The green industry law was adopted as part of the Finance Act 2024. It introduces a series of measures including the aim is to decarbonize industry. The purpose of the law is to finance green industry, in particular by creating a tax credit for investment in green industry (named C3IV below).

Find out more in this article:

After the government's commitment of responsibility before the National Assembly and adoption in the Senate, the Finance Act for 2024 has been passed. Ln addition to being validated by the French Constitutional Council, these measures must also be authorized by the European Commission. The measures described below are therefore based on the current status of the text, and will need to be confirmed.

Which companies and activities are concerned by C3IV?

Article 5 of the Finance Bill stipulates that the companies eligible for the tax credit are companies " industrial and commercial businesses taxed on their actual profits "or certain companies exempted by virtue of restrictively enumerated provisions.

Eligible companies will be able to benefit from C3IV on the following non-replacement investmentscommitted to activities that contribute to :

- Production of battery cells and modules, wind turbines, solar panels and heat pumps;

- The production of essential components designed and used primarily for the production of this equipment;

- The extraction, production, transformation and valorization of the critical raw materials needed to produce the equipment and components defined above.

How to calculate C3IV?

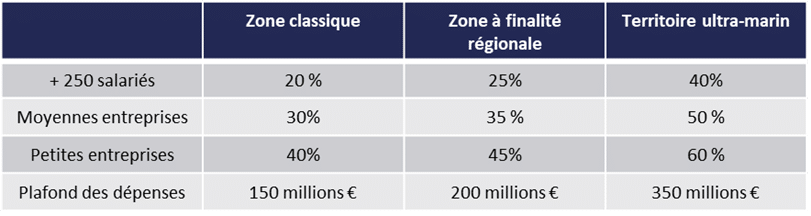

The tax credit rate will be 20% of investments. Depending on the geographical area and the company's structure, the rate will vary (see table below).

The tax credit will be capped at 150 million euros per principleThis ceiling may also vary in certain zones (see table below).

What conditions must be met to benefit from C3IV?

Article 5 of the Finance Act (LoF 2024) sets out the various eligibility criteria to qualify for C3IV. For expenses to be considered eligible, the company must :

- Operate investments in France for a period of five years from commissioning (3 years for SMEs);

- Not to transfer investments out of the country for the next five financial years;

- Not to have transferred its activities from the European Union to the national territory during the previous two years;

- Investments must not have started before January 1, 2024.

What expenses are eligible for C3IV?

The bill specifies the expenses that would be eligible and the conditions to be met. Visit Details of the application of the Finance Act will be presented when the implementing decree is published, after validation by the European Commission.. To date, eligible expenses are :

- Movable and immovable property (buildings, land, etc.) required for the operation of eligible facilities

- IP rights: patents, licenses, know-how subject to several conditions:

- Balance sheet assets ;

- Be mainly used in the production plant;

- Be depreciable ;

- Be acquired at market conditions from an unrelated third party;

- Be allocated to the operation of investments.

- Temporary occupancy authorizations for the public domain constituting a real right

The The above expenses are to be "reduced by taxes and charges". with the exception of expenditure to bring the asset into a usable condition. Visit public subsidies received must be deducted from the tax base..

How do I get C3IV accreditation?

Collecting C3IV will requireobtain prior approval from Bercy.

The LoF 2024 sets out a series of conditions that must be met in order to be approved:

- " The company meets the cumulative conditions mentioned in I (Make investments in one of the 4 categories, have not transferred identical activities outside the national territory within two years; have not transferred the activity outside the national territory for five years (three years for SMEs); comply with accounting and tax reporting obligations)". ;

- " The investment plan is part of one or more of the operations mentioned in II (batteries, wind power, solar panels and heat pumps). " ;

- " The information provided in support of the application is such that the investment plan is considered economically viable. "

To obtain approval, you must submit a file specifying :

- A general presentation of the company and its needs

- A complete presentation of the investment project and viability of the investment plan

- Environmental benefits and commitments

In practice, how do you get C3IV accreditation?

The approval review service is now open. Visit companies can submit an application to the following address: c3iv@dgfip.finances.gouv.fr. In the case of building construction work, the application for approval should be made before the work begins.

Applications will be reviewed by :

- the Direction Générale des Entreprises (DGE) in collaboration with

- Direction Générale des Finances Publiques (DGFIP) and

- the French Environment and Energy Management Agency (ADEME).

Article written by

Alex PROUVEUR

Innovation tax consultant

Would you like to talk to C3IV experts to prepare your certification and declaration?

Discover our dedicated support for securing your tax credit (CIR, CII, CICo) or your application for JEI status.

Newsletter

Receive all our expert news by e-mail.

Subscribe to our newsletter.