Toulouse Court of Appeal ruling of July 29, 2024 rejects capitalized development expenditure declared as depreciation in the tax base. research tax credit.

A company involved in biotechnology research and development submits a claim for reimbursement of the research tax credit, in respect of expenses incurred on projects recognized as eligible.

In this case, the company took into account the depreciation of fixed assets as part of its research expenditure for the research tax credit, the company having capitalized these expenses.

The Montpellier administrative court, followed by the Toulouse administrative court, ruled that the company's development expenditure could not be capitalized as research expenditure, as the company could not justify that the disputed fixed assets related to :

- Clearly individualized projects with serious chance of technical success within the meaning of article 212-3, paragraph 1 of the French Chart of Accounts ;

- Projects featuring serious chances of commercial profitability provided for under article R 123-186 of the French Commercial Code and article 212-3 of the French General Chart of Accounts.

The Court also took the opportunity to point out that the absence of any challenge by of the company's practice of capitalizing research expenditure for a period prior to that in dispute cannot constitute a formal position within the meaning of article L. 80 B of the French tax code.

Analysis by our tax experts

The question our customers often ask us is whether it is possible to combine, in the same year, the capitalization of research expenditure and the inclusion of the corresponding depreciation allowances in the base for the research tax credit (CIR)?

BoFIP gives us some answers:

"In addition, it should be noted that the provisions of Art.article 244 quater B of the CGI relating to the research tax credit are distinct from those provided for in thearticle 236 of the CGI. Accordingly, development costs, although capitalized for accounting purposes at the company's discretion, may be included in the research tax credit declaration filed for the year in which they were incurred, provided that they correspond in nature to the eligible expenses listed in II of Article 244 quater B of the CGI.

It is up to the company to reconstitute, from globalized and immobilized costs, the amount of each category of expenditure eligible for the research tax credit, to declare these expenses under the corresponding headings of the above-mentioned declaration and to justify these amounts in the event of an audit.

Of course, the expenses thus included in the tax credit base must not be taken into account a second time through the amortization of the intangible asset linked to the capitalization of development costs. It is therefore confirmed that the research tax credit is only conditional on the nature and reality of the expenditure incurred by companies and the scientific and technical nature of the programs to which they relate, irrespective of how they are accounted for (RM Feltesse n° 12558, JO AN of March 19, 2013, p. 3058). "

This means that development costs, although capitalized for accounting purposes at the company's discretion, can be included on the research tax credit return filed for the year in which they were incurred.

In practice, as we can see from this decision, the answer is nuanced. In fact, the two systems are distinct, and are based on very different eligibility criteria:

About the CIR :

The tax authorities specify that only operations designed to dispel scientific and/or technological uncertainties are eligible for the CIR.

Each R&D operation is designed to answer a scientific and technical question, and seeks to resolve a difficulty encountered during the development of the project for which no solution exists (notion of a lock). The work must lead to an appreciable departure from widespread practice in your field and must be based on a level of technical expertise that distinguishes it from common know-how in your profession, involving engineers and technicians.

| Your work has | Explanation |

|---|---|

| An element of novelty | It is new knowledge, not new or greatly improved products or processes resulting from its application, that should be measured. |

| An element of creativity | Apply new concepts or ideas to improve the state of knowledge. |

| An element of uncertainty | The probability of solving the difficulty encountered, or the way to achieve it, cannot be known or determined in advance on the basis of identifiable knowledge. |

| A systematic scientific approach | The activity is structured and carried out systematically (planned and recorded - not trial and error). |

| Reusability of acquired knowledge | An R&D operation should result in the possibility of transferring the new knowledge acquired, guaranteeing its use and enabling other researchers to reproduce the results obtained as part of their own R&D activities (in-house in the first instance). |

Concerning the capitalization of development costs :

Costs must be relate to clearly individualized projects with a serious chance of technical success and commercial profitability.

In accordance witharticle 213-27 of the PCGIn all cases, costs incurred during the research phase must be expensed. On the other hand, costs incurred during the development phase can be capitalized. A clear distinction must therefore be drawn between research and development:

- Research phase This is general research, not applied to a specific production project.

- Development phase These include product design and testing costs.

Costs incurred during the development phase may be capitalized provided they relate to clearly individualized projects with a good chance of technical success and commercial profitability. The company must therefore demonstrate that it simultaneously meets the following cumulative criteria :

- The technical feasibility of completing the intangible asset so that it can be put into service or sold;

- The intention to complete the intangible asset and use or sell it ;

- The ability to use or sell this intangible asset ;

- The ability of the intangible asset to generate future economic benefits; in particular, the company must demonstrate the existence of a market for the output of the intangible asset or for the intangible asset itself, or, if the intangible asset is to be used internally, its usefulness;

- The availability of appropriate resources (technical, financial and other) to complete the development and use or sell the asset;

- The ability to reliably measure the expenditure attributable to the intangible asset during its development.

On the From an accounting point of view, development costs can only be capitalized from the date on which the six conditions for capitalization are met. Expenditure recorded prior to this date can no longer be capitalized (article 212-3 of the French General Chart of Accounts).

In conclusion: Projects must meet the eligibility criteria for both schemes. In practice, projects will have to be "technically feasible", yet involve a degree of technical and scientific uncertainty. Justification is difficult, as today's decision demonstrates, but not impossible, as the BOI stipulates.

Best practices recommended by our tax experts

Complementing the work of a chartered accountant or CFO with a consulting firm with cutting-edge scientific and financial expertise is the winning strategy for capitalizing on your research and development costs!

The capitalization of development costs is a management decision that will have an impact on the CIR. The capitalization of certain R&D projects will not be compatible with the CIR scheme. In addition, the method of capitalizing eligible costs is preferential, which means that it is definitive, except in exceptional cases where the method is changed.

Upstream, a separate analysis will be necessary. First, to validate the criteria for capitalization, (any capitalization of development work must be carried out in accordance with the accounting rules governing development costs in accordance witharticle 213-27 of the PCG) and the second to validate CIR eligibility criteria (in relation to CIR tax rules). on the basis of tax legislation, in particular Article 244 quater B of the CGI, and irrespective of the accounting option chosen).

The scope of eligibility of your R&D work for the CIR will therefore have to be determined on a case-by-case basis, and the company will have to make separate, coherent supporting files.

It is up to the company to reconstitute, on the basis of globalized and immobilized costs, the amount of each category of expenditure eligible for the CIR, to declare this expenditure in the corresponding sections of the above-mentioned declaration and to justify these amounts in the event of an audit.

The CIR base will not be the same as for capitalization as a fixed asset and care must be taken not to include the same expenditure twice in the CIR base.

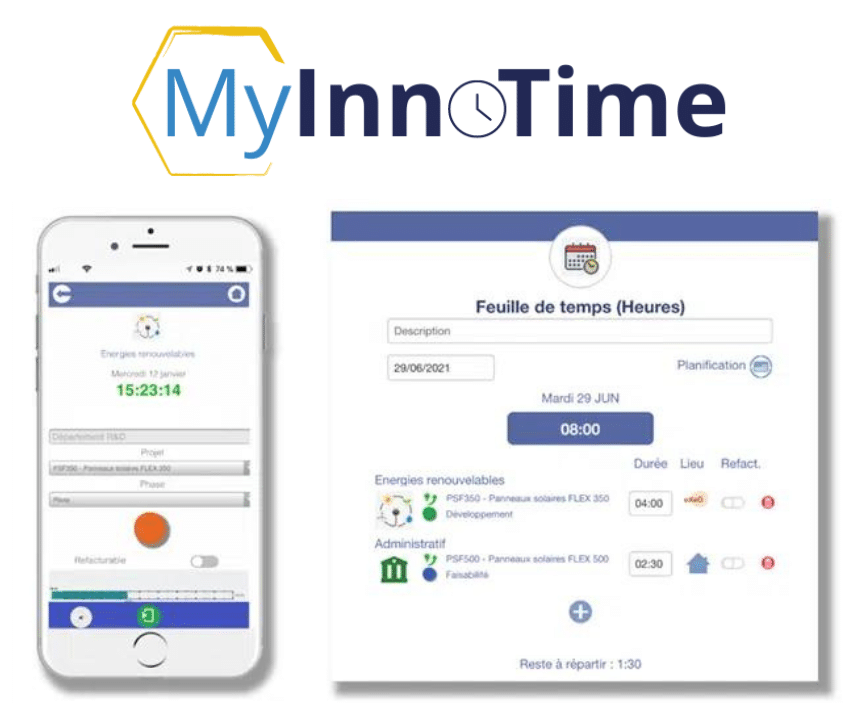

We therefore advise our customers to formalize their R&D work with precise time tracking detailing the different phases of the projects and the tasks carried out.

Secure your CIR / CII with a time and activity management solution!

Do you have a question about capitalizing your R&D expenditure?

Newsletter

Keep up to date with the latest innovation tax news.

Subscribe to our newsletter.

Discover our dedicated support for securing your tax credit (CIR, CII, CICo) or your application for JEI status.