Local taxation

Failure of the PLF 2026 and adoption of a special law: what consequences for innovation taxation and the CIR, CII and green industry schemes?

Analysis of more than 80 administrative court rulings (May-June 2025) on local taxation. Assessment principles, exemptions (CGI 1382, 11°), and procedural guarantees to secure your taxes.

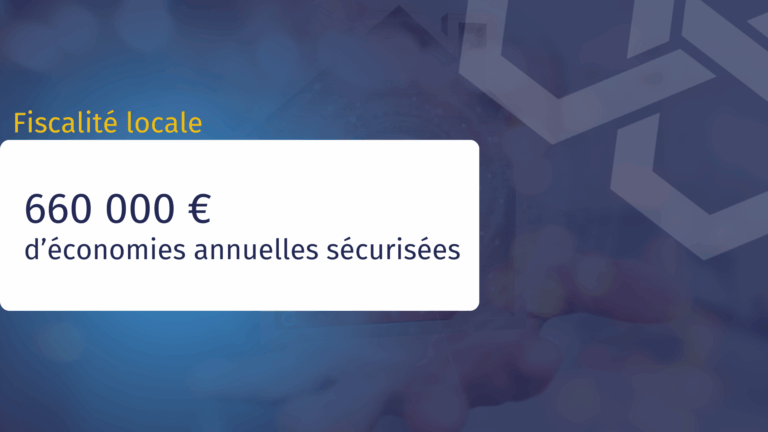

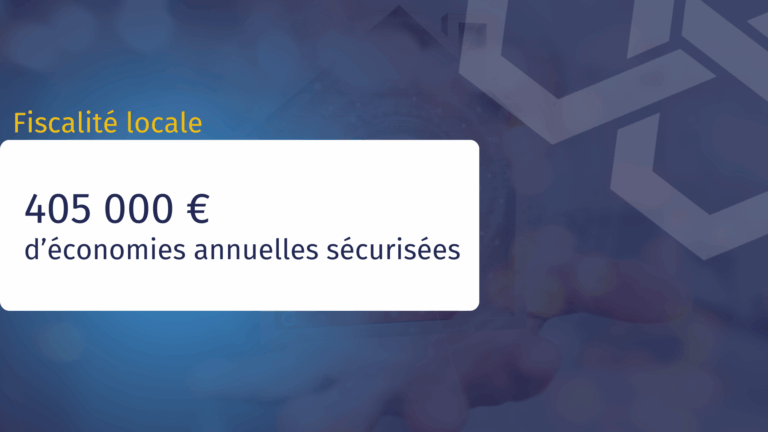

Discover the full case study of a large retail real estate investment company facing a €480,000 tax adjustment. Our experts applied Article 151A to secure €405,000 in annual savings.

Discover the full case study of a large retail real estate investment company facing a €480,000 tax adjustment. Our experts applied Article 151A to secure €405,000 in annual savings.

Faced with budgetary uncertainty in 2026, discover the four levers that CFOs can use: public aid, tax financing (CIR/CII), local tax audits, and HR optimization to generate cash quickly.

Discover how to accelerate your eco-design initiatives, transform your industrial model, and secure access to public funding (ADEME, Bpifrance) for responsible innovation.

Learn everything you need to know about Tascom (tax on commercial premises). Find out about the thresholds for liability (400 m² / €460,000), how it is calculated, surcharges/reductions, and the rules for drive-throughs.

Plan ahead for your 2025 local taxes! Our summary of key deadlines (CFE, property tax, CET, Decloyer) for businesses and property owners, with deadlines of December 15 and 31, 2025. Avoid tax oversights.

Analysis of more than 80 administrative court rulings (May-June 2025) on local taxation. Assessment principles, exemptions (CGI 1382, 11°), and procedural guarantees to secure your taxes.

Find out about your rights in the event of a tax audit or reassessment, how long you have to lodge a claim and best practices for effectively contesting the situation.

Services

Sectors