A circular from the CNAM increases the annuities and capital allowances paid to victims of accidents at work and occupational diseases by 1.8% on April 1, 2022.

After an accident at work or an occupational disease, if the after-effects justify it, a partial permanent disability rate (IPP) can be assigned to your employee. This rate takes into account nature of disabilitythegeneral conditiontheageand professional skills and qualifications of your employee. It is established by the Caisse Primaire's medical advisor and set according to the indicative scale of invalidity for industrial accidents appended to the Social Security Code. This rate entitles you to lump-sum compensation or a annuity. In the event of death, the beneficiaries can also benefit from a financial assistance.

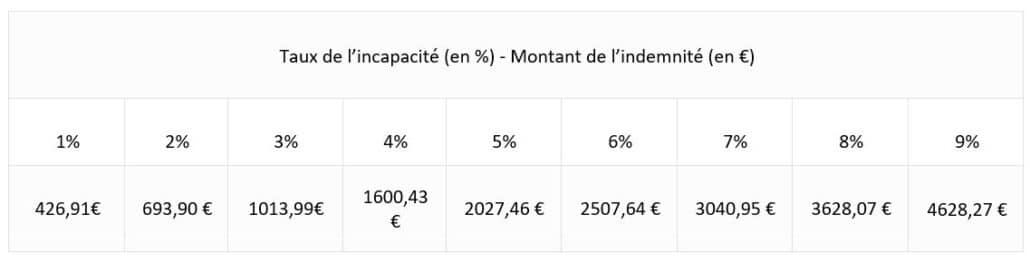

What is the capital indemnity?

When the partial permanent disability rate (IPP) is less than 10%the lump-sum compensation paid to the employee is based on the following scale:

Focus on the AT/MP pension

When theIPP is equal to or greater than 10%the employee is entitled to a periodic pension:

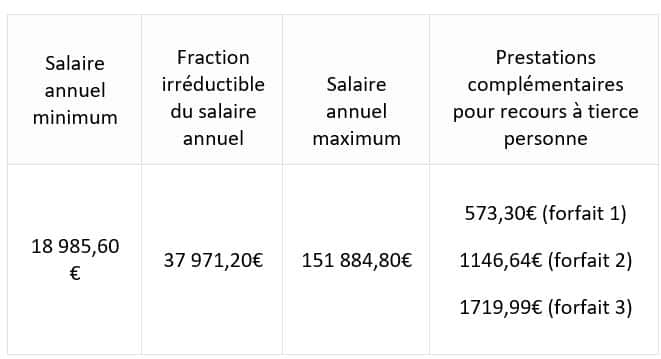

The calculation elements of the AT/MP pension are also revalued:

How is the AT/MP pension calculated?

The pension is calculated on the basis of the salary of the Last 12 months preceding the work stoppage. It is equal to the annual salary multiplied by the degree of disability previously reduced by half for the portion of the degree below 50 % and increased by half for the portion above 50 %The annual salary is not always taken in full.

So, if the annual salary is higher than the minimum pension salary (i.e. €18,631.28) will be retained in the following proportions:

- Up to 2 times the minimum annuity wage: it is counted in full;

- From 2 to 8 times the minimum annuity wage: the fraction exceeding two times the minimum wage is counted as one-third;

- Above 8 times the minimum annuity salary: the maximum annuity salary will be applied.

AT / MP pension = annual reference salary x corrected IPP rate *

the proportion of the PPI rate awarded ≤ 50% is divided by 2; the proportion of the PPI rate >50% is multiplied by 1.5. Ex: PPI rate awarded = 60% at corrected PPI rate = 40% (50/2+101,5)

PPI rate assigned = 20% to corrected PPI rate =10% (20/2)

This revaluation has no impact on the calculation of the AT/MP contribution rate. The partial permanent disability rates are charged to the employer's account according to the Average Cost Category scale2, set each year by ministerial order. If you don't want to miss out on the latest news on work-related accidents and illnesses, don't hesitate to contact us.

Find out more about reporting accidents in the workplace

Receive all our expert news by e-mail.

Subscribe to our newsletter.