The Déclaration Sociale Nominative (DSN) is a system designed to simplify and secure administrative procedures for employers. It replaces most social security declarations with a single, paperless monthly transmission of key payroll data.

Since it came into force in 2017, the DSN has undergone several important changes that have strengthened its role and consequently the need to ensure that its content is compliant.

In this article, we review the 6 main reasons why it's essential to make your DSN data reliable.

1. Make sure you meet your obligations

Ensuring the reliability of your DSNs is a key factor in meeting your legal obligations towards your employees, as well as towards the organizations that rely on DSNs to collect various types of information.

Obligations towards the employee

The DSN contains a great deal of information relating to each employee (salary, withholding tax rate, health, unemployment, provident fund, retirement or vocational training, etc.).

It transmits this data to the relevant bodies (URSSAF, MSA, DGFIP, Agirc-Arco, mutual insurance companies, Pôle Emploi and OPCO skills operators), which carry out the tasks entrusted to them: opening and maintaining social entitlements and calculating them.

This means that you need to ensure the accuracy, completeness and consistency of the data transmitted via DSN, in order to comply with your legal obligations towards employees and avoid any disputes with them.

Obligations to organizations

The DSN will make it easier to collect employer contributions, benefit from tax exemptions/reductions, check declared contributions and share and cross-reference data between the various players, in order to simplify procedures and limit fraud. The underlying objective is therefore to guarantee payment of the right amount of employer contributions..

Your DSN is therefore of the utmost importance, as it enables us to check the consistency of the data entered in payroll, and thus avoid situations that are said to be "at risk" (under- or over-contributions, errors or anomalies that could lead to adjustments).

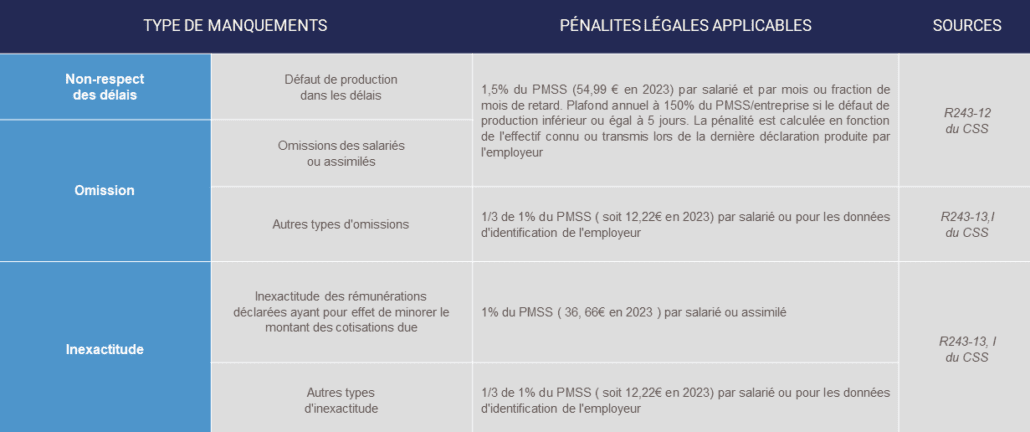

Focus on penalties

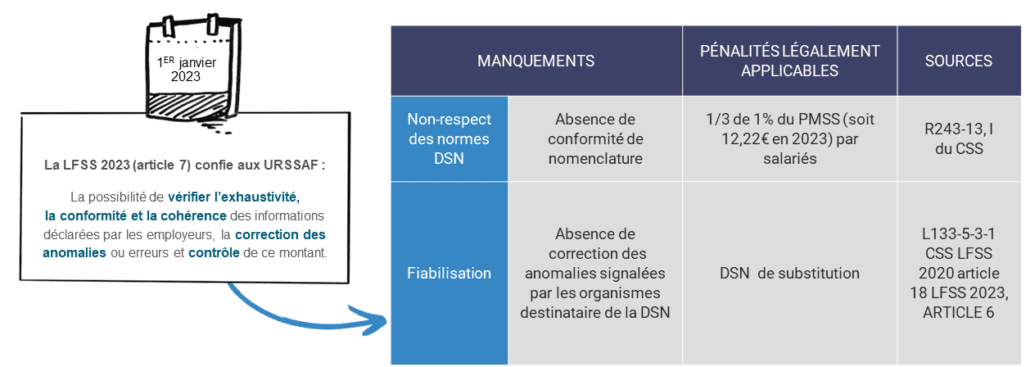

The last resort for a non-compliant declaration, the substitution DSN has been envisaged by the Social Security Financing Law for 2023.

In the event of prolonged inaction or inactivity, the substitution DSN is a system for correcting erroneous DSNs by social security organizations (OPS).

Expert advice: a formidable toolbox

- DSN VAL

- DSN CTL

- Business CRM

- D2BI

DSN VAL and DSN CTL are two tools that detect anomalies prior to filing, as opposed to CRM, which checks business elements after the DSN has been filed. They do not have the same function, but are complementary.

2. Guarantee your employees' social rights

The quality of the data transmitted is essential because it has a direct impact on the employee's :

- social rights linked to sickness, unemployment, retirement, social benefits with the introduction of the Net Social Amount (NSA)...

- taxation (withholding tax)

With your DSN, you can avoid errors, omissions or delays that could penalize your employees in the payment of their social benefits, which could lead to a deterioration in the social climate.

Example DSN facilitates the calculation and payment of daily benefits in the event of sick leave, thanks to the DSIJ.

Your DSN is, in a way, a tool for the social protection of your employees and administrative simplification for you as a company. Take care of it.

3. Avoid time-consuming reporting of anomalies to be corrected

Making your DSNs more reliable saves you from reporting anomalies, which can be tedious to rectify. These can lead to delays, penalties or calculation errors. So how do you make your DSN more reliable?

Today, the company is involved at every stage of the control chain, and its responsibility is increasingly engaged:

- Ensuring that data input complies with current standards and rules (technical specifications, instruction sheets drawn up by GIP-MDS)

- By working closely with its publisher, who must be a signatory of the DSN Charter

- Updating information on employees, employment contracts, social security contributions, etc.

- By analysing and verifying DSNs and business reports, where applicable

- By correcting errors or inconsistencies detected by DSN recipient organizations within a timeframe close to that of the erroneous DSN.

Expert advice

Anticipate rather than correct:

- Prefer to submit DSNs several days before the due date

- Business Intelligence tools provide a solution for reading data backwards and forwards

4. Escaping URSSAF's substitution DSNs

"With the digitization of DSNs, anomaly checks become systematic and, as a result, organizations are able to automate sanctions, in addition to the checks carried out by URSSAF inspectors. In the event of inaction or prolonged default by the contributor, URSSAF and MSA will be able to make the necessary corrections themselves, by producing a so-called substitution DSN. URSSAF is tending to become judge and jury of your declarations, so don't be overwhelmed by this central and strategic issue".

Laure Finan, payroll and DSN expert at G.A.C. Group

To facilitate the process, a forthcoming decree will define the categories of information available to companies to enable them to complete their social security declarations and ensure compliance with social legislation (Article L133-5-3 of the Social Security Code).

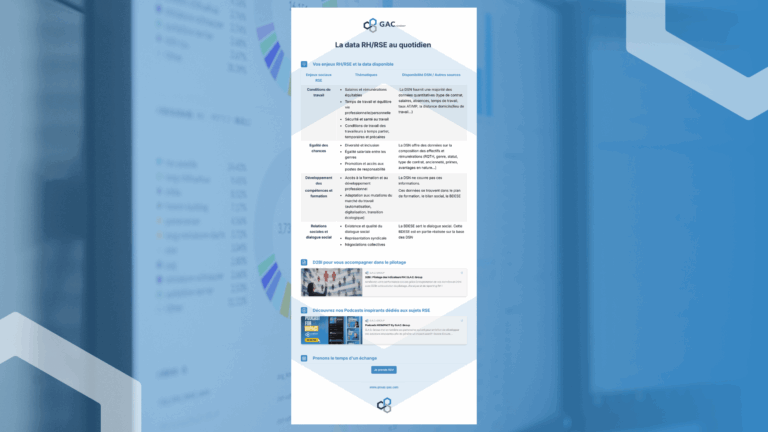

5. Obtain usable data and implement an effective HR policy

DSN is a goldmine of information. The monthly and annual data it contains can be used to meet legal reporting obligations (BDESE, gender equality index, Bilan Social....).

These same data offer unparalleled analysis opportunities for implementing an effective HR policy.

Making DSN data reliable is therefore a major challenge for companies, who need to anticipate future changes and adapt their internal processes. It also contributes to your company's social compliance.

G.A.C. has developed a business intelligence solution to help you monitor and exploit your DSNs. With its unrivalled computing power, D2BI enables you to monitor and analyze a multitude of relevant indicators on your payroll, staff turnover, absenteeism, and so on.

This solution allows you to track and trace your declarations, and provides personalized support from experts. Don't wait any longer to make your DSN data more reliable and take full advantage of the benefits of this system!

6. A calmer approach to URSSAF inspections

Control based on reliable data means lower risk of adjustment

URSSAF controls based on reliable, consistent data reduce the risk of adjustments or penalties for companies. A healthy DSN saves you precious time and provides lasting security for your company's economic and social situation.

Would you like to assess your knowledge of DSN?

Take our quiz now!

Our team of specialists in payroll, social security contributions and DSN will carry out an audit to ensure that your DSNs are compliant, so that your company can be on the safe side.