When the state of health of an employee, victim of an accident at work or an occupational disease, is stabilized but presents after-effects preventing him from recovering all of his previous capacities, it is declared consolidated. Consequently, he no longer receives daily allowances but an indemnity for a Incapacity Ppermanent Partificial.

Determining the degree of disability

The employee is examined by the medical officer attached to the Caisse Primaire d'Assurance Maladie (French primary health insurance fund) (CPAM). The latter draws up a after-effects assessment report on the basis of medical documentation provided by the employee (such as an operation report, radiology report, medical prescriptions, etc.).

The medical officer sets a rate of Permanent Partial Disability. It is determined by medical and professional criteria (nature of disability, age, general condition, physical and mental faculties, skills) and the indicative disability scale appended to the Social Security Code.

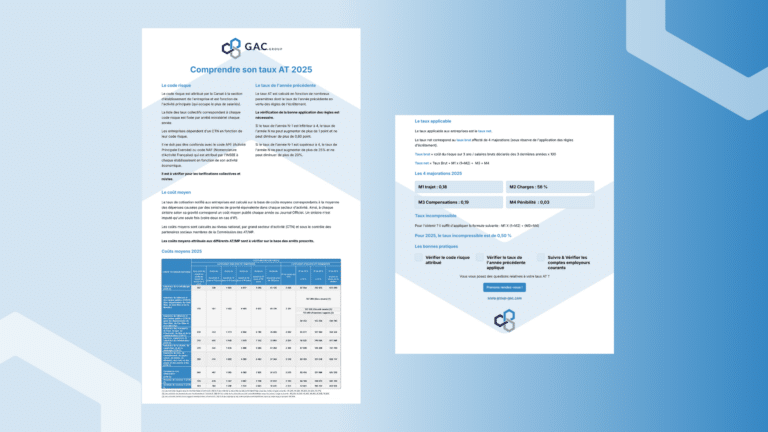

Indicative disability scale

The purpose of the indicative disability scale is to provide the basis for a estimate of consequential loss the after-effects of accidents at work or occupational illnesses. This indicative nature is justified by the fact that of average rates offered from which the doctor candiscard after having explained the reasons (existence of a previous pathological condition).

Here is an excerpt:

3.2 DORSO-LUMBAR SPINE: Persistence of pain in particular and functional discomfort (whether or not there are sequelae of fracture):

- Discrete 5 to 15

- Important 15 to 25

- Very significant functional and anatomical sequelae 25 to 40

To these rates may be added estimated rates for co-existing nerve damage.

Current rates committee

A comité d'actualité des barèmes des accidents du travail et des maladies professionnelles (occupational injury and illness rates committee) was created by a decree of February 9, 2016 (JO of February 11, 2016). This committee is responsible forupdate scalesIn addition, the medical rate can be adjusted to take account of changes in work-related injuries and pathologies. In addition, this medical rate can be increased by a professional coefficient in the event of loss of earnings due to the impact of the after-effects on professional activity, for example following dismissal for medical unfitness.

The role of the CPAM

Opinion and conclusionsof the PPI rate to be applied are then determined by communicated to the Caisse Primaire d'Assurance Maladie administrative services (CPAM).

It calculates the employee pension and notifies the employer's decision as well as to the employee. The CPAM must send the decision awarding an IPP rate to the employer. by registered mail with acknowledgement of receipt. In addition, the deadlines and appeal procedures must be indicated on the letter.. This information provides the employer with a clear 2-month deadline for file a complaint either before the Commission de Recours Amiable (CRA) or the Tribunal du Contentieux de l'Incapacité (TCI).

The rate assigned to the employee has a impact on the industrial accident pricing the employer to contest it.

If this rate is between 1 and 9%, the employee receives a capital allowance. This compensation gives rise to a lump sum charge to the employer's account of approximately € 2,000.

On the other hand, if the rate is equal to or greater than 10%, the employee receives a life annuity. Depending on the size of the fixed rate and the sector of activity, the employer's account is charged with a lump sum of approximately € 50,000 to € 500,000.

The procedure for contesting the degree of disability

The degree of disability notified by the primary health insurance fund following an accident at work or occupational disease. can be contested by the employer.

Indeed, this rate determines the amount of the pension allocated to the employee and has a direct financial consequence on the contribution rate for "accidents at work and occupational disease" of the establishment concerned.

Jurisdiction of the Disability Litigation Tribunal

This rate can be contested before a court of law. Tribunal du Contentieux de l'Incapacité (Incapacity Litigation Court) (TCI). This procedure falls under the social security technical litigation. The TCI has no jurisdiction to verify whether the injuries are attributable to the claim or to judge the validity of the length of sick leave, which requires medical expertise before the Tribunal des Affaires de Sécurité Sociale (Social Security Court). On the other hand, it litigation judge on decisions concerning disability, and on the status or degree of disability in the event of non-work-related accident or illness.

The employer applies to the TCI with territorial jurisdiction for a reduction in the rate of IPP. There are twenty-six TCI established within the jurisdiction of each Direction Régionale des Affaires Sanitaires et Sociales.

In the ten days following receipt of the dispute, the court secretariat address a copy to the employee's primary health insurance fund, inviting him to present his written commentsin triplicate, within ten days. Within the same time limit, the caisse is required to send the secretariat the medical documents concerning the case and to send a copy to the claimant or, where applicable, to the doctor designated by the claimant.

In fact, the medical conclusions listed at the bottom of the CPAM notification do not, in most cases, make it possible to ensure the adequacy between the sequelae described and the PPI rate attributed.

It is therefore advisable, at the time of referral, to ask the CPAM for a copy of the medical report to an expert physician appointed in advance by the employer to assess the validity of the rate of PPI awarded.

The secretariat of the TCI summons employer and CPAM by post at least fifteen days before the hearing. Summonses are sent by registered letter with acknowledgement of receipt. The procedure is oral. However, the parties may submit written observations.

The TCI's decision must state the reasons on which it is based. It is pronounced in open court and notified to the parties by registered letter with acknowledgement of receipt within 15 days of the judgment.

The TCI judgment may be appealed within a period of one month from the notification to the CNITAAT, headquartered in Amiens.

The Court also has jurisdiction in the first and last instance.t for disputes relating to pricing (setting contribution rates, granting rebates, imposing additional contributions, etc.).

The appeal is made by a registered declaration with a request for acknowledgment of receipt to the secretariat of the TCI which rendered the judgment.

The secretary of the TCI records the call and sends it by simple letter, receipt of the declaration. As soon as the formalities have been completed by the appellant, the secretary notifies, by simple letter, the opposing party of the appeal.

At the same time, he sends the general secretariat of the CNITAAT the entire case file with a copy of the judgment, the appellant's statement and the letter advising the opposing party.

Upon receipt of the appeal file, the Secretary General of the Court invites the parties involved to submit a brief within twenty days.

Competences of the CNITAAT

The General Secretary of CNITAAT ensures communication of briefs and exhibits during the examination of the case. In principle, the court rules on documents in accordance with the provisions of art. R.143-27 of the Social Security Code.

As soon as the order closing the investigation has been issued, the parties are summoned to the hearing fifteen days at least before the date of the hearing.

The procedure is oral. However, parties who submit written observations to the Court are not required to attend the hearing, although the judge may order the parties to attend.

Decisions pronounced at a public hearing are notified by post to the parties and may be appealed against within two months (with the need to have recourse to a lawyer at the Court of Cassation).

Special feature: under no circumstances does the Cour de Cassation rule on the merits of the case (on the rate). On the other hand, it judges the form by verifying the application of the rules of law and the conformity of the decisions taken by the CNITAAT.

The Court can dismiss the appealin which case the procedure is complete. On the other hand, if it overturns the decision, the case is referred back to the CNITAAT for a retrial.

The benefits of contesting the PPI rate

A favorable decision for the employer before the TCI or the CNITAAT may result in a significant drop of its contribution rates. The Tribunal or the Court thus has the possibility of reducing the rate of IPP initially attributed to the employee, within the strict framework of relations between employers and social organizations. This reduction in the rate entails a modification of the lump sum charged on the employer account of the establishment concerned.

Indeed, from the data transmitted by the health insurance fund, for each accident and occupational disease, the retirement and occupational health insurance fund (CARSAT) charges a lump sum according to the average cost category. permanent incapacity (CCM IP).

The IP CCM

The IP CCM is determined based on the permanent disability rate assigned as follows:

- CCM IP1 = less than 10%

- CCM IP2 = 10 to 19%

- CCM IP3 = 20 to 39%

- CCM IP4 = 40% and above

The court decision indicating a reduction in the PPI rate initially allocated has an impact on the establishment's pricing only in the event that a modification of the average cost category of permanent disability has been made.

Example: a PPI rate of 15% (CCM IP2) reduced to 9% (CCM IP1).

As a reminder, the reduction of this rate following an appeal by the employer has no effect on the rights definitively acquired by the employee.

Once the final and favorable judgment at the end of the appeal period, a request for employer account correction is sent to CARSAT together with the decision.

To this end, it correction of rates initially notified to the employer.

It is ultimately the employer's responsibility to request from URSSAF the reimbursement of contributions unduly paid, if applicable.

If you don't want to miss any HR news, subscribe to our newsletter!