Find below :

A little background on the IP Box

To comply with OECD recommendations, the finance law for 2019 has profoundly modified the system of taxation of intellectual property products.

Indeed, the Organization for Economic Co-operation and Development (OECD) - then the European Union - in its recommendations to combat harmful practices, established the so-called " NEXUS », consisting in correlating the tax advantage linked to income from intellectual property, to the research expenses linked to the assets generating the said income.

Thus, the previous system, which consisted of taxing income eligible for 15%, without any other specific conditions, was deemed not to comply with the approach recommended by the OECD, and therefore replaced.

We will therefore, in this article, present and then comment on the calculation methods of the device, codified in article 238 of the General Tax Code, and the difficulties that companies that opt for this new system may face.

Scope and calculation methods

Beyond the operation of the device, the field of application has also been quite significantly modified.

Eligible companies

Are eligible, as for the Research Tax Credit (CIR), industrial and commercial companies, subject to a real tax system.

Eligible transactions and income

Article 238 of the General Tax Code provides that the special regime applies to the net result of the sale, concession or sub-concession operations relating to the following assets which have the character of fixed asset items:

- Patents in the broad sense which include utility certificates and supplementary protection certificates attached to patents;

- Plant variety certificates (VOC);

- Software protected by copyright ;

- Industrial manufacturing processes which are the result of research operations, which are an essential accessory to the exploitation of a patent or utility certificate, and which are the subject of a single license agreement with the invention.

One of the main novelties of this device is the opening of the device to companies publishing software protected by copyright.. It should be noted that the software is protected by copyright without any particular formalities, provided that the author is able to indicate that he has "demonstrated a personalized effort that goes beyond the simple implementation of an automatic and constraining logic". to develop it, according to the terms of the judges of the Court of Cassation.

Calculation methods

Determination of net income

The taxpayer must first identify the eligible income. Then calculate the tax benefit relative to said income.

: Article 238 of the General Tax Code provides that are eligible income from assignment, concession or sub-concession operations relating to the intellectual property assets mentioned.

The main difficulty that companies can face, especially for software publishers, is to identify and'isolate eligible income.

Indeed, by way of example but it is often the case, the granting of a license is often accompanied by an after-sales service, a hotline, a maintenance service... and all these services will not be eligible for the scheme, but are subject to “global” billing. If the contract does not individualize the price of each service, it will be appropriate for the company to reconstitute and individualize the turnover that can enter into the “IP BOX” result.

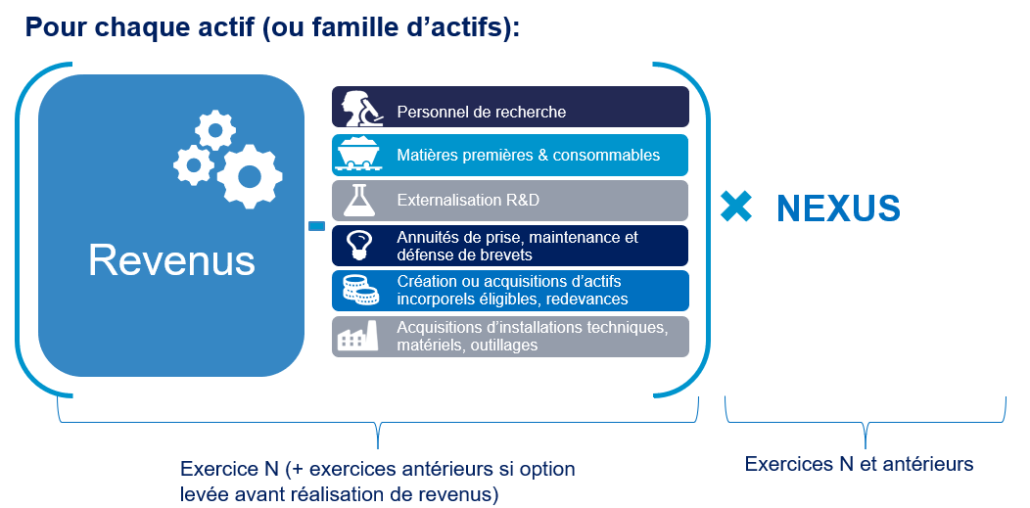

The net income eligible for the preferential rate is obtained by the difference between the income related to the sale/concession/sub-sale of the asset in question and the direct expenses incurred for the acquisition and development of this asset.

Research and development expenses are deducted from eligible income. This provision, which may appear to penalize taxpayers who make a major research effort, has been included to ensure that expenses potentially eligible for the CIR do not give rise to a second tax advantage on the same operations.

Payroll costs, costs of acquiring or creating equipment, supplies and raw materials used, costs of obtaining and maintaining industrial property titles, royalties for assets in sub-concession and asset acquisition costs.

The method used to calculate net income eligible for the preferential treatment differs from that used to calculate net income under ordinary law:

- The expenses deducted are those directly related to the acquisition, research and development of the asset in question, without taking into account the surrounding costs;

- This calculation must be made by asset, except to justify the impossibility of tracking income or research expenses by asset. In this case, the assets can be grouped by family.

Nexus Ratio Determination

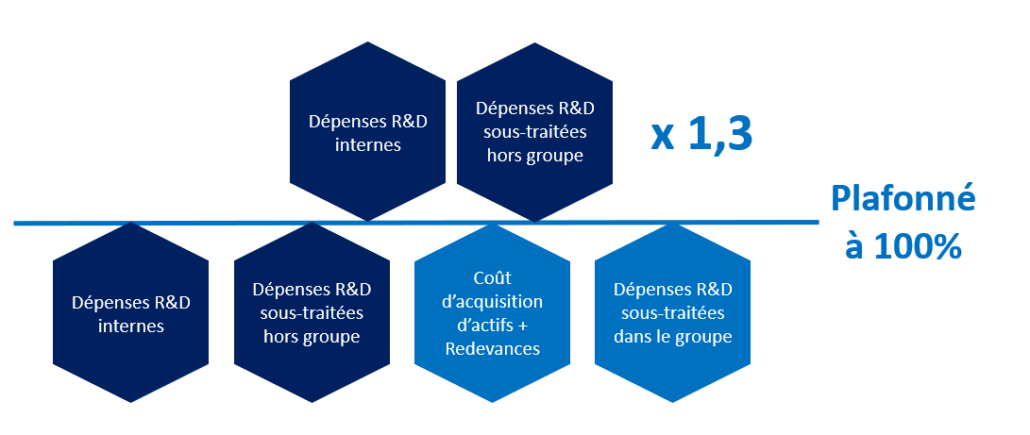

The net income thus obtained is weighted by a so-called Nexus ratio, which reflects the degree of involvement of the reporting company in the development of this asset.

Thus, and it is through this operation that the system meets the requirements of the OECD, the tax benefit is linked to the research expenses incurred directly by the declaring company. Therefore, a company that has developed its assets internally at 100% will have a ratio of 1, and will be taxable at 10% on all of its eligible income.

Explanatory diagram

Step 1: Determining net income

Figure 1: Mechanism for calculating net income under the preferential regime for an asset

Step 2: Nexus ratio calculation

Figure 2: Formula for calculating the Nexus ratio for an asset

The tax saving therefore corresponds to the difference in the tax rate on the tax base constituted by the calculated net income of the asset, and this for each asset for which the company opts.

In the event of no income or negative net income

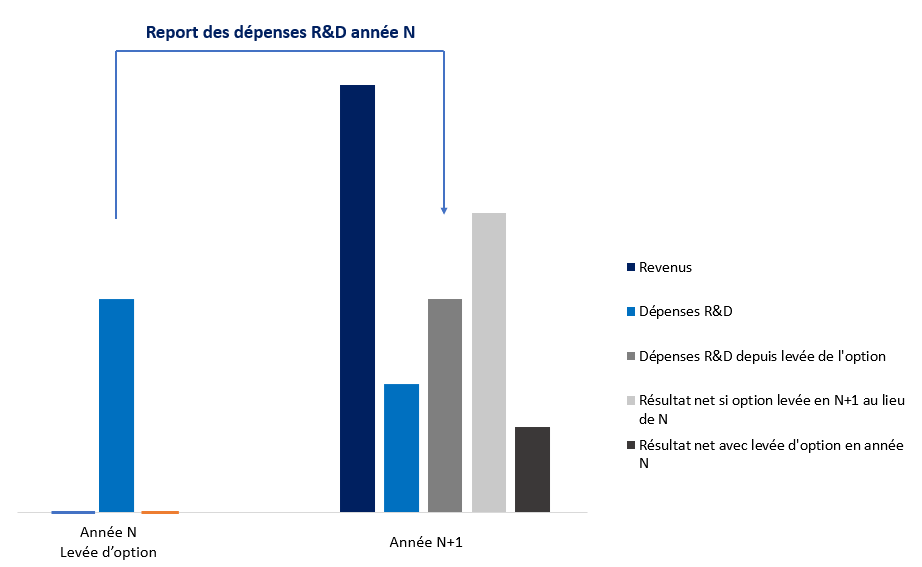

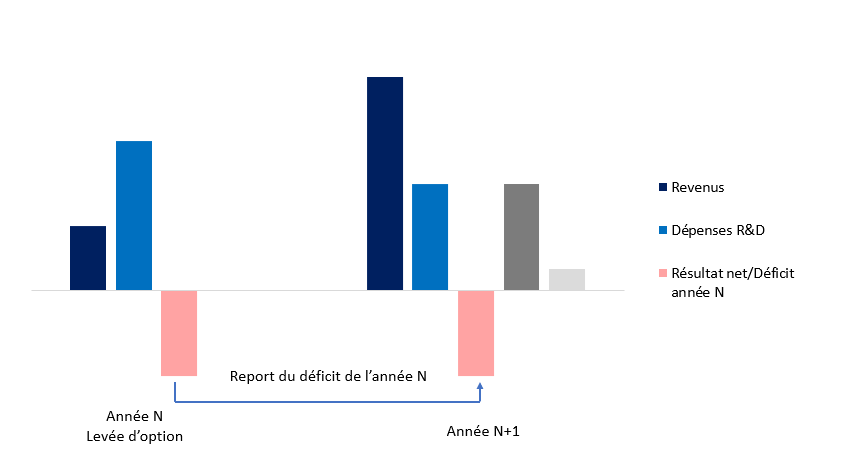

In the absence of income or in the event of a net loss, the favorable regime will have no impact on the amount of tax owed by the company for this financial year. However, if the option has been exercised for this asset, the potential savings of future years will be impacted, the deficit being carried forward to the following years.

The choice to exercise the option for an asset must therefore be based on a case-by-case analysis and projections.

Step 3: Drawing up the justification for calculating the benefit

In order to make the right trade-offs and secure calculations, but also to present the tax authorities with a robust methodology, a detailed analytical follow-up of income and expenses per asset is an asset and a necessity.

Indeed, the tax advantage obtained by the company can be quite significant and certain gray areas have not yet been clarified, neither by the judges nor by the administration.

So, just as the CIR scheme has encouraged companies to structure the monitoring of their R&D, both in terms of activities carried out and investments made, the IP BOX is an opportunity to question and improve management control.

Article written by our experts :

Marion CHABRILLAT

Innovation consultant specializing in the IP Box device

François-Xavier PIC

Tax lawyer