EXPERT'S ARTICLE - By Manuel Balency-Béarn, Consultant HR Performance, at GAC Group

Every year, in February, employers with 20 or more employees must send AGEFIPH a declaration related to theobligation to employ disabled workers (DOETH).

The obligation to declare disabled employees applies to all companies employing at least 1 person, regardless of the nature of the contract (fixed-term contract, permanent contract, trainee contract, apprenticeship contract, etc.).

If they do not meet their obligation to employ disabled workers, they must pay a contribution, the amount of which depends on the missing units. The employment rate for disabled people remains fixed at 6 % of the company's workforce.

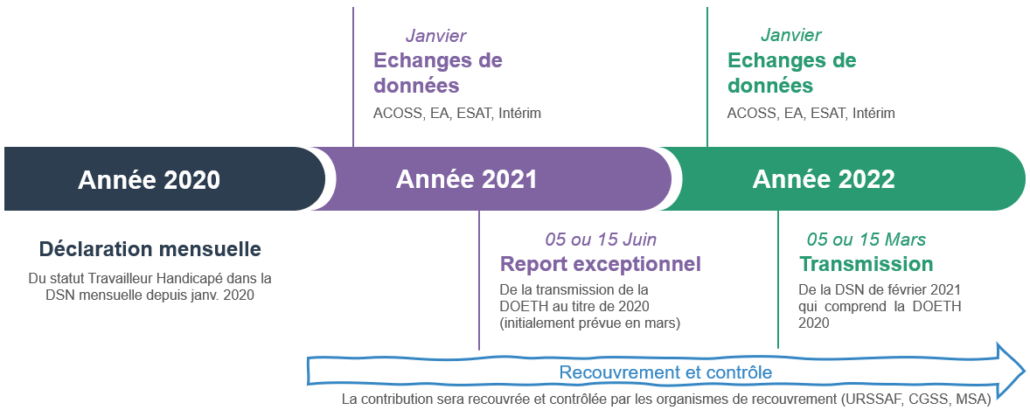

From 2021, they are now collection agencies (URSSAF, CGSS, MSA) and no longer by AGEFIPH which cover this contribution.

How to declare DOETH?

Until this year, it was possible to declare DOETH in 2 ways:

- Firstly, in the form of a paper declaration to be sent by post;

- But also by remote transmission on the Teledoeth site.

Nevertheless, from 2021, sending DOETH via these two channels will no longer be possible. Indeed, like almost all social declarations, the DSN will integrate the DOETH.

Thus, the DSN for the month of February, sent before March 5 or 15, will receive the DOETH linked to employees employed during the previous calendar year.

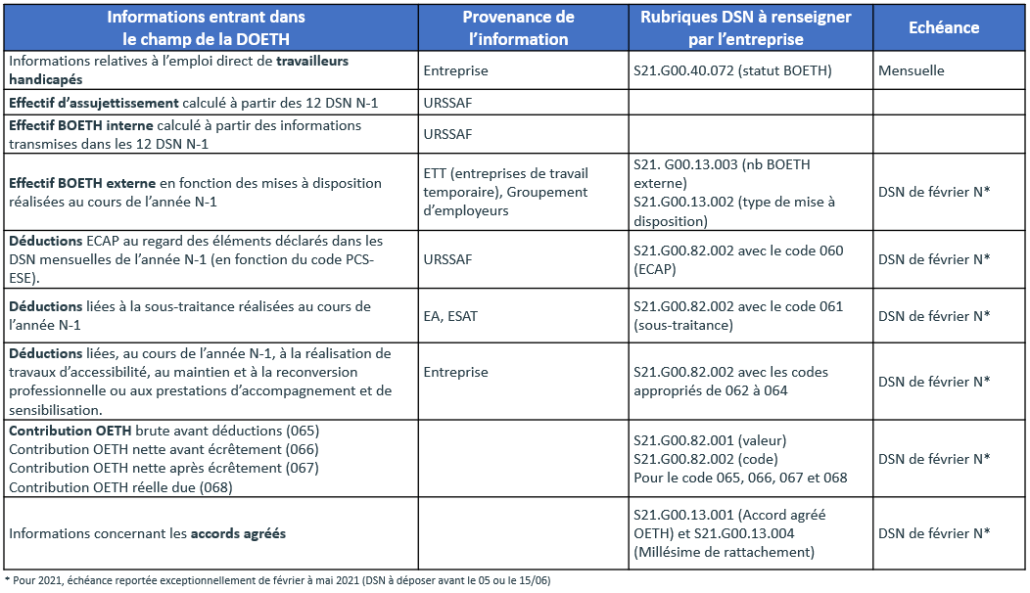

Accordingly, and since January 2020, all employers, whether or not subject to the employment obligation, must declare the status of disabled worker in each monthly DSN. This is to allow collection agencies to determine, at the end of January of the following year, the number of Bbeneficiaries of theOblockingEuse of Tworkers Hdisabled people employed by the company for a full year.

Special attention must be paid to the quality of the data transmitted in DSN (individual, contract and activity blocks). Indeed, entry and / or parameterization errors in DSN will cause an incorrect count of the BOETH workforce and / or reductions according to age, which may distort the calculation of the final contribution.

On June 23 and June 30, 2020, the GIP-MDS, in charge of the contracting authority of the DSN, provided details on the DSN declarations of the OETH and of the AGEFIPH contribution of which the subject employers are if necessary liable.

Exceptional postponement of the DOETH subscription date

In March 2021, the DOETH for the year 2020 will be exceptionally postponed to the DSN of month of May 2021 to be sent by 5 or 15 June 2021, subject to the publication of the decree on jobs requiring special aptitude conditions (ECAP).

Data exchanges prior to the development of the DOETH (before January 31)

Headcount

The collection agencies calculate and transmit the number of taxable persons retained on the basis of data from the 12 DSNs for the previous year.

It should be remembered that it is now the “social security” workforce that is used and no longer the “labor law” workforce. The number of employees no longer includes temporary workers..

Indeed, entry errors and / or DSN settings (contract and activity blocks) will cause an incorrect count of staff and may distort the calculation of the OETH.

“internal” BOETH workforce

Collection agencies will pass on the BOETH workforce that they have employed and declared in the past year to companies.

BOETH "external" workforce

Temporary employment companies (ETT) and employers' groups will calculate and then send to their user companies the number of BOETH staff that they will have made available to them during the employment period of year N - 1 .

ECAP deduction

The collection agencies calculate and make available to companies the number of employees carrying out ECAPs with regard to the elements declared in the monthly DSNs for year N-1. This calculation is thus carried out on the basis of the workforce corresponding to certain profession codes and socio-professional category (PCS-ESE). An additional code will have to be entered from 2021 for security guard jobs.

Particular attention must be paid to the supply of these headings in DSN. Indeed, if the headings are not supplied, the ECAP deduction cannot be taken into account by the collection agencies.

However, the decree on ECAP is still awaited and may modify the current list.

Deduction linked to the signing of supply, subcontracting or service contracts

These are adapted companies, establishments or work support services and disabled self-employed workers who send their client companies an annual certificate relating to year N-1.

Deductible expenses

The company declares directly, without waiting for any particular flow, the expenses concerned. For example under accessibility work, maintenance and retraining, etc.

Integration of this data in the DOETH (before the DSN closing in February)

The employer making his annual declaration must integrate all of this data into his DOETH. He will indeed pay particular attention to the data to be provided which does not come directly from the declarant:

The "External BOETH Number "

S21.G00.13.003" by specifying the type of provision in the "Type BOETH externe - S21.G00.13.002" field, code 01 - BOETH intérimaires, code 02 - BOETH salariés d'un groupement d'employeurs mis à disposition.

Deductions

They are to be declared under the heading “Contribution code - S21.G00.82.002”, code 060 for ECAP, 061 for the deduction linked to contracts and subcontracting, and various codes for other deductible expenses according to their nature ( 062 for accessibility works, etc.).

These deduction amounts to be declared in DSN are those before application of the capping rules specific to each deduction.

Calculation of the AGEFIPH contribution

The employer calculates the annual contribution on the basis of the data previously transmitted and declared in several stages through the block "Establishment contribution - S21.G00.82" under the headings "Value - S21.G00.82.001" and "Contribution code - S21.G00.82.002 ”with the following values to be used:

- Code 065 - Gross OETH contribution before deductions

- Code 066 - Net OETH contribution before capping

- Code 067 - Net OETH contribution after capping

- Code 068 - Actual OETH contribution due.

These values are zero if the employer has satisfied their OETH.

OETH completed by application of an approved agreement

The GIP-MDS has created a sheet explaining how to declare the annual OETH contribution in the event of an approved agreement (sheet 2353 of the DSN knowledge base created on June 30, 2020).

Information concerning approved agreements should be entered in the block “OETH supplement - S21.G00.13” under “S21.G00.13.001 - OETH approved agreement”, specifying the year concerned by the agreement in the section "S21.G00.13.004 - Matching year".

DOETH control

It should be remembered that the collection agencies are responsible for collection and the control of DOETH. Thanks to the DSN, they will be able to operate automated remote controls.

It seems logical that eventually alerts will be triggered and business reports will be issued if any discrepancies exist between:

- the contribution calculated by the employer and that calculated by the collection agency;

- as well as the data entered by the employer and the various data flows (staff, ECAP, etc.) sent by URSSAFs or third-party organizations.