The reform of the DOETH came into force on January 1.er January 2020 and was applied for the first time, in many areas, in the Declaration made in 2021 based on 2020 data.

Let's take a look at the main changes to understand what's in store for us from January 1, 2025.

A look back at some of the DOETH reform measures

So-called "incentive" measures

As of January 1, 2020, all companies must file a DSN declaration, but only those with 20 or more employees are subject to at the obligation to employ disabled workers.

Similarly, the threshold must be reached for 5 consecutive years to trigger the obligation.

Multi-site companies (with or without management autonomy) are required to file a single declaration, rather than one per establishment.

The contribution is declared and paid to URSSAF (or to MSA for companies in the agricultural sector), which forwards it to Agefiph.

Transitional measures to limit the increase in contribution

A capping system had been put in place to mitigate the financial impact of this reform on contributions, with 2 mechanisms:

- Capping on the rise calculated between the contribution paid for the DOETH 2020 (paid in 2021) and the DOETH 2019 (paid in 2020), in stages: 30 % up to €10,000 increase, 50% from €10,001 to €100,000 and 70% for an increase over €100,001.

Capping of contributions paid in respect of DOETH 2021, 2022, 2023, 2024 with the increase in the contribution due in N reduced in relation to N-1 by :

- 80 % in 2021 (DOETH for the year 2021, payment and declaration made in 2022) ;

- 75 % in 2022 (DOETH for the year 2022, payment and declaration made in 2023) ;

- 66 % in 2023 (DOETH for the year 2023, payment and declaration made in 2024) ;

- 50 % in 2024 (DOETH for the year 2024, payment and declaration made in 2025).

The 2025 contribution and beyond

As you can see, from the 2025 contribution onwards, the capping measures will no longer apply, and you will therefore be affected by a substantial increase in your contribution.

The end of these transitional measures is the ideal time to implement a sustainable disability policy.

Implementing a sustainable disability policy

There are several ways for employers to meet this obligation:

- Reaching 6 % of its workforce of disabled workers, either internally or externally,

- The conclusion ofan approved agreement concluded at branch, group or company level,

- The payment of a contribution to URSSAF,

- Setting up contracts with ESAT, EA or TIH,

- The implementation of deductible expenses.

If these systems are not deployed, the company will have to pay a contribution to URSSAF.

A company that fails to reach the 6 % rate will have to pay a contribution that varies according to its workforce and the number of jobs it lacks.

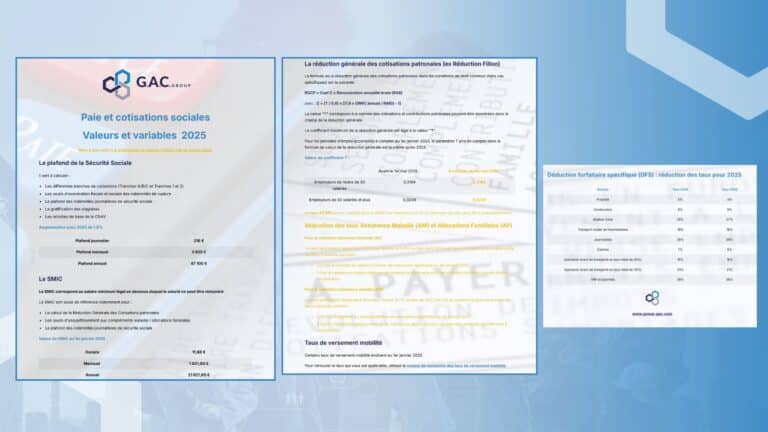

Company size | Contribution per missing job |

20 to 249 employees | 5 865 € |

250 to 749 employees | 6 210 € |

750 employees and more | 6 532 € |

Implementing a sustainable disability policy is an important step towards inclusion within a company.

If this implementation commits companies to a CSR approach, in a very concrete way, it requires internal resources, costs... How can we demonstrate that internal mobilization will meet expectations?

before embarking on this process, companies pragmatically carried out a simulation of their contributions, and in particular a simulation of the contribution they would make when the capping scheme came to an end?

Simulating the amount of the increase

Simulating your 2025 contribution on the basis of 2024 data will give you an overview of the situation, enabling you to anticipate it financially and to implement actions in favor of a disability policy. These actions will not only promote the inclusion of people with disabilities, but also limit or even eliminate the contribution due, without any capping mechanism.

To help you, we offer a tool to simulate the impact of the end of capping:

Indicator management

Year-on-year simulations are necessary and effective, but not a panacea.

In fact, by deciding not to suffer but to manage indicators relating to disability, you are becoming part of a virtuous process, and laying the foundations for a sustainable disability policy.

For example, you can start by tracking the number of employees subject to social security contributions, which are often incorrectly published by URSSAF or MSA, to determine your target employment rate. You can also track and update ECAP codes and RQTH validity and renewal dates.

Indicators are crucial to building a solid, long-term disability policy.