A merger of an establishment or a company takeover can have important consequences on the occupational injury rate of the acquiring establishment. And this, notwithstanding the modalities of the operation (transfer, takeover of a company, merger of intra-company establishments).

Can a merger-acquisition operation involve the transfer of the AT/MP risk?

As soon as the three criteria cumulative If the following conditions are met, the operation will involve the transfer of the occupational injury risk:

- Takeover of more than half the staff of the plant concerned

- Takeover of a similar activity

- Resumption of means of production

These criteria derive from article D. 242-6-17 of the French Social Security Code, which restricts the scope of application of the notion of new establishment:

" A newly-created establishment is not considered to be the result of a previous establishment in which a similar activity was carried out, using the same means of production and having taken over at least half of the staff. ".

According to the Cour de cassation, these legal criteria for excluding the existence of a new establishment are cumulative and not alternative, so that the absence of a single criterion must lead to an establishment being considered as new.

How is occupational injury risk transferred?

If all three criteria are met, CARSAT merge on the date of the transfer, the accident/illness rate of the establishment taken over with that of the acquiring establishment.

- Either the acquiring establishment was already activeIn this case, the elements used to calculate the two accident/illness rates will be merged.

- Either the acquiring establishment has just been createdits AT/MP rate will be calculated on the basis of (payroll and claims) of the business taken over.

There is a significant risk that the institution taken over will have a large number of claims and will increase the transferee's contribution rate.

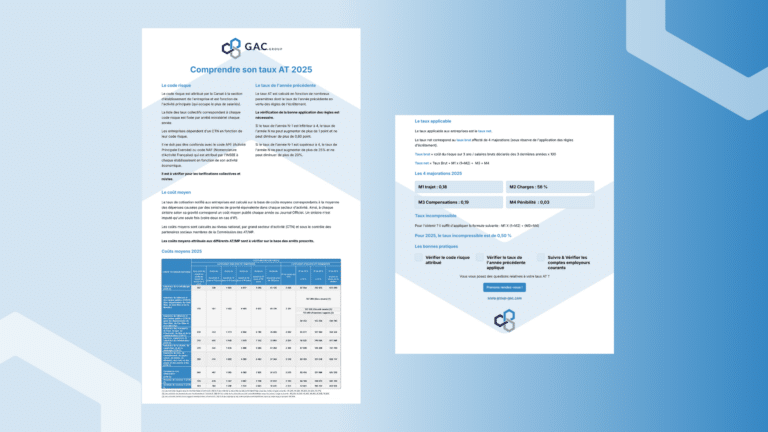

Example of the impact of a merger and acquisition on the rate :

Establishment X has an applicable rate of 2.48% with an annual payroll of €14,628,730 and an average loss experience.

Establishment Y has an applicable rate of 2.18% with an annual payroll of €1,220,004 and a fairly high loss experience.

Establishment X takes over 70% of the personnel of establishment Y as well as the means of production to carry out a similar activity: there is thus a transfer of risk from establishment Y to establishment X.

The rate applicable to establishment X after the merger and the assumption of the claims of Y will be 2,92% applicable to a higher payroll of €15,848,734. This represents an increase of €73,395 in occupational injury and health insurance contributions.

It is therefore strongly recommended before any operation to verify the rates of occupational accidents and diseases of the various establishments to be taken over and identify the financial risks.

What will your rate be after the trade-in?

Our experts can calculate your merged rate!

If you don't want to miss any HR news, subscribe to our newsletter!