By Asuncion Roxan Salmeron, HR Performance Consultant, G.A.C. Group

There are a few new features to take into account at the start of 2020. Details below:

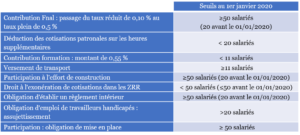

1. Harmonization of staffing thresholds according to the contributions concerned

From 1er January 2020, only the thresholds of 11, 50 and 250 employees will create new obligations for employers in application of the PACTE Law.

A summary table below shows the main obligations:

2. Extension of the general reduction in employer contributions

From 1er January 2020, the calculation of the general reduction is also modified in accordance with Decree n ° 2020-2 of January 2, 2020.

Limit for imputing the general reduction on contributions for accidents at work and occupational diseases

The general reduction will thus be deducted from the contributions due for work accidents and occupational diseases. within the limit of 0.69 % of the remuneration.

The parameter T taken into account in the calculation formula is therefore modified. Thus, from 1er January 2020, T is equal to:

- 0.3205 for employers with less than 50 employees with a Fnal rate of 0.10%;

- 0.3245 for employers with 50 or more employees with a Fnal rate of 0.50%.

Special case: Calculation of the general reduction in the event of application of the specific standard deduction (DFS)

The amount of the general reduction calculated after application of the DFS for the jobs which are eligible for it is capped at 130 % the amount of the reduction calculated without application of the DFS.

As a reminder, in the absence of application of the DFS, the sums paid as professional expenses are excluded from the contribution base and therefore from the base of the general reduction.

So, in case of application of the DFS, it will suit perform two calculations :

- A first, by calculating the general reduction without application of the DFS

- A second, by applying the DFS to ensure whether or not to apply the ceiling of 130% ...

3. Declaration of the status of disabled worker via the DSN

From 1er January 2020, all companies, regardless of their workforce, must declare each month the disabled worker status of their employees via the DSN.

The company's payroll software will have to integrate the new features of the DSN 2020 standard.

Thus, companies will have to fill in at the level of the “Contract - S21.G00.40” block, the disabled worker status of their employee within the “BOETH status - S21.G00.40.072” section, as well as the associated change block. “Old BOETH status - S21.G00.41.048” in the event of late compliance with the 2020 standard by the payroll editor.

For more information, please consult the instruction sheet posted on the dsn-info.fr website at the following address: http://dsn-info.custhelp.com/app/answers/detail/a_id/2128