International consulting firm in innovation and performance

Our mission: accelerate the innovation and performance of companies and territories for a responsible development and sustainable growth

4 main areas of expertise :

Aligning strategies for sustainable growth and innovation

- Diagnosis of innovation capabilities

- Strategic marketing

- Sustainable innovation and growth strategy, sustainable value chain performance

Financing your innovation and development

- Taxation of innovation (CIR, CII, IP Box, JEI, etc.)

- Public grants and subsidies

- European collaborative projects

- Private funding

- Financing strategy

Managing your innovation and projects

- Structuring, steering and monitoring project portfolios

- Performance and impact assessment

- Decision support software suite

performance performance

Reduce, manage and ensure the reliability of your tax system

- Local/real estate taxation, urban planning taxation

- Energy and environmental taxation

- Innovation taxation

Control and secure your social charges and data

- Controlling payroll taxes

- Professional risk management and practice compliance

- DSN compliance

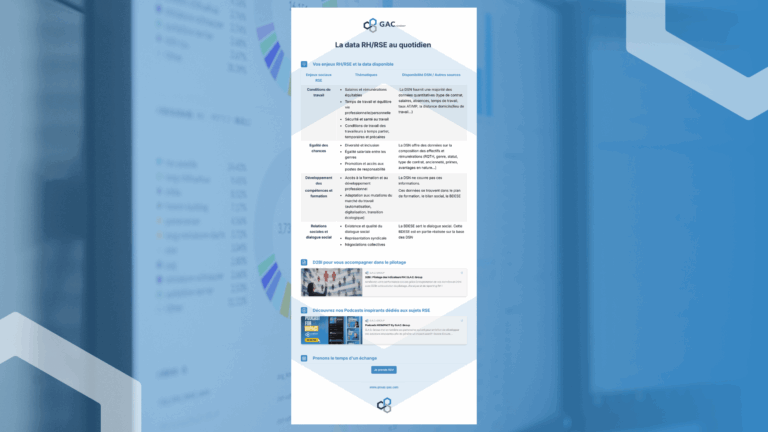

Manage your HR indicators

- Digital platforms for strategic decision-making

- Monitor your claims experience and automate your regulatory reporting

- Production and enhancement of HR data (BDESE, CSRD, VSME)

and territories

Accelerating CSR, sustainability and resilience strategies

- Aligning sustainability with economic growth

- Diagnosis & roadmap

- Eco-design

- Project financing

- 360° stakeholder onboarding

- Regulatory compliance: AGEC (eco-contribution, waste management), CSRD, VSME...

Supporting the sustainable performance of your human capital

- Securing social rights

- Occupational risk prevention

- Diversity and Inclusion

- Training & employability

- Exploiting and leveraging HR/CSR data

Build your decarbonization and environmental performance trajectories

- Energy performance

- Low-carbon trajectory

- Regulatory compliance (audit, Tertiary and BACS decrees, BEGES)

- Project financing (grants and subsidies, Energy Savings Certificates)

Evaluating public policies and promoting regional influence

- Studies socio-economic industrial, digital and environmental transitions

- Sector and innovation strategy

- Welcoming businesses and entrepreneurship

- Program performance evaluation

- Public action improvement plan

Join European collaborative projects to boost your competitiveness and impact

- Financing transitions and projects

- Setting up European collaborative projects

- Program management and coordination

Accelerating European and inter-regional cooperation

- European sectoral and thematic studies

- Development and management of capitalization platforms

- Dissemination and communication strategy

Our sector-based approach, a major asset for our customers

At G.A.C. Group, we have chosen to adopt a sector-based approach to adapt to the specific needs of each customer, whether in terms of regulation, innovation or digital transformation. Our consultants have in-depth knowledge of each sector, enabling them to offer tailor-made solutions that meet our customers' expectations and objectives.

Our latest news

If you too would like to help our customers meet their challenges and contribute to the transformation of their organizations, join us and become part of an exceptional human and professional adventure!

Find out more about ...

Our clients

Our partners

Newsletter

Receive all our expert news by e-mail.

Subscribe to our newsletter.

Contact us

By clicking on send, I consent to the information entered in the form being used by GACGroup to respond to my request. To know the details of the processing or exercise my rights, in particular the withdrawal of my consent to the use of the data collected, I can consult the Privacy policy of GAC Group.