EXPERT'S ARTICLE - By Samia Benmahrez, Consultant HR performance, at GAC Group

This teleservice allows employers who contribute to the general scheme to consult the contribution rate for work accidents and occupational diseases (AT / MP) applicable to their establishment and the list of recognized claims impacting their future rates.

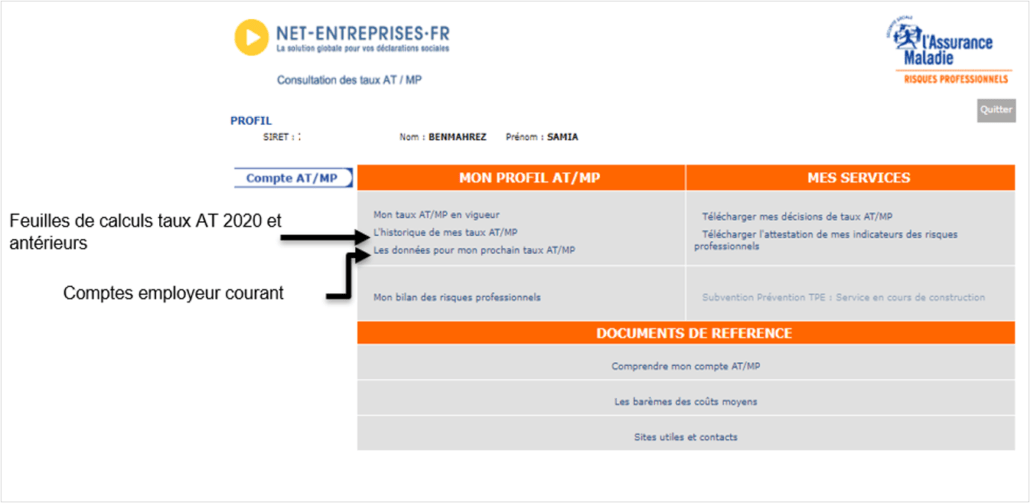

Today, the AT / MP account evolves on Net-businesses and is divided into three sections:

1. My AT/MP profile" section

First, on this 1st block, you can browse :

- Your AT / MP rate which is in effect.

- The history of your AT/MP rates for the last 3 years, i.e. 2020, 2019 and 2018.

- Claims data which allow you to follow in real time the AT / MP recognized within your company.

2. My services" section

Then, on this 2nd block, you can find:

- Notification of the AT / MP rate: as a reminder, since January 2020, notifications of the AT / MP contribution rate for companies at the real rate (+149 employees) are no longer sent by post.

- The professional risk assessment: this is a new service which allows the company to know the number of claims for its establishment over the last three years. You can then compare your claims experience with that of companies of the same size carrying out the same activity as yours.

- Certification of the company's occupational risk indicators compared to regional and national rates over three years. This certificate can now be downloaded directly into the account. This document may be requested in calls for tenders for certain public contracts.

3. Reference documents" section

Finally, regarding this block, you can consult:

- The information sheet on pricing.

- The scale of average costs in force.

- Useful contacts: the ameli.fr site, the INRS site and the 3779 telephone.

Expert advice :

- First and foremost, good claims management requires regular review of your current employer account.

- In order to avoid sending us this document every month, we suggest that you consult it directly on your Net-Entreprises account.

- In fact, you have the possibility of registering your consultant as a “declarant” in your Net-Entreprises space by only allowing him to view your current employer account.

Don't hesitate to contact us if you have any questions on the subject.