New in DSN for the year 2021:

-

Individual contributions:

2. Other new features:

Replacement of the DOETH (AGEFIPH Declaration): Since January 2020, the OETH status of the employees concerned must be supplied with DSN. In May 2021, annual data related to this procedure such as the number of temporary workers used, expenditure for services by people with disabilities and expenditure for workstation improvement will be transmitted. in DSN. The previous DOETH is no longer to be done in 2021. Transmission of AT / MP rates : Companies with more than 10 employees and more will be notified automatically, which will replace the registered letter. Thanks to the machine to machine, the new rates will be received by the payroll software in order to integrate them immediately into payroll, which will avoid regularizations at the beginning of the year. Provision of the payment slip for the payment of daily allowances (BPIJ) in machine-to-machine API: The BPIJ is a complementary service of the DSN (for employers transmitting reports of work stoppage events) allowing easy consultation and quickly details of the settlements made on the employer's account concerning the subrogated daily allowances of his employees. This function will be available in June 2021. Management of the supplementary retirement: A new block is introduced in the technical vehicle for the supplementary retirement. This makes it possible to respond to the ordinance imposing the consolidation of hat-type retirement rights on a ceiling per employee. Management of the directory registration number (NIR): From 2021, NIRs, commonly known as social security numbers, which have not been issued correctly will no longer be accepted. Since the employee's NIR does not have a normal structure - i.e., only begins with 1 or 2 and does not have many 9s - it is mandatory to identify the employee by declaring a NTT (Numéro Technique Temporaire) in the "Numéro technique temporaire -S21.G00.30.020" section, which may not be used for more than 3 months. It must be accompanied by all possible information on the employee's birth details in the appropriate fields. This is a transitional solution as long as the employee has a NIR or a NIA recognized by Social Security. We must not invent a NIR. Management of exempted overtime: From 2021, these hours must be reported in DSN separately.3. Quality of DSN content

- The DSN: an obligation since 2017

- In the event of inaccuracy of the declared remuneration having the effect of reducing the declared contributions: 1 % of the PMSS, or 34,28 €[1] per employee.

- For any other type of content error: 0.33 % from the PMSS, i.e. 11,31 €1 per employee. Penalty not applicable in the event of regularization by the employer within 30 days of the transmission of the incorrect DSN.

- In the event of omission of employees: 1.5 % of the PMSS, i.e. 51,42 €1 per employee and per month or fraction of a month late. Amount capped at 150 % PMSS per company if production defect is less than or equal to 5 days.

- In the event of omission of identifying information from the employer: 0.5 % from the PMSS, i.e. 17,14 €1 per employee.

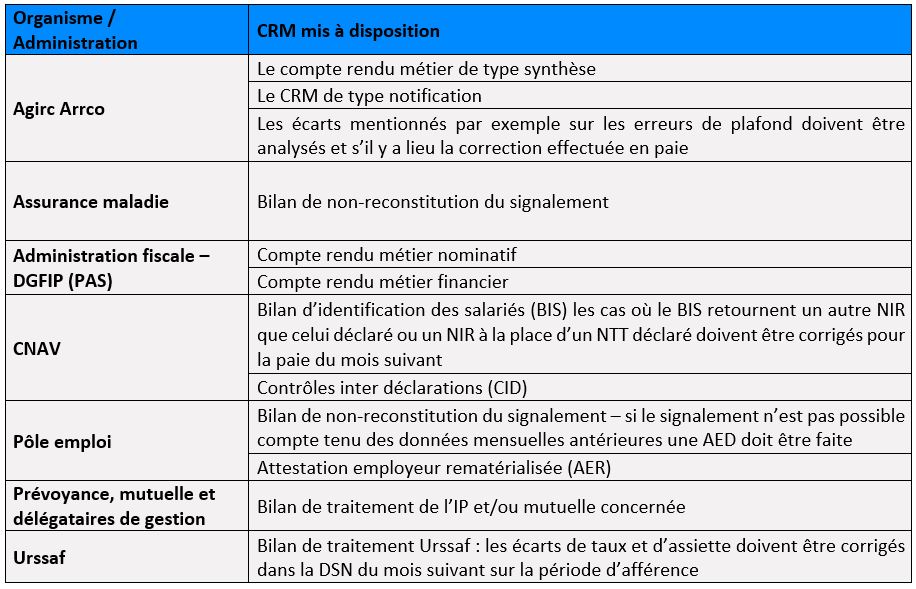

- Feedback following the filing of the DSN or the event report

The Anomaly Report (BAN):

The anomaly report is the report informing the declarant of one or more anomalies following the checks carried out on his declaration. It is made available on his DSN dashboard, in order to inform him of the invalidity of his declaration. These mainly involve checks on the essential information of the DSN, which relates to its structure, to the declarant's identification information and to an employee identification report. Two types of controls exist: Blocking check: the DSN is rejected. You must correct the information as soon as possible and issue a new DSN, before the due date Non-blocking check: the DSN has been accepted, but deviations potentially need to be corrected for correct inclusion by all recipient organizations and administrations.- Business reports (CRM):

Policyholder returns: the error reporting module

Error reporting module to the employer upon intervention by employees after consultation with www.mesdroitssocial.fr : Employees will be able to report the discrepancies observed between the resources collected and the items displayed on this portal, and if the discrepancy is not justified, the company will be notified.Priority consistency checks according to the URSSAF network:

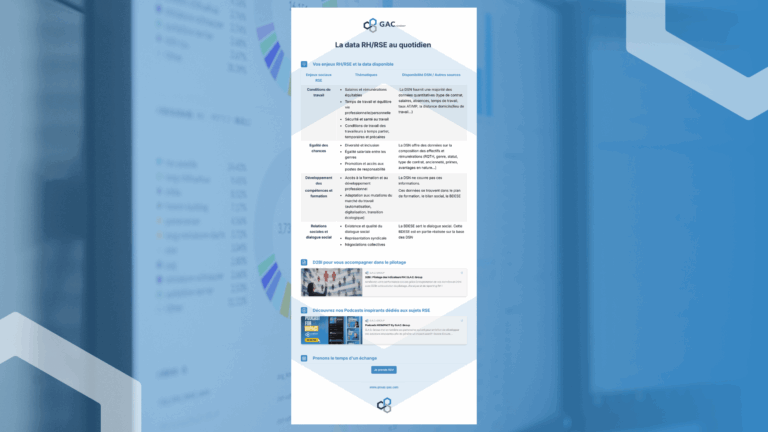

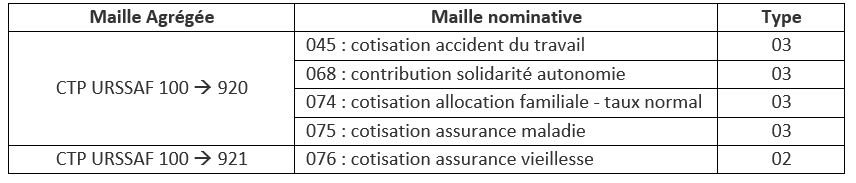

In August 2020, the URSSAF network highlighted on its website the points of vigilance to succeed in making its DSN relating to "Urssaf data" more reliable. We can assume that a certain number of remote controls will be put in place, in particular on the following items: Concept of work quota: it corresponds to the employee's contractual working time. The work quota is involved in the calculation of certain social exemptions or certain social rights. This data is expected in the DSN and is used by the organizations receiving the DSN. Unemployment insurance contributions: they must be entered in aggregate and nominative; it should be checked that there are no unexplained differences between the aggregate and the sum of the registered shares. According to URSSAF, to guarantee the rights of employees to unemployment insurance, the greatest rigor must be applied to each declaration. Other contributions declared to URSSAF: URSSAF generally recommends checking the consistency between the aggregated data declared via the personal type codes (CTP) and the individual data of employees; Since the 2021 standard, all CTP must be broken down by employee, which will probably generate, in the event of inconsistency, the issuance of business reports in the coming months. General contribution reduction (RGC):- in particular, reference is made to the extended RGC applicable to employer contributions for supplementary pensions to be provided on the declaration sent to supplementary retirement organizations;

- the monthly minimum wage used for the calculation for each employee must make it possible to reconstitute the calculated reduction; an automated control can easily be set up on this item;

- the individual RGC amounts must appear in negative but not the aggregated amount, otherwise this would cancel the amounts declared in registered form.

- Reinforcement of URSSAF controls in 2021:

- Rise in importance of these remote checks on the quality of DSN content: the so-called “data reliability” procedure:

In particular, the URSSAF network plans to carry out declarative checks in 2022 on the consistency between aggregate contributions and registered contributions.

It should also be remembered that the LFSS for 2020 has tightened the noose by giving the legal tool to recipient organizations. to make the content corrections themselves, which may lead to regularizations of payments made by positive or negative contributors. To do this, the collection agency must follow a strict procedure which must be defined by a decree in the Council of State. Thus, according to the new article L133-5-3-1 of the CSS, the declarants are informed of the results of the completeness, conformity and consistency checks carried out by the bodies for which the declared data are intended; are required, in the event of an anomaly resulting from these verifications, to make the required corrections. In the event of a deficiency, the organizations to which the declaration was sent can make this correction themselves.. However, before any application, a Council of State decree must determine the conditions and methods of application of these provisions, and in particular the contradictory procedure prior to the correction of declarations by the recipient organizations and the organizational arrangements guaranteeing the simple and coordinated nature of the procedures it provides.Resumption of attitude checks

The health crisis has led to a suspension, or even an outright cancellation of the assessment checks initiated during the year 2020. In many cases, it was a simple postponement. It is therefore to be expected that controls will resume in full force in 2021 with a slight catching-up effect if conditions allow. We have already seen from our customers that inspectors are starting to rely on DSNs transmitted via net-entreprises and use automated remote control processes to guide their investigations.An expansion of the collection and scope of control of URSSAF:

AGEFIPH Declaration In theory, the first remote controls could be implemented this year. This will be the case in particular when the employer declares staff data different from those already known to the URSSAF network and which is based on past DSNs. This year, the automated reception of general and OETH staff calculated by ACOSS and MSA is organized: the calculated staff will be transmitted for automatic integration into DSN. Declarations made to the supplementary pension funds: From 1er January 2022, the supplementary pension contributions (AGIRC-ARRCO) will be collected by the URSSAF network. The integration of these contributions into the URSSAF control field will undoubtedly generate more detailed business reports than those which exist until now and will therefore have to give rise to very short payroll corrections. It should be noted that URSSAF inspectors will see their field of investigation increase significantly since they may be required to carry out much more in-depth personal checks due to the insurance nature of these contributions. Moreover, in the event of a global adjustment of the base, contributors will suffer naturally higher levels of adjustment since they will integrate almost all of the social charges included in the pay slip. Parafiscal taxes From 1er January 2022, it is expected that the apprenticeship tax and the contribution to continuing vocational training will now be collected by ACOSS and the MSA on the basis of DSN data. This data will then be transmitted to the OPCOs and to France competences. Pre-calculation of the Gender Equality Index The indicator will be proposed on the dashboard with a calculation made by the administration from the DSN data. Content errors will cause the index to be calculated incorrectly. Thus, it seems more and more obvious that in the future, errors in the content of your DSNs will impact almost all of the recipient organizations and will be subject to automated checks carried out directly by the URSSAF which may give rise to adjustments. more substantial in case of control.[1] Values 2021