Recall

The article 231 ter of the General Tax Code (CGI) institutes the office tax (TSB). This annual tax, applicable in the Ile-de-France region, concerns the owners of premises used as offices, commercial premises, storage premises and parking areas.

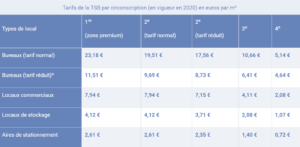

The amount of the tax is calculated by multiplying the area of the premises at a rate per m². Its amount depends on the location of the buildings.

Creation of the premium constituency

Until 2019, there were 3 constituencies. However, the finance law for 2020 established a new “premium” constituency concerning premises located in certain districts of Paris (the most popular) and certain municipalities located nearby.

The Ile de France region is therefore now divided into 4 constituencies:

- 1st district: 1st, 2nd, 7th, 8th, 9th, 10th, 15th, 16th, and 17th arrondissements of Paris (75), the municipalities of Boulogne-Billancourt, Courbevoie, Issy-les-Moulineaux, Levallois-Perret, Neuilly-sur-Seine and Puteaux (92).

- 2nd constituency: Paris (75) and the Hauts-de-Seine department (92) outside the zones corresponding to the 1st district. Some communes in Hauts-de-Seine benefit from a reduced rate. These are Bagneux, Châtenay-Malabry, Colombes, Fontenay-aux-Roses, Gennevilliers, Malakoff and Villeneuve-la-Garenne.

- 3rd district: Seine-Saint-Denis (93), Val-de-Marne (94) and the municipalities of Seine-et-Marne (77), Yvelines (78), Essonne (91) and Val-d ' Oise (95) which are part of the urban unit of Paris.

- 4th district: Other towns in the Île-de-France region.

Premium constituency rate

The new 1st district is therefore subject to a 20% tariff higher than the former 1st district. However, this only concerns office premises.

Finally, taxpayers do not receive any tax notice directly. A spontaneous declaration accompanied by the payment must therefore be sent to the competent service by the taxpayer. before 1er next march.

Our approach

In conclusion, our experts verify the elements to be declared before March 1, 2020 in order to analyze taxable surface areas according to :

- Of categories of premises

- Of exemptions

- Of any possibility of reprocessing