The "DGFiP Statistiques" collection aims to provide annual information on current trends in French taxation. We would like to draw the attention of our readers to the publication on May 13, 2025 of a new contribution entitled " Production taxes in 2023: a further decline in their weight in the economy ".

According to the authors of the study, " In 2023, €92.7 bn in production taxes were collected. These taxes represented 3.3 % of GDP in value and 3.7 % of value added declared by companies (excluding public administration, education, human health and social action). These ratios fell after production tax reforms aimed at boosting the competitiveness of French companies, notably in the wake of the health crisis. By way of comparison, in 2019, the year before the wave of production tax reforms, production taxes accounted for 3.7 % of GDP in value and 5.0 % of value added. ".

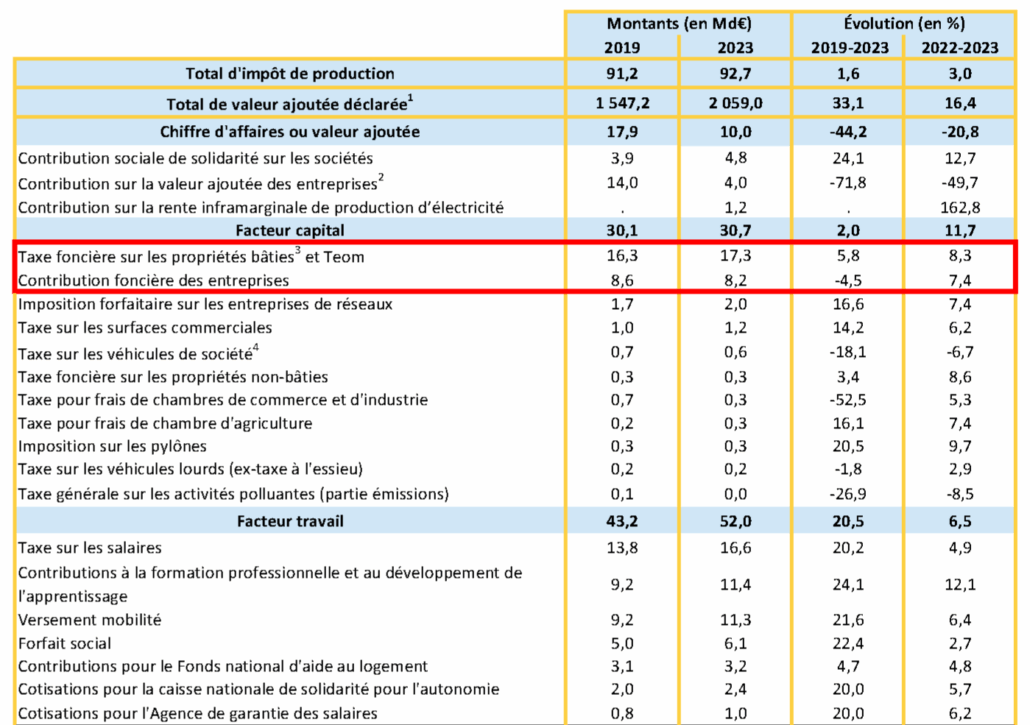

It should be noted that capital taxes increased only slightly in value between 2019 and 2023 (+2 %), due in particular to the drop in the business property tax (-4.5 %), which benefited from the reduction in the rental value of industrial establishments in 2021.

Breakdown of production taxes

Source: DGFiP, Urssaf

- Excluding the "public administration, education, human health and social work" sector

- Net of rebate resulting from the capping of the Contribution économique territoriale (CET) based on added value

- Only business property tax

- This tax on company vehicles has been replaced in 2021 by the annual tax on CO2 emissions and the tax on emissions of atmospheric pollutants.

However, over the 2019-2023 period, the increase in taxable bases for production taxes combines with this initial drop, leading to an overall increase in revenue of 1.6 % in value.

In the industrial sector, particularly targeted by the reforms (halving of rental values and halving, then gradual reduction, of CVAE rates), the reduction in the weight of production taxes was driven by a 68 % reduction in the amount of CVAE and a 34 % reduction in the amount of property tax on built-up properties paid by industrial companies. The real estate sector did not benefit from a comparable reduction in production taxes, due to the weight of property tax, which was not subject to any specific measures.

Looking only at tax-based charges (i.e., those collected by the DGFiP), large industrial companies saw the biggest drop in their production tax rate (- 2.1 points of value added).

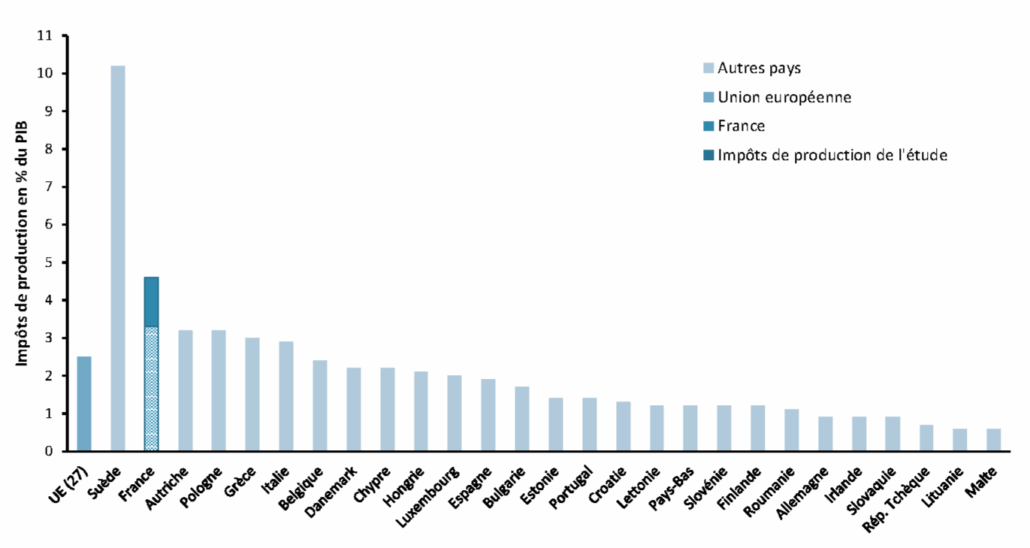

That said, France ranks second in the European Union in terms of production taxes, behind Sweden.

Production taxes as a percentage of GDP in value terms in 2023

Sources: DGFiP, Acoss, Eurostat

You can access the full study by clicking on the link below:

Would you like to discuss this point with one of our local tax experts?

Article written by:

Adama SARR - Senior consultant in local taxation at G.A.C Group

With an MBA in Business Law, Adama has spent the last fifteen years working in the consulting field, where she enjoys offering her clients personalized tax support based on reliable, tried-and-tested processes. She pays particular attention to keeping abreast of developments in the taxation of our products. On a day-to-day basis, she acts as a tax expert, analyzing our customers' tax bases with a view to securing and optimizing their real estate taxation.

Have you received your property tax notice?

Don't leave it unanalyzed. This white paper gives you an overview of the current situation, with figures and comparisons.to better understand the evolution of taxes on your establishments. In principle, you have until December 31 of the year following the year of assessment to contest or request a review of your notice.

Our tax consultants offer support throughout your real estate and restructuring investments (assistance with tax returns, budgeting, development tax, archaeological tax, etc.) to ensure that your local taxes are secure. You need solid, reliable cash management to enable your business to grow: our financial performance division, made up of tax consultants backed by expert lawyers, is dedicated to securing your tax environment through a high level of expertise and personalized support.

Newsletter

Keep up to date with the latest local tax news.

Subscribe to our newsletter.