Human Resources

Mode d’emploi DRH/Paie : périmètre d’un audit des charges sociales, étapes, pièces à préparer, erreurs fréquentes, livrables et plan d’action.

RGDU, congés naissance, heures sup : découvrez les réponses de nos experts paie 2026 suite au webinar pour sécuriser vos décisions et rester conforme.

Décryptez la paie 2026, anticipez DSN (CRM de rappel → substitution) et échangez RPS en Tea Time. Demandez votre invitation.

DRH : optimisez votre performance RH en 2026. Échanges confidentiels entre pairs sur vos priorités et arbitrages. Session de 60 min, synthèse anonymisée.

G.A.C. Group annonce l'acquisition de DIDACTHEM. Découvrez comment cette alliance renforce l'offre de conseil en prévention des risques et performance RH.

Découvrez comment l'AIMV fiabilise ses DSN et renforce son expertise paie grâce à l'accompagnement de G.A.C. Group. Sécurisez vos déclarations dès maintenant.

HR/Payroll teams: Get up to speed on the key developments for 2026. Prioritize short-term actions and anticipate the impact on your payroll in 45 minutes.

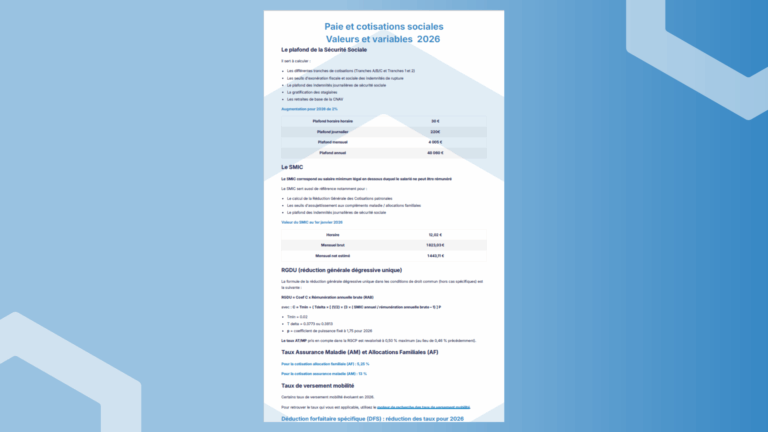

Optimize your 2026 management! Discover our infographic of payroll figures: SS ceiling, SMIC, AM/AF rates and DFS reduction. The essentials at your fingertips.

Since 2023, the DSN has been synonymous with CRM corrections to be processed and time spent “catching up” on errors to avoid substitute DSNs. This model is on its last legs: correcting the DSN means you're already behind. True performance now means anticipating, by making the DSN more reliable at every stage of the payroll cycle.

G.A.C. Group announces the acquisition of STFU. A strategic alliance to accelerate sustainable innovation and business performance.

Control average 2026 costs and psychological risks. Download our special report to optimize your compliance and HR performance.

G.A.C. Group appoints Hakim Saidi Managing Director France to steer growth and future acquisitions. Find out more about the Group's new strategic challenges.

Find out how a transitional HRD has been securing payroll and optimizing social charges with G.A.C. Group for over 10 years.

Boost your HR and payroll performance in 2026: 10 concrete resolutions to secure your payroll, manage your data and reduce financial risks.

Services

Sectors