What is the Bonus-Malus?

As with your car, it is a yearly mechanism of reduction or increase of your employer's unemployment insurance contributionse.

Have you terminated a number of contracts (permanent, fixed-term or temporary) and registered with Pôle Emploi over the last 3 years?

You are potentially affected by this measure. Let's take a look at the conditions that give rise to an increase or reduction in your employer's unemployment insurance contributions.

Why was the bonus-malus system for employer contributions introduced?

To encourage employers to take responsibility encourage long-term hiring (permanent contracts, long-term fixed-term contracts).

How is the Bonus-Malus calculated?

In function:

- Of number of contract terminations working and number of registrations with Pôle Emploi of your employees who have left over the last 3 years (which is related to your headcount (EMA) to give your separation rate).

- Of median separation rate for your industry (set by order each year).

When must the bonus-malus on employer contributions be applied in payroll?

From the payrolls of the month of September 2022for some companies.

Is my company affected by this modulation?

Your company is affected by this modulation if:

- Your company (and therefore all your establishments) has 11 employees and more ;

- Over the last 3 years (excluding apprenticeship contracts, insertion contracts and resignations), you have recorded numerous contract terminations (CDI, CDD, temporary work) giving rise to registration at the Pôle Emploi ;

- Your main activity is in one of the following sectors:

- Woodworking, paper and printing industries (IDDC entered in DSN item S21.G00.11.022 : 83,1700, 1492, 1495, 58,172, 184, 489, 614, 2089, 2089, 3222, 8211, 8212, 8231, 8241, 8251, 8311, 8412, 8415, 8421, 8431, 8432, 8522, 8531, 8541, 8721, 8731, 8741, 8822, 8831, 9022, 9211, 9581, 9602, 9702, 9711, 9891)

- Manufacture of rubber and plastic products and other non-metallic mineral products (IDDC entered in DSN field S21.G00.11.022:45, 87, 135, 211, 292, 669, 832, 833,1170, 1499, 1558, 1800, 1821, 1942, 3151, 3227)

- Water production and distribution; wastewater treatment, waste management and pollution control (IDDC entered in DSN field S21.G00.11.022: 637, 2147, 2149, 227)

These conditions being cumulativeIf you are in this situation, there is a good chance that your unemployment insurance rates will be over 4.05% for all your employees from September 2022 onwards.

On the other hand, if you don't have many contract terminations, your rate may be lower. modulated downwards.

How can I ensure that it is applied to my September paychecks?

When and how is my company informed?

In July 2021 and June 2022, URSSAF should have sent you an email about your eligibility for the scheme.

In the first week of September 2022, you will receive a business report on your net.entreprises dashboard, which will inform you of the rate to be applied to your September payroll.

How to check the calculation of the applicable rate?

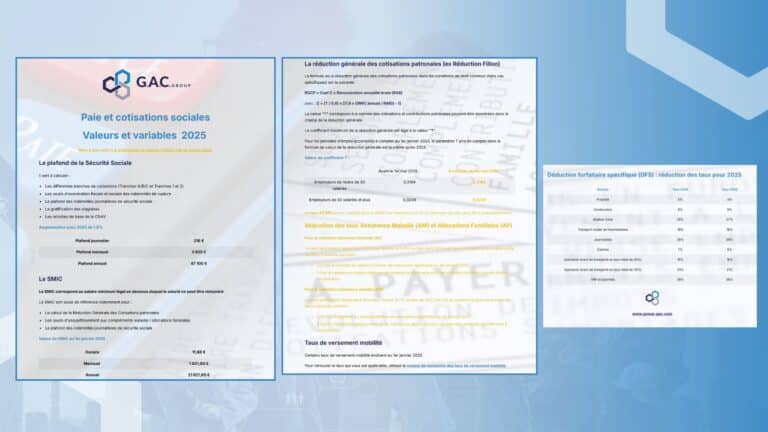

The calculation of the modulated rate of the unemployment insurance contribution is as follows:

(Company separation rate/sector median separation rate) × 1.46 + 2.59

Please note that there is a specific calculation and therefore a specific rate that applies to employees affiliated to a paid leave fund:

(Company separation rate/sector median separation rate) × 1.62 + 2.43

All these calculations depend on many elements specific to each company.

How does this tiered rate affect my contributions?

The impact is diverse but at the moment, we are still waiting for details by decree to be published in the Official Journal. Our experts will keep you informed.

How to declare this modulation?

The reporting procedures are precise and new CTPs have been created depending on the company's situation, the employee's status, etc. (Cf. instructions sheet 2572).

What are the penalties for misapplication?

The collection of the unemployment insurance contribution is handled by Urssaf in accordance with the rules, guarantees and penalties applicable to the collection of contributions under the general Social Security scheme.

In order to avoid any adjustment or to guarantee the reliability of this new mechanism, our experts will accompany you.

FINAN Laure

HR Performance Consultant - Audit of Social Charges

To learn more about the Malus-Bonus

Do you have a question about the Bonus-Malus? Please contact us!

Our support consists of check the quality of the content of your DSNs by identifying any human/parameterization errors or undetectable errors, and thus avoid financial and social risks for your business. Our expertise is combined with D2BI technology.

Make an appointment now!

Choosing G.A.C. Group means entrusting payroll and social security experts with the security and reliability of your payroll, so that you can focus on your core business. At G.A.C. Group, we're convinced that a successful company is one that knows how to turn its legal obligations into opportunities. Our teams are at your side to help you develop your social performance.

Receive all our expert news by e-mail.

Subscribe to our newsletter.