The research expenditure entrusted to a third party accounts for a large share of the CIR budget of a company. Subcontracting, co-contracting, collaborative research with a private or public laboratory, approved body... these are the concepts you need to master in order to enhance the value and security of these expenses, all the more so since the tax environment has changed significantly recently.

Indeed, the end of the doubling of public subcontracting expenses, the creation of the Research Collaboration Tax Credit (CICo) and new case law have overturned practices that had been in place for several years.

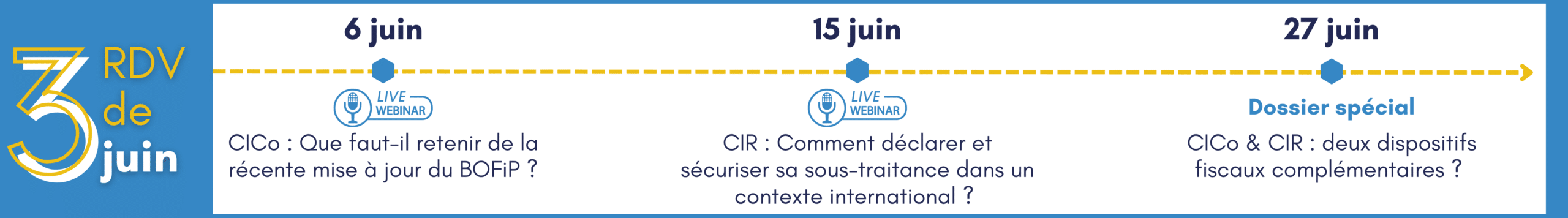

That's why we're bringing you an exclusive saga on these complex and topical subjects. There will be 3 events during the month of June 2023, so mark your calendars!

Tuesday, June 6, 2023 - Webinar "CICo: What should we keep in mind from the recent BOFiP update?"

- In partnership with Hauts-de-France Innovation Développement (HDFID)

The tax doctrine dedicated to the Tax Credit for Collaborative Research (CICo) was published on April 13, 2023 and a public consultation has been opened on the subject. The documents put forward include theeligibility of organizations and expensesfrom calculation tax credit and its use, as well as reporting obligationsToday, many research and knowledge dissemination organizations (ORDCs) and reporting companies are wondering about the CICo, which is tending to become a tax credit in its own right. The notion of intellectual property resulting from collaborative research also raises legitimate questions.

G.A.C. Group joins forces with Hauts-de-France Innovation Développement (HDFID) to give you all the answers. Our innovation tax experts will address the following topics following key points :

- Eligibility conditions and links with the CIR

- Nature of eligible costs and calculation methods

- Contractualization required by CICo

- Sharing work and results

To receive the replay, please fill in the form below.

Experts and special guests

François-Xavier PIC, Head of Tax Law at G.A.C. Group

François-Xavier holds a Master's degree in Private Law and a specialized Master's degree in "Juriste et Management International", and has been developing his expertise in research taxation for the past ten years. Today, he is head of the Innovation Tax Business Unit at G.A.C., where he is constantly on the lookout for new developments (legislation, case law, administrative doctrine), and assists his clients when they are faced with tax audits.

Adélie BEAGUE, Europe Research Innovation Project Manager at HDFID

With a degree in strategic marketing, Adélie has been specializing in research funding and technology transfer for almost 10 years with SATT Nord, as well as in innovation consulting. Today, she supports private and public research players in their efforts to work more closely together within Hauts-de-France Innovation Développement, to boost technology transfer and exchanges between the academic and business worlds.

Sarah CHERFI, Tax Consultant, G.A.C Group

Sarah holds a double master's degree in tax law and finance. She began her career in a law firm, working as a tax and business lawyer. Sarah then joined G.A.C Group's legal and tax team, where she helps clients secure their research and innovation tax credits, particularly in the face of government controls.

Thursday, June 15, 2023 - Webinar "CIR: How to declare and secure your subcontracting in an international context?"

- In partnership with DFCG Midi-Pyrénées

Subcontracting expenses for the CIR are clearly defined: capping, service provider approval or contract drawn up by the customer are key elements in securing your declaration. However, certainties become blurred in a international context especially for groups with subsidiaries outside France. New provisions have highlighted a number of tax subtleties that companies need to be aware of, particularly on the subjects of cascade subcontracting or the collaboration contract.

For this webinar, G.A.C. Group joins forces with the DFCG Midi-Pyrénées to shed light on the concept of subcontracting in the CIR in the specific context of international business. Our experts will illustrate what they have to say with concrete case studies key points addressed will be :

- Subcontracting for the French CIR in an international context (conditions for valorizing work carried out in Europe)

- Case studies : Romanian and German CIR

- Securing the CIR for an international group (recoverable amount - notion of transfer price, identification of eligible work)

To receive a replay of the webinar, please fill in the form below.

Experts and special guests

François-Xavier PIC, Head of Tax Law at G.A.C. Group

François-Xavier holds a Master's degree in Private Law and a specialized Master's degree in "Juriste et Management International", and has been developing his expertise in research taxation for the past ten years. Today, he is head of the Innovation Tax Business Unit at G.A.C., where he is constantly on the lookout for new developments (legislation, case law, administrative doctrine), and assists his clients when they are faced with tax audits.

Anne BRIQUETEUR URBAIN, President DFCG Midi-Pyrénées

A chartered accountant and statutory auditor, Anne graduated from ISEG Paris and holds a DESS in Accounting Information Systems Design and Management from the University of Reims. She has been with KPMG since 1994. She performs statutory audit, contractual audit and consulting assignments for family-owned groups and small and medium-sized companies, and has also developed strong expertise in consolidation.

Alexandru COJOCARU, Innovation Consulting Manager, G.A.C. Group

With a degree in environmental engineering and solar energy, Alexandru has extensive experience of the business world. He started out as an R&D and IT engineer, before specializing in finance and business administration. Today, he puts his entrepreneurial spirit and passion for innovation to good use in his role as Innovation Consulting Manager, helping his customers to manage their research tax credit and innovation.

Tuesday, June 27 - Special report: "CICo & CIR: two complementary tax schemes?

- Exclusive publication for subscribers to previous webinars

The management of outsourced R&D expenditure under the CIR is becoming increasingly complex for companies, in particular since the creation of CICo in 2022. In fact, the recent publication of tax doctrine has led to changes in the CICo, and it is likely that some of these changes will be implemented in the future. interactions will take place between CIR and CICo for subcontracting or cooperation contracts for the same R&D project.

In this special report, discover our tax experts' analysis of the complementarity of the CIR and CICo schemes and how make the most of your outsourced R&D contracts with your public and private service providers and partners.

G.A.C. Group is listed among the CIR-CII consulting firms by the Médiation des entreprises