October 2022 - Statistics and annual figures on the CIR published by the Ministry of Higher Education and Research

The use of the CIR seems to stabilize over time compared to 2018, the year for which we have final data, so the 2020 data do not show any major changes.

In 2018, the amount of the "CIR" (CIR, CII and CIC included) amounted to €6.89bn compared to €6.84bn in 2020. The use of the CIR is therefore part of a steady trend (it can nevertheless be noted that the claim relating to the CII doubled between 2014 and 2018, rising to €265 million).

In 2018, SMEs accounted for €1.8 billion of the claim (CIR only) versus €1.9 billion in 2020.

The report also points out that since 2018, the CIR benefits mostly the manufacturing industry while the ITC benefits mostly service companies.

The research expenditure reported is primarily personnel expenditure, which is an important point and highlights its positive impact in terms of employment.

The use of the CIR remains concentrated in four regions (86% of the claim), with the Ile-de-France region unsurprisingly accounting for two-thirds. This concentration is less pronounced for the ITC (71% of the claim concentrated in 4 regions, including 40% in Ile-de-France).

Finally, it should be noted that spending on the CIC (Collection Tax Credit) remains marginal, with a receivable of €31 million in 2020.

June 2022 - Senate information mission on the theme of excellence in research/innovation, shortage of industrial champions: look for the French mistake

Out of a set of 14 innovation tax aid schemes, the CIR represents 86% of the total cost.

(Namely that these tax incentives were estimated at nearly 7.4 billion euros for 2019, 2020 not having been studied due to the health crisis).

This trend is found in a majority of OECD countries, where we observe that an increasing share of public aid for R&D and innovation is provided in the form of tax incentives. France is therefore no longer an isolated case but it remains one of the countries using it most intensively.

Within OECD countries, tax incentives have therefore increased to the detriment of direct subsidies, which demonstrates a generalization of the tax tool and a desire to let the market guide innovation. Furthermore, within the EU, the State aid framework leads to favoring indirect support for innovation.

The increase in the amounts of tax aid translates into significant support for R&D investments. To reach this conclusion, the CPO compared the TEIS (effective rate of corporate tax) on R&D and the effective rate of IS in order to measure the specific support granted to R&D and innovation in relation to the other economic sectors.

For the year 2018, France has the second highest gap in the OECD: the TEIS on investments of all kinds is 29.2 %, against 11.6 %, once all the tax support mechanisms based on R&D expenditure, i.e. a reduction of 17.6 points. (Today, this difference would be less, the nominal rate of the IS in France having fallen by 8 points).

A senate fact-finding mission on the theme of excellence in research/innovation, shortage of industrial champions: look for the French error” presented its conclusions on June 9, 2022.

The first observation made by this fact-finding mission is that even if the French State devotes a considerable effort in favor of innovation, it can be improved. This is reminiscent of the report of the CPO (council of compulsory levies) which made the same observation last February.

The solution proposed by the senators, to allocate a better distribution of funds to research and a catch-up in favor of innovative companies, is an action plan which is divided into three points:

- At parliamentary level

- At governmental level

- And with the private sector

1) At the parliamentary level

The senators are in favor of a series of tax recommendations, around the research tax credit (CIR) in particular, in order to correct certain windfall effects:

- Eliminate the CIR beyond the ceiling of 100 million euros for R&D expenditure while increasing the rate accordingly below this ceiling;

- Calculate the ceiling of the CIR at the level of the parent holding company for groups that practice tax consolidation and increase the rate accordingly below the ceiling of 100 million euros for R & D expenditure.

- Similarly, it is proposed to double the ceiling of the innovation tax credit (CII) to bring it to 800,000 euros, in order to better support the scaling up of innovative industrial SMEs by allowing them to finance more expensive demonstrators.

- In addition, it is proposed to institute an “innovation research coupon” of 30,000 euros for SMEs, within the limit of an overall envelope of 120 million euros.

- Finally, the adoption of a multiannual innovation programming law, the drafting of which would fully involve Parliament, seems essential in order to meet the "long-term need" of industrial and innovation players and to ensure a global, readable and coherent approach to budget planning in a context of dispersion of appropriations and their governance.

Another point of concern raised by the conclusions: the feeling of confusion faced with the plurality of systems to which companies are likely to subscribe. On this point, the senatorial mission is in favor of an increase in the number of “turnkey industrial sites”.

2) At the governmental level

At the government level, the senators call for a normative and administrative reform in order to mobilize public procurement more on innovative projects, which also implies adapting it to a culture of risk inherent in the research process.

The report laments that “our education system instills a fear of failure”. Elected officials also regret the “lack of technical and industrial culture of the administration”, as well as the “excessive lengths” of its procedures, which have something to put off many actors.

The senators propose:

- The use of all the flexibilities of the Public Procurement Code (precise description of needs to guide the choice, setting of technical standards, specific rules in the field of defense and security which allow recourse to the negotiated procedure without publicity or prior competition, etc.);

- The integration of support for innovation among the general principles of public procurement law so that other objectives of an economic, ecological and social nature come to counterbalance respect for competition, by applying the principle of proportionality, to following the example of what is already done in other European States;

- The tripling of the ceiling for innovative purchases, which makes it possible to award public contracts without advertising or prior competition, to bring it from 100,000 to 300,000 euros;

- Training public buyers in innovative purchasing, in order to introduce a culture of risk and make them aware of the flexibility offered by public procurement law, which is often misunderstood or ignored by the contracting authorities;

- The adoption, at European level, of a Small Business Act in order to reserve part of public procurement for smaller European economic players. Faced with the administration's lack of technical and industrial culture and the excessive length of administrative procedures, it is essential to strengthen initiatives to facilitate procedures and shorten deadlines to align administrative and economic time by:

• Setting quantified objectives for the timeframes for administrative procedures (examination of files, marketing authorisation, etc.);

• Systematizing the practice of procedures carried out in parallel and guaranteeing that the administrations are committed by their previous responses;

• Increasing the number of “turnkey industrial sites” through better planning of their use, in collaboration with local authorities and decentralized State services, and by favoring recycling operations for industrial wastelands.

The senators also raise the fact that intellectual property, in particular industrial property, is a major source of competitiveness for companies and for the economy. And that in France, this issue is however insufficiently taken into account by the public authorities and SMEs. Following the example of what exists with our neighbours, it is proposed to create a High Commission for Industrial Property placed under the Prime Minister in order to integrate, at the highest level, this issue into the overall strategy of support for 'innovation

3) At the level of the private sector

In addition to the initiatives taken by the public authorities, the fact-finding mission indicates that the private sector must invest in order to support all stages of the development of innovative industrial companies. To do so, the senators propose:

- The extension of the Tibi initiative to the financing of innovative industrial, technological breakthrough and biotechnology companies, via the mobilization, from 2023, of institutional investors (in particular mutual insurance companies and provident organisations) to support the creation of made aware of the specificities of industrial projects;

- Raising the awareness of asset managers – particularly industrial families – of the need to propose investments in the development of industrial start-ups;

- Improving the training of financial analysts in the issues specific to innovative industrial companies and in the interest of better distributing their investments throughout the national territory;

- The acceleration of the creation of a "European Nasdaq" dedicated, as of now, to digital unicorns and allowing, in a second phase, to accommodate industrial unicorns; •

- Encouraging large groups to get involved in the emergence and growth of innovative companies by integrating, within corporate social responsibility criteria, collaboration between large groups and innovative start-ups and SMEs. Elected officials mention here for large groups the inclusion, within the criteria of social responsibility, of a principle of collaboration with start-ups and innovative SMEs.

In addition, the report insists on the need to re-establish bridges between the private and the public, by multiplying the “places of friction” between the academic world and the economic world.

Source: http://www.senat.fr/commission/missions/2021_recherche_innovation_industrie.html

February 2022 - Report by the CPO (Conseil des prélèvements obligatoires): "Redistribution, innovation and the fight against climate change: three major tax issues in the wake of the health crisis".

What is CPO?

It is an institution associated with the Court of Auditors which has been tasked with evaluating the development and economic impact of the tax policy adopted.

I. Observations

The report first identifies the six channels through which the effects of tax incentives for innovation are transmitted:

– The quantity and quality of innovation (CIR)

– The geographical location of innovation activities

– Taking into account the life cycle and age of companies (JEI)

– The level of training (JD in the CIR)

– Innovation financing (FPCI)

– The distribution between basic and applied research and the sector orientation of research.

The cost of tax incentives in favor of research and innovation is growing and essentially concentrated on the CIR. The report thus indicates that tax incentives for innovation have been prioritized over the past 20 years. So if in 2000, these tax incentives represented only 16.5% of the total aid for innovation, this amount rose to 74.5% of the total aid in 2015.

This development can be explained by economic and legal considerations: the State is seeking greater neutrality in the innovation support systems, in particular in order to comply to the state aid system.

Out of a set of 14 innovation tax aid schemes, the CIR represents 86% of the total cost.

(Namely that these tax incentives were estimated at nearly 7.4 billion euros for 2019, 2020 not having been studied due to the health crisis).

This trend is found in a majority of OECD countries, where we observe that an increasing share of public aid for R&D and innovation is provided in the form of tax incentives. France is therefore no longer an isolated case but it remains one of the countries using it most intensively.

Within OECD countries, tax incentives have therefore increased to the detriment of direct subsidies, which demonstrates a generalization of the tax tool and a desire to let the market guide innovation. Furthermore, within the EU, the State aid framework leads to favoring indirect support for innovation.

The increase in the amounts of tax aid translates into significant support for R&D investments. To reach this conclusion, the CPO compared the TEIS (effective rate of corporate tax) on R&D and the effective rate of IS in order to measure the specific support granted to R&D and innovation in relation to the other economic sectors.

For the year 2018, France has the second highest gap in the OECD: the TEIS on investments of all kinds is 29.2 %, against 11.6 %, once all the tax support mechanisms based on R&D expenditure, i.e. a reduction of 17.6 points. (Today, this difference would be less, the nominal rate of the IS in France having fallen by 8 points).

II. Report

The CIR can be improved, in particular because of its limited effectiveness in terms of developing private R&D (assessment carried out by the CNEPI: National Commission for the Assessment of Innovation Policies).

The device remains complex. Certain terms of the scope and base of the CIR appear complex and are not always effective.

- 1st example : the inclusion in the base of the CIR of expenditure relating to patents, technology watch and standardization is redundant with the existence of budgetary mechanisms with equivalent objectives targeted at SMEs.

- 2nd example : the doubling of the expenditure base relating to the hiring of young doctors, apart from the fact that it results in the amount of the CI exceeding the remuneration of the doctor, does not encourage the hiring of doctors (CNEPI).

- 3rd example : the inclusion of a lump sum for operating expenses has raised questions about its compliance with European law. This justifies the abolition, from 2022, of the doubling of the base for subcontracting to a public R&D body.

Tax control is considered to be improving, the control coverage rate appears sufficient and the monitoring of controls should be refined with the deployment of the PILAT information system (will make it possible to monitor the reasons for control from May 2022 ).

The CIR is now a reason for programming controls for the FA due to its significant budgetary impact and significant fraud linked to recurring situations.

The coordination of controls between the DGFIP and the experts of the MESRI should in principle be revised to make them more consistent.

In summary for the CPO, the “nuanced results” of the CIR plead for a reflection on the place it occupies in the French policy of support for innovation.

It should be noted that the CPO also considers the patent box regime to be “not very effective”.

The JEI evaluation underlines an overall positive effect on R&D employment, but limited in time.

The CPO thus proposes several scenarios for the evolution of the CIR (with a variable budgetary impact) with the aim of improving its efficiency:

- 1st scenario: refocus the CIR on SMEs & ETIs in order to concentrate the tax claim where the assessments show that it is the most effective.

- 2nd scenario: maintaining the current configuration of the CIR with a rationalization of the least efficient elements of its base (removal of the doubling of the base for JD/exclusion of VT expenses, management of patents and standardization, abolition of operating expenses, abolition of the collection tax credit).

- 3rd scenario: a “green” CIR, encouraging research expenditure in the field of the environment. (3 difficulties: what would come under green R&D, the compatibility of this instrument with European law on State aid, adaptation of tax audits accordingly).

The CPO favors the path of a stricter progressive ceiling of the CIR, the reduction of the nominal rate of corporate tax already reducing the interest of this tax incentive.- (All OECD countries with CIR have opted for a lower cap). The CPO is also concerned to favor the stability of incentives and not to distort a system which remains an element of fiscal attractiveness.

The CPO also notes that the JEI and CII systems would benefit from being streamlined.

A 2018 report (Jacques LEWINER) thus proposed extending to the eligible expenses of the CII, those retained by the JEI. Merging the two devices would make innovation aid more legible and increase the duration of the device (contested by the CPO).

Source: https://www.ccomptes.fr/system/files/2022-02/20220209-rapport-defis-fiscaux_0.pdf

December 2021 - Legislative developments - LF 2022

The finance law for 2022 was adopted on December 30, 2021.

We return below to the new measures impacting the field of innovation.

- Implementation of a tax credit for collaborative research (CICO)

This system is intended to compensate for the elimination, within the framework of the 2021 finance law, of the doubling of expenditure subcontracted to public bodies as well as the increase of 2 million in the ceiling for all subcontracting expenditure. contracting for expenses entrusted to public bodies.

- The companies concerned : industrial, commercial, craft or agricultural companies taxable according to the real regime or benefiting from certain exemptions.

- The research organizations concerned They must meet the definition set out in European Commission Communication No. 2014/C 198/01 on the framework for state aid for research, development and innovation. At this stage, we do not know whether certain structures will be assimilated to the public sector, as is the case with the CIR scheme.

These bodies must be approved by the minister responsible for research. They must not maintain a link of dependence with the company with which they wish to collaborate.

The question was asked to the MESRI to know if the approval will be the same as that to be obtained for the Research Tax Credit, the ministry indicated that today the procedure was not stopped, and that it was going to be to be soon.

- The contract :

– It is concluded between a company and a research organization;

– It is concluded prior to the start of the research work;

– It provides for the invoicing of works at their cost price;

– It establishes a common objective, the distribution of work, the procedures for sharing risks and results (including intellectual property rights, which cannot be attributed in full to the company);

– The contract must provide for the possibility for the organization to publish the results of their own research conducted within the framework of the collaboration (criterion whose implementation should be clarified)

- Eligible expenses:

- The expenses invoiced by the research organization cannot exceed 90% of the total expenses incurred;

- The work is performed within the EU or EEA;

- Research operations are carried out directly by the research organization, except in the case of derogation provided for in the contract for an approved organization;

- Expenses are included in the tax credit calculation basis within the overall limit of 6 million euros per year.

- Public grants received by companies are deducted from the tax credit calculation bases, whether they are definitively acquired or repayable.

- Amounts valued under the CICO cannot be taken into account in the basis for another tax credit or reduction.

The tax credit rate is 50% for micro-enterprises and SMEs and 40% for other companies. Like the CIR, the benefit of the tax credit is conditional on compliance with the exempted framework scheme for aid to research, development and innovation for the period 2014-2023 (taken on the basis of Commission Regulation (EU) No 651/2014 of June 17, 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty).

This new system is not affected by the de minimis regulation.

The device will come into force from 1er January 2022.

Source: Section 69

CONCLUSION: This new device, if it comes to compensate for the end of the doubling of the expenses incurred towards public service providers, does not necessarily have a comparable field of eligibility. Indeed, this new tax credit will apply to cooperation contracts between public structures and the taxpayer, conversely, the contracts eligible for the Research Tax Credit concern contracts for the provision of services carried out on behalf of taxpayers.

Details on the calculation methods will be provided by an update of the administrative doctrine.

It will therefore be appropriate for each service to arbitrate between the two systems. Details from Bercy on the subject are therefore eagerly awaited…

July 2021 - DOCTRINE: Modification of the BOFIP regarding the research tax credit

In the expected update of BOFIP of July 13, 2021, the tax administration commented on the adjustments to the CIR and CII made by the last two finance laws, and took into account the latest developments in case law relating in particular to the eligibility criteria. and subcontracting expenses.

Thus, all the main changes are as follows:

I) Evolution on the definition of eligible research and development activities

A) Recognition of the 5 eligibility criteria

With regard to activities eligible for the CIR, the 2015 update of the Frascati Manual has been incorporated and, in particular, formalizes the 5 eligibility criteria, already included in the MESRI guide, namely:

- The first 3 historical criteria which are:

- Uncertainty,

- The novelty,

- Acquiring new knowledge

- To which are officially added 2 additional criteria, namely:

- Systematicity in the sense of justification of the R&D approach, of the experimental plan,

- Transferability / reproducibility in the sense of justification of the perspectives offered other than the current project.

Source: BOI-BIC-RICI-10-10-10-20 n ° 1

B) Definition of a fundamental research activity and an experimental development activity

The French tax authorities have clarified the definition of fundamental research activities. This definition is set out in Decree no. 2021-784 of June 18, 2021, specifying the procedures for approving research organizations and scientific or technical experts to whom companies may entrust the performance of research operations in application of paragraph d bis of II of Article 244 quater B of the General Tax Code. Pure fundamental research and targeted fundamental research are therefore both considered as activities eligible for the CIR.

Regarding experimental development, the tax administration has also updated the definition. Thus, this new definition is taken directly from the Frascati Manual and includes among other things that “ Experimental development consists of systematic work - based on knowledge gained from research and practical experience and producing new technical knowledge - aimed at leading to new products or processes or to improving existing products or processes (Frascati Manual , § 2.32) ”.

Source: BOI-BIC-RICI-10-10-10-20 n ° 20 to 30 and n ° 70

II) Distinction between research and development activities and related activities

An important development is emerging, namely the emergence of precision in the process of identifying R&D activities.

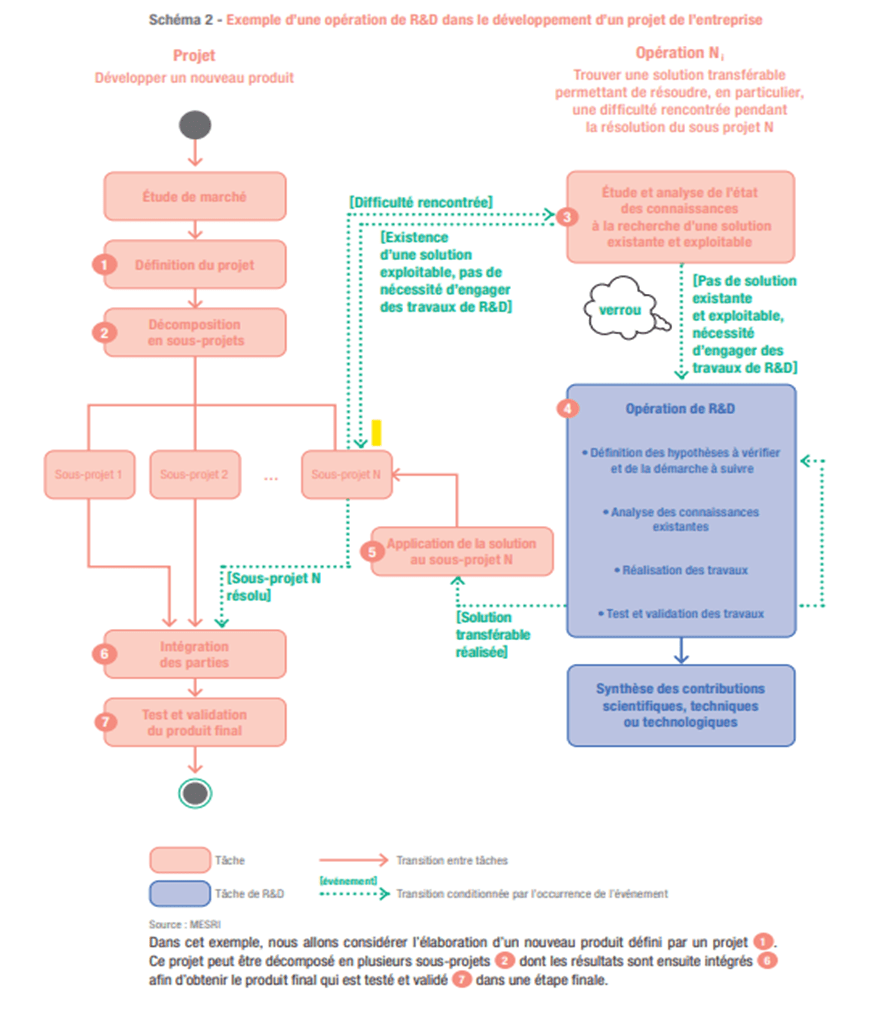

In particular, it contains a diagram emanating from the CIR 2020 guide published by the MESRI and illustrating the steps allowing the identification of R&D activities. This diagram makes it possible to highlight the way in which R&D operations can be part of the commercial development of a new product. In particular, it is specified that this diagram does not claim to cover all cases of R&D in companies.

However, the tax administration does not use the explanatory example below which also appears in the CIR 2020 guide.

Source: BOI-BIC-RICI-10-10-10-25 n ° 60

III) Evolution of staff costs

A) On staff made available by another company

If historically, the administration only referred to the strict provision of personnel in its administrative doctrine, it now extends the field of valuation to the expenses relating to temporary workers since they are research personnel directly and exclusively assigned to R&D operations.

Source: BOI-BIC-RICI-10-10-20-20 n ° 60

B) On support staff

The tax administration supports its doctrine regarding the exclusion of the valuation of support staff. Indeed, it considers that the support activities are those which do not fall directly within the scientific and technical tasks of the R&D and which are not carried out by personnel qualified for the R&D.

These include administrative activities (including clerical tasks and the activities of the central finance and personnel departments), management, legal and regulatory, commercial, transport, warehousing, maintenance and upkeep, safety and quality. These expenses are covered by the lump sum for operating expenses.

Source: BOI-BIC-RICI-10-10-20-20 n ° 140

IV) Taking into account of the new rate of operating costs

The tax administration has come to modify the rate of operating costs lowered to 43% the rate applicable for eligible expenditure from 1er January 2020.

Source: BOI-BIC-RICI-10-10-20-25

V) Evolution of outsourced expenses

A) Scope of approvals

As the French tax authorities rightly remind us, a company can include in the basis for calculating its research tax credit (crédit d'impôt recherche - CIR) expenses incurred in carrying out research operations that it has entrusted to the public research organizations or similar bodies listed below.

In this respect, the tax authorities remind us that the exemption from the approval requirement for certain research organizations only applies until December 31, 2021. As a result, from January 1, 2022, all research organizations (public, assimilated to public or private) will have to hold an approval issued by the minister in charge of research if they wish to be entrusted with research operations for which the related expenses are eligible for the CIR for the principal.

There will therefore no longer be any distinction between public, assimilated and private organizations. All of them will have to be approved so that their principal can value the expenses entrusted to their own CIR.

Source: BOI-BIC-RICI-10-10-20-30 n ° 15

B) Point of attention on eligible expenses

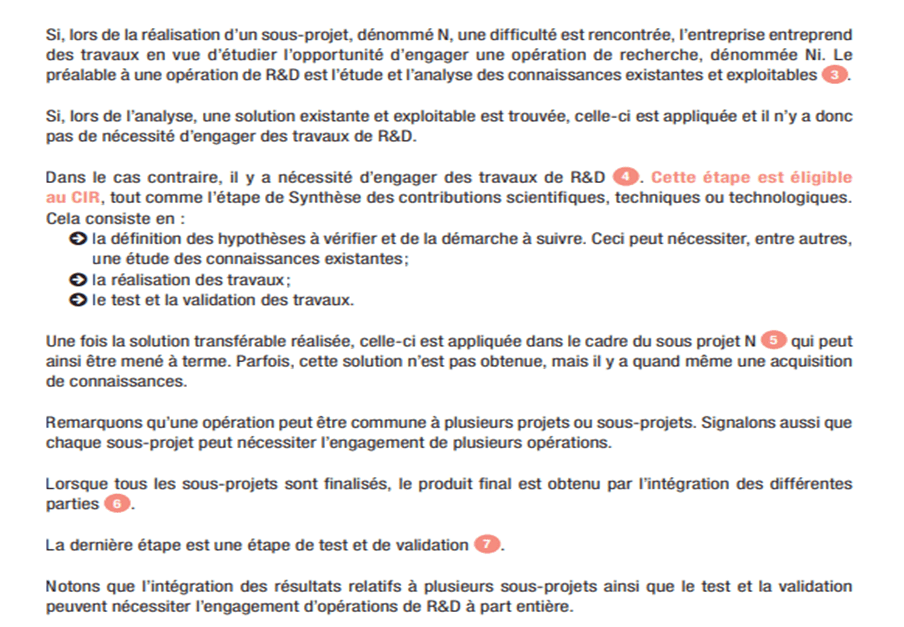

The administration recognizes two types of outsourced expenses.

- Expenses corresponding to outsourced research operations (the rule).

Here the expenses corresponding to outsourced research operations refer to expenses considered eligible before FNAMS decision of the Council of State of July 23, 2020, and still in force according to the administration.

First of all, it is recalled, as historically, that “ the expenses incurred must relate to real research and development (R&D) operations, clearly individualized, the realization of which is either completely entrusted to a third-party research organization, or carried out within the framework of a research collaboration with this organization. "

Then the administration schematically makes a distinction between outsourced R&D work (blue and gray path in the diagram) and outsourced work not falling under R&D (pink path in the diagram). Another point of novelty, it presents a vision of the contractual relationship between the principal and the third entity carrying out the work.

The blue and gray paths, which are of particular interest to us in this section, provide details on the contractual research and the research operation carried out within the framework of a collaboration.

Thus, the administration indicates within the framework of a research collaboration that a " a company party to the collaboration may integrate the amounts invoiced by another party to the collaboration into the basis for calculating its CIR, provided that these are eligible expenses, that this financial flow is provided for by the balance of the contract collaboration and that the party issuing the invoice does not include these expenses in its own CIR. It is specified that the invoiced amounts do not include a margin ".

Note that, if the pink path seems to rule out any possibility of valuation at the CIR at the principal, this is mitigated in paragraph 172 by taking into account the FNAMS judgment previously cited. We will detail the scope of this paragraph in the next section.

Source: BOI-BIC-RICI-10-10-20-30 n ° 171

2. Expenditure corresponding to scientific and technical work essential to the performance of eligible research operations carried out internally by the principal (the exception).

Here the expenditure corresponding to essential scientific and technical work refer to expenses considered eligible after FNAMS decision of the Council of State of July 23, 2020. This paragraph intervenes as an exception to the rule, which is that outsourced operations identified as non-R&D (pink path) are not initially eligible within the meaning of the CIR, as defined in paragraph 171.

However, the tax authorities are finally taking into account the latest FNAMS case law.

This means that subcontracted expenses are eligible for the customer's tax credit, provided they are necessary to the R&D approach of the eligible project, even if the subcontracted operations do not individually correspond to R&D work.

It should be noted that it is the client's responsibility to justify the essential nature of carrying out eligible research operations that the latter carries out internally.

Source: BOI-BIC-RICI-10-10-20-30 n ° 172

C) Deletion of the administrative doctrine on the deduction of services in the subcontractor's CIR.

The tax authorities have also taken into account the latest case law issued by the Conseil d'Etat on September 9, 2020, known as Takima.

The doctrine relating to the valuation of expenses incurred by an approved subcontractor on behalf of a principal has been abolished, which in turn means that the invoices issued must be deducted from the tax base. This had the effect of creating a negative balance on the amount of the approved subcontractor's CIR.

Today, the approved subcontractor must not value in its CIR the R&D services entrusted to it by a principal who can benefit from the CIR.

D) Comments on the 2021 Finance Act's ban on cascade subcontracting.

These comments provide clarification on the prohibition of cascading subcontracting.

On the one hand, the French tax authorities confirm that the principal cannot take into account invoices from a subcontractor who subcontracts the work himself, unless the second-tier subcontractor is himself approved or is public (or assimilated).

On the other hand, the tax administration specifies that the principal is entitled to benefit from the share of the expenses incurred by the tier 1 subcontractor, but that he cannot take into account in his own CIR expenditure incurred by a tier 2 subcontractor if the latter is not approved.

This is explained by the following example:

Or company E which entrusts the performance of a research operation to an approved private body A which invoices it for € 1 million in services.

€ 500,000 corresponds to work carried out directly by A.

€ 200,000 corresponds to work subcontracted by A to another approved private research organization.

€ 300,000 corresponds to work subcontracted by A to a non-eligible organization.

Company E will thus be able to take into account in the calculation basis of its CIR an amount of € 700,000 of eligible expenses (= 500,000 + 200,000).

It would seem that the possibility of cascading subcontracting is confined to two levels. Indeed, the tax administration specifies that “if these second-tier service providers themselves call on other organizations to carry out certain scientific or technical work essential to the research operations entrusted to them, the share of the expenses relating to this work, invoiced by the first-class service provider, is not eligible for the tax credit for the principal.

The tax administration recommends that the invoices be included in the invoices so that the principal has visibility of the portion that can be valued at the CIR, namely:

- The identity and address of the second-tier subcontractor organization called upon,

- The eligibility of the said organization for the CIR subcontracting system,

- The share of the invoiced amount corresponding to the work carried out by this organization.

Finally, the DLF provides a welcome clarification on cascading subcontracting, in the event that the tier one subcontractor is not eligible for the CIR (certain audiences, or foreign subcontractor), and that the subcontractor - rank two trader is declaring.

Indeed, this is the only case now where there is a risk of double valuation of the work (A, principal, would value the invoice of B, an ineligible public subcontractor who would in turn subcontract a service. to C, who would declare to him CIR on the work carried out for B, since the latter cannot declare CIR).

In such a case, the administration specifies that the subcontractor C must behave as if his principal were declaring to the CIR, and not to make CIR on the work in question, which will be valued at A.

Concretely, Bercy offers an example summarizing this scenario:

In year N, company A eligible for the CIR entrusts a public research organization B with the performance of a research operation. B invoices A for an amount of € 100,000.

B entrusts part of the research related to this project to an approved private body C. B does not meet the conditions to benefit from the CIR.

C shows in N a total amount of € 140,000 of expenditure eligible for the CIR, broken down as follows:

- € 50,000 relating to work carried out on behalf of B

- € 90,000 relating to an R&D project carried out on its own account.

C will declare in the calculation basis of his CIR for year N an amount of € 90,000 in expenditure (= 140,000 - 50,000).

- A will declare in the calculation basis of its CIR an amount of € 100,000.

The declaration of approved subcontractors should not be simplified by this measure; verifications of the subcontracting context of the latter should indeed give rise to verification.

Source: BOI-BIC-RICI-10-10-20-30 n ° 175 and 177

E) Details of expenditure outsourced to public bodies

The tax administration takes note of the Finance Law for 2021 coming, by its article 132 to end, as from 1er January 2022, to the taking into account of expenses for the double of their amount in the event of subcontracting entrusted to a public body or similar.

However, it is specified that up to December 31, 2021, expenditure entrusted to a public or similar body (rank 1) which entrusts all or part of the service to a public or similar body can be valued for double their amounts. (row 2).

Finally, in a consistent manner, the administration is applying this measure by removing the ceiling of € 2 million dedicated to services entrusted to public research organizations from the 1er January 2022.

This results in the obligation for the declaring company to realize internally at least ¼ of the research expenses valued in its CIR.

Source: BOI-BIC-RICI-10-10-20-30 n ° 180 to 350

VI) On the methods of deducting public subsidies and expenditure incurred for consultancy services

In this part of the administrative doctrine initially reserved for public subsidies, the tax administration has implemented it from the part on the deduction of expenses incurred for consulting services.

Also, the administration takes up in its comments the case law of the CAA of Marseille, of January 17, 2019 which considers that zero innovation rate loans (PTZI) distributed by Bpifrance is assimilated to public funding of research projects. So the same modalities apply to PTZi as the modalities applicable to repayable grants.

Source: BOI-BIC-RICI-10-10-30-20

VII) On the status of SME in the Community sense

The tax administration has withdrawn the BOI-RES-BIC-00034 which provided details on the elements of assessment of the quality of SME in the community sense.

The administration is backtracking following a decision by the CAA of Nancy on December 3, 2020 on the quality of SMEs in the community sense. From now on, the buyout by a larger group does not lose the status immediately.

As a reminder, in a decision of 18 December 2012 “Euratom”, the Commission added to the thresholds for the recognition of SME status, the possibility of immediate loss of status when the company qualified as an SME was bought by a larger group.

However, as the December 3 ruling points out, the Euratom decision was never taken up by the European Commission as part of Annex I to Commission Regulation (EU) No. 651/2014 of June 17, 2014, and is therefore devoid of regulatory value.

It should therefore be noted that only the conditions of non-compliance with the threshold for two consecutive years lead to the loss of the status of SME in the Community sense.

| A word from our experts : This long-awaited modification of the administrative doctrine is all the more appreciable as it includes all the developments, adjustments and decisions in terms of research tax credit in recent months. Indeed, several clarifications were expected (compliance with the TAKIMA and FNAMS case law, contours of cascading subcontracting, etc.), and even if certain measures remain open to criticism in our view (deduction of the PTZi, the wording of the case law FNAMS is not exactly similar and may give rise to interpretation), they have the merit of clarifying the administration's position on a certain number of points. Thus, it is to be hoped that the administration will be consistent in the application of these new comments made by Bercy. The same goes for the next MESRI CIR Guide. Indeed, despite its lack of enforceability, the administration tends to follow the recommendations of the guide, which can potentially give rise to some legal uncertainty for the verified taxpayer. The 2020 CIR guide, as well as the various expert feedback, have indeed shown some reluctance regarding the application of the latest case law. |

December 2019 - The impact of the abolition of the CICE on personnel expenses -

As the year ended, in the continuity of our last news which dealt with the impact of the amendment relating to the reduction in the flat-rate rates for taking into account operating expenses (targeted reduction from 50% to 43%), we have chosen this month to devote our study to the replacement of the CICE in 2019 by a reduction in employer contributions. Indeed, this replacement had a direct impact on the determination of staff costs.

The CICE represented a tax credit impacting 6% of the remuneration paid, when these did not exceed 2.5 times the amount of the minimum wage. The CICE was the subject of a declaration and a tax credit to be charged directly to the corporation tax or constituted a claim on the State, resulting in a reimbursement (immediate or deferred according to the criteria).

Today, the CICE has been replaced by a reduction in employer health insurance contributions for salaries not exceeding 2.5 times the amount of the minimum wage. These contributions were set at 13%. The reduction resulted in a drop of 6 points, which therefore corresponds to employer health insurance contributions of 7% for the employees concerned.

This reduction therefore has a direct impact on the wages paid by companies benefiting from this reduction each month. Employer health insurance contributions constitute compulsory social contributions (BOI-BIC-RICI-10-10-20-20-20181205). The gain represented by the reduction in these contributions has a direct impact on companies declaring research tax credit, because for the salaries paid, the inclusion of this contribution in the CIR will be 7% instead of 13%, for the employees concerned. This means that the rate of employer contributions eligible for the CIR system will represent 36% and no longer 42% (on average).

Taking into account the average proportions of profiles valued in the system, the impact would thus represent an additional reduction of around 3% on the personnel costs declared to the CIR and CII.

Providing businesses with the means to innovate, transform and create jobs is the ambition of the PACTE law promulgated on May 22.

One of the essential measures of the law is the modification of article 1833 of the civil code, now supplemented by a second paragraph: "The company is managed in its social interest, taking into account the social and environmental issues of its activity ”. If the implications of this reform seem limited for some, the modification of article 1833 of the civil code, supplemented by the modification of article 1835 which now allows companies to specify in their statutes a reason for existence, introduces social responsibility. at the heart of business life.

Society can no longer be satisfied with having as sole objective the realization of profits or savings, it must take into account social and environmental issues. This obligation, conceived as an obligation of means, obliges managers to integrate social and environmental issues into account in each decision-making process.

The voluntarily broad expression “social and environmental issues” gives a certain latitude to the judges responsible for interpreting the law, it encourages companies to develop a global attention on these subjects.

Social and environmental issues integrated into the decision-making process?

The binding force of the text remains relative, in fact article 1844-10 recalls that social and environmental issues cannot constitute a cause of invalidity of decisions or of the company itself. It also seems unlikely that third parties could engage the liability of the managers.

Nevertheless, the partners will now be able to more easily question the leaders who are diligent in the face of social and environmental issues. A form of environmental and social activism cannot be ruled out.

From a legal point of view the company must first satisfy its interests, nevertheless the modification of article 1833 inevitably leads the leaders to integrate the social and environmental implications in the decision-making process.

It should be noted that companies requesting aid and subsidies must already in many cases justify taking concrete account of social and environmental issues.

The entry of CSR into the Civil Code marks a general movement to take these issues into account. Formerly reserved for listed companies, CSR is now the responsibility of all companies. This notion must eventually become a compass that guides the life of companies.

Source:

Context

Presented by the Minister of Justice in the Council of Ministers on May 9, 2018, Ordinance No. 2018-341 was published in the Official Journal on May 10. This text modifies the intellectual property code in order to ensure the compatibility of French legislation with the European texts forming the "patent package": regulations (EU) n ° 1257/2012 and n ° 1260/2012 of December 17, 2012 and agreement on the unified patent jurisdiction of February 19, 2013.

The entry into force of the ordinance relating to the European patent with unitary effect and to the unified patent jurisdiction comes in response to the drawbacks of the current European patent system. Indeed, it should be remembered that the protection granted by a European patent does not have automatic effect in the 38 States parties to the Munich Convention of October 5, 1973. On the other hand, the patent generates significant costs for the patent. patent holders. Finally, in the event of infringement of his rights on the territory of several Member States of the Union, the holder of a European patent is often forced to apply to several national courts.

Objectives pursued

To respond to the drawbacks of the current European patent system, the objective pursued by this ordinance is to strengthen the rights of patent holders by creating a European patent with unitary effect, which confers rights having a uniform scope on the territory of all Member States while guaranteeing them a reduction in costs.

This ordinance also aims to rationalize litigation by creating a unified jurisdiction whose decisions will apply to the territory of all the contracting member states.

Adaptation of the intellectual property code

Law No. 2016-1547 of November 18, 2016 on the modernization of justice in the 21st century empowered the government to adopt by ordinance the provisions necessary to ensure the compatibility of French legislation with the “patent package”.

Pursuant to this law, the ordinance of May 9, 2018 modifies the intellectual property code (articles 2 to 18 of the ordinance) by providing, in particular, for the articulation between the various patents, the exclusive competence of the court. unified patent, the dissemination to third parties by the INPI of information relating to the European patent with unitary effect and the extension of the effects of this patent to overseas territories.

The minutes of the Council of Ministers of May 9, 2018 underlines that after the publication of this ordinance and its implementing decree, “the whole system constitutes a considerable step forward for investment in research and the competitiveness of companies. . "

The legal certainty of patent holders is thus reinforced.

Source: Ordinance n ° 2018-341 of May 9, 2018 relating to the European patent with unitary effect and to the unified patent jurisdiction