G.A.C. Group's partner lawyers and tax team have won a case for SAS Rousseau against the French tax authorities in a dispute concerning the floor rental value of real estate acquired under a finance lease.

Reminder of the "SAS Rousseau" decision: what is the scope of the floor rental value?

In a decision in principle rendered on April 5, 2022 (n° 448 710, SAS Rousseau), the Conseil d'Etat ruled that " The floor rental value to be applied in application of thearticle 1499-0 A of the French General Tax Code is that used to tax the lessor for the year of acquisition, as established after exercise, where applicable, of the administration's right of reversal or the lessor's right of complaint. This rental value may be contested by the lessee who has acquired the industrial fixed assets, in connection with the taxes to which he is liable in respect of each non-barred financial year, under the conditions of ordinary law. ".

The application of this principle implies that the lessee, when contesting taxes due in respect of a fiscal year that is not time-barred, may request a recalculation of the floor rental value used to tax the lessor for the year of acquisition, if this value is not the one that should have been used.

The "SAS Rousseau" affair or the chronology of a judicial saga... with a happy ending

2022-2023: the tax authorities persist in their refusal to apply the Conseil d'Etat's solution

As part of the settlement on the merits of this case, the tax authorities refused to accept this analysis. It took the view that the relevant floor rental value should be the one actually used to tax the lessor for the year of acquisition, and not the one that should have been used.

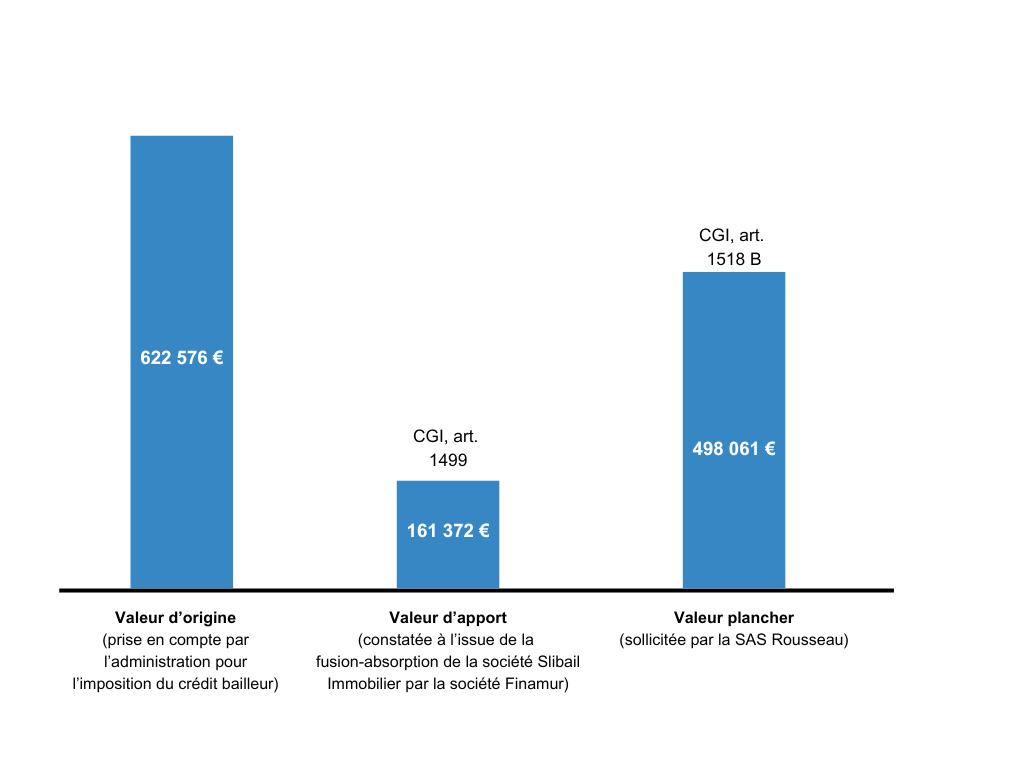

In this case, SAS Rousseau acquired the building in question in 2012, by exercising the purchase option granted to it by two lessors, Finamur and Natiocredibail. The leasing contract under which this option was exercised was signed in 1991 between Rousseau Holding on the one hand, and Slicomi and Natiocredibail on the other. Although the original value was €622,576, this was incorrectly taken into account by the tax authorities between 2008 and 2012 when taxing the lessor.

When taxing the lessor between 2008 and 2012, the value that should have been retained was not €622,576, but, in application of thearticle 1499 of the French General Tax Code (CGI)In 2006, Finamur absorbed Slibail Immobilier (then known as Slicomi). This cost price corresponded to the contribution value of €161,372.

With regard to thearticle 1518 B of the CGIHowever, this value would have been insufficient. It was in fact lower than the floor value corresponding to 80 % of the basic rental value recorded before the transaction (i.e. 80 % of the aforementioned sum of €622,576, or €498,061).

By specifying that article 1518 B of the CGI should be applied when reconstituting the rental value that should have been retained between 2008 and 2012, Rousseau had not requested that the book value be reduced to the floor. To its detriment and with honesty, it had, on the contrary, indicated to the tax authorities that, having corrected the error consisting in retaining a value of €622,576 rather than €161,372, it was necessary to "correct the correction", and increase the value that should have been entered in the accounts (i.e. €161,372) up to the floor provided for by article 1518 B of the CGI (€498,061, i.e. 80 % of €622,576).

Under these conditions, the tax authorities confused the initial correction (replacement of an erroneous original value by the correct book value, i.e. €161,372) with the correction of this correction (application of article 1518 B of the French General Tax Code, making it possible to retain €498,061 rather than €161,372), and took the view that the minimum rental value provided for in article 1518 B of the French General Tax Code was only applicable if it was higher than the value of the fixed assets entered in the accounts by the owner company.

Similarly, the tax authorities were wrong to state that, although they had noted that the cost price of the fixed assets transferred to Finamur had been valued at a lower level than at the time of their acquisition in 1991, the provisions of article 1518 B of the CGI could not be applied to the case in point, the provisions of article 1518 B of the CGI could not be applied to the case in point, since SAS Rousseau neither argued nor demonstrated that the tax authorities would have set the rental value of the assets in question on a basis other than the market value entered in the lessor's accounts following the merger-takeover transaction in 2006.

It was established that the original value of the fixed assets in dispute following the merger-takeover transaction in 2006 was excessive, and had to be reduced from €622,576 to €161,372. It was only subsequently that this new value was to be subject to the mechanism of article 1518 B of the French General Tax Code, and raised to €498,061.

2024: the tax authorities finally change their minds and give the taxpayer full satisfaction

By referring to the initial rental value that had actually been used, and not to the rental value that should have been used, the position of the tax authorities was in direct contravention of the combined provisions of articles 1499 and 1518 B of the CGI and, ultimately, of the Conseil d'Etat ruling cited at the beginning of this commentary.

And it vainly claimed that article 1518 B of the CGI could not be invoked to reduce a rental value to a floor. The reduction in rental value requested by SAS Rousseau was in fact based on article 1499 of the CGI, with article 1518 B of the CGI then having the effect, to the detriment of the company, of limiting this reduction by means of a floor mechanism.

Aware of the weakness of its position, the tax authorities finally accepted, in the course of the proceedings, the possibility of applying the minimum rental value set out in article 1518 B of the CGI following the merger-absorption operations of 2004 and 2006 and, as a result, pronounced the resulting rebates.

Lessons to be learned from the "SAS Rousseau" case in terms of local taxation

In conclusion, a lessee who acquires industrial fixed assets under a leasing contract may still contest the floor rental value assigned to it by the tax authorities under article 1499-0 A of the French General Tax Code, in respect of taxes due for years that have not expired.

What role did G.A.C Group's partner lawyers and tax experts play in the "SAS Rousseau" case?

G.A.C. Group's partner lawyers acted as counsel for SAS Rousseau and played a crucial role in this case. In particular, they :

- Advised SAS Rousseau throughout the proceedings, analyzing the legal situation and developing a defense strategy;

- used their in-depth knowledge of local taxation to challenge the minimum rental value set by the Administration;

- represented the company before the authorities and various courts.

After a lengthy legal battle, the French tax authorities finally agreed with SAS Rousseau to review the floor rental value of the properties in question.

This success is an important victory not only for SAS Rousseau, but also and above all for all taxpayers fighting against excessive floor rental values. It also demonstrates the expertise and efficiency of G.A.C. Group's partner lawyers and tax team in the field of local taxation.

Would you like to find out more about your tax situation?

Article written by:

Aymeric GIVORD - Local tax expert at G.A.C. Group

A local tax consultant since 2002, Aymeric has been working for over 15 years with eminent lawyers and associate professors, with a view to developing case law in a way that is favorable to taxpayers. With his teams, he is notably behind the Plénière fiscale ruling "SA GKN Driveline" (CE, December 11, 2020, n° 422 418) as well as the landmark decision in favor of SAS Rousseau (CE, April 5, 2022, n° 448 710). Its day-to-day work consists of analyzing the tax bases of industrial establishments, business premises and certain residential premises owned and/or operated by companies or certain organizations, in order to make recommendations and identify potential optimizations, and to support them in implementing these actions, particularly in the event of legal disputes.

Our tax consultants offer support throughout your real estate and restructuring investments (assistance with tax returns, budgeting, development tax, archaeological tax, etc.) to ensure that your local taxes are secure. You need solid, reliable cash management to enable your business to grow: our financial performance division, made up of tax consultants backed by expert lawyers, is dedicated to securing your tax environment through a high level of expertise and personalized support.

Newsletter

Keep up to date with the latest innovation tax news.

Subscribe to our newsletter.