 2024) under the heading "Contribution code - S21.G00.82.002" with value "076 - Balance of apprenticeship tax paid in cash".

Apprenticeship tax and deductions

Over the same timeframe, DSN April 2024Two types of amounts can be deducted from the apprenticeship tax balance:

- Subsidies paid in kind directly to CFAs in the form of equipment and materials in line with training needs (Contribution code - S21.G00.82.002, code 077 - Reduction in the balance of the apprenticeship tax linked to subsidies to apprentice training centers (art. L6241-4 of the French Labor Code) paid in kind")

- For companies with 250 or more employees covered by the supplementary apprenticeship contribution, any "alternating credits from which they would benefit if they had more than 5 % of alternating work-study students on their payroll in 2023 (Contribution code - S21.G00.82.002, code "078 - Réduction du solde de la taxe d'apprentissage liée à des créances alternants (Art. L6241-4 du code du travail)).

If necessary, you can find the DSN reporting procedures on the instructions sheet. 2537 for the balance of TA.

Apprenticeship tax and 2023 expenditure on initial technological and vocational training (excluding apprenticeships) and professional integration :

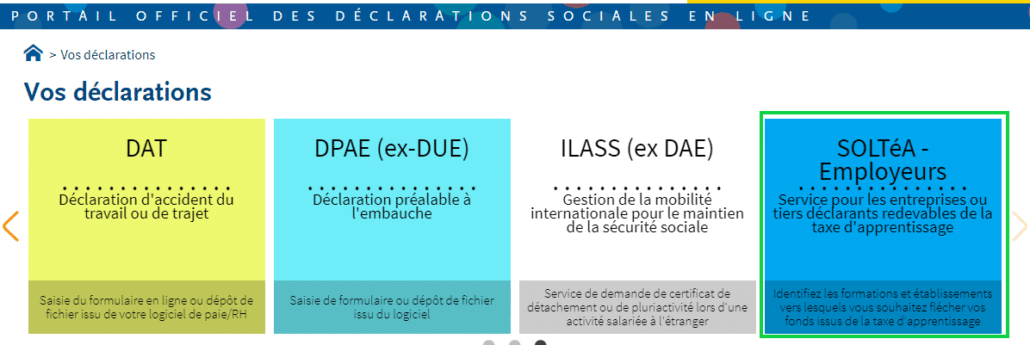

Companies must designate beneficiary establishments via a dematerialized service: SOLTéA which will open May 27, 2024.

Caisse des Dépôts, which receives the funds collected by URSSAF, is responsible for making payments to the establishments designated by employers.

There will be two allocation periods during which employers can decide to allocate funds to SOLTéA:

- May 27 to August 2, 2024;

- from August 12 to October 4, 2024.

The SOLTéA service can be accessed from your net-entreprises space:

To find out more about the platform, go to here.