As your DSN for December 2022 has not yet been submitted, our payroll and DSN expert, Claire Guillou, reviews the key points of the professional prevention account.

What is the Professional Prevention Account?

The Ameli.fr website reminds us that "The professional prevention account enables employees exposed to at least one risk factor on a list of 6 above a certain threshold to accumulate points. This account can be used to finance training, a move to part-time work or to validate pension insurance quarters".

Impacts in DSN

The employer declares in DSN the risk factors to which the employee is exposed above the thresholds at the latest in the DSN of December 2022, filed before January 5 or 15, 2023.

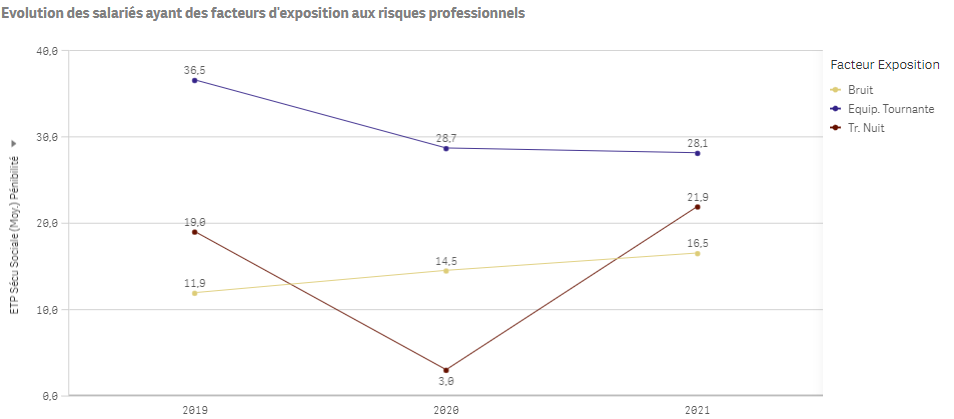

To identify exposed employees, several factors must be taken into account (see below), as well as the period of exposure:

- Night work;

- Repetitive work;

- Work in alternating shifts;

- Working in a hyperbaric environment;

- Noisy environment;

- Temperature extremes.

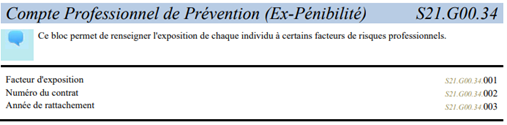

The employer declares occupational risk factors via block "S21.G00.34" of the DSN :

The declaration must be made for employees who are covered by the general or agricultural regime, with a private law contract of one month or more.

In the event of an error, the employer will be able to rectify the 2022 declaration via a rectifying nominative social declaration (DSN):

- If the correction is unfavorable to the employee, until April 5 or 15, 2023.

- If the change is favorable to the employee, until December 31, 2025.

The professional prevention account is automatically created and fed following the declaration.

The employee or ex-employee can then manage the data related to his or her professional prevention account online, in particular :

- Modification of your personal data

- Consulting your points balance

- Request to use points

Our payroll and DSN expert's advice:

As far as possible, make sure before submitting the December 2022 NSN that you have declared, in block 34, all persons concerned by an exposure above the thresholds to at least one risk factor in order to save yourself :

- Regularization blocks are always difficult and time-consuming to set up

- Conflictual and tense relations with employees or former employees whose rights have been infringed.

Our BI solution based on the DSN will allow you to verify the declared elements.

Indeed the dedicated application on D2BI The 4 sheets of paper allow you to review your previous declarations and to check the current year's declaration once you have submitted the NSN containing the information.

Payroll, DSN, professional risk management: G.A.C.'s global HR performance support

Our payroll and DSN experts work in close collaboration with our occupational risk management specialists in order to provide a global response to your problems.

So, if you need more specific information, especially if you have questions about the C2P itself, such as What are the risk factors? How can the rate of occupational accidents and injuries be controlled?Our dedicated team of consultants will be able to help you determine how they can support you.