December 2022 DOCTRINE: Parliamentary question on the IP Box

Parliamentarians have the possibility to send written questions to the Government.

It is in this context that one of them questioned the Minister of Economy, Finance and Industrial Sovereignty and Digital te about :

- "The major difference in treatment between sole proprietorships and companies benefiting from the so-called IP Box regime (article 238 of the CGI)."

- And on what the government intends to do "to improve the IP Box system and remedy the difference in treatment it creates".

The The preferential regime, provided for in Article 238 of the CGI, allows the application of the following to products derived from certain intellectual property rightsa reduced rate of 10%.

She also points out that the preferential rate (10%) applies indiscriminately to companies subject to corporation tax (IS) and to sole proprietorships subject to income tax (IR). This has the effect of significantly reducing the corporate income tax rate from 25 % to 10 % (article 219 I. a. of the CGI), while the reduction in the personal income tax rate for sole proprietorships is almost anecdotal.

She therefore asks the government what it intends to do to improve the IP Box system and remedy the unequal treatment it creates in spite of itself.

The parliamentarian draws attention to the recommendations of the European Union and to the measures put in place by our European neighbors such as "Belgium and Luxembourg, where an abatement on the taxable base is applied, respectively of 85 % and 80 %".

The Question was published in the Official Gazette on December 27, 2022, we expect the answer of the government during 2023.

Source: https://questions.assemblee-nationale.fr/q16/16-4442QE.htm

November 2022 | LEGISLATIVE EVOLUTION: Modernization of the video game tax credit

Pursuing its strategy to make France a leader in video game production, the French government hast adopted a new decree which aims to modernize the system. The CIJV scheme has also been extended until December 31, 2028.

The eligibility of games for this preferential regime is based on a "Contribution to the development of creation" scale, known as the "cultural scale", which is based on various criteria that make it possible to define the cultural nature of video games (article D331-22 of the French Cinema and Moving Images Code). The previous version, conceived in 2007 when the system was created, no longer corresponded to the current stakes of the industry and was modernized at the end of a work carried out by the National Center of Cinema and the Animated Image (CNC) and the General Direction of the Companies in connection with the professionals of the sector.

Video games that have cumulatively obtained a certain number of points are considered to meet the creation conditions mentioned in the previous paragraph.

The purpose of the new scale is to modernize the video game tax credit so that it responds to the problems that "game designers" may encounter. This decree makes it possible to adapt the criteria to current games, the criteria are simpler, better defined and more objective, which makes them more predictable.

This new system is intended to be an incentive, with a more detailed cultural objective than its predecessor. In particular, it enshrines the principle of "original creation".

Thus, projects that demonstrate original visual, narrative and/or musical creation during the creation of a new universe and/or a new concept are awarded points.

Points may also be awarded for innovative nature of the gametechnological innovation is an integral part of the dynamics of video game creation. It will be better adapted to mobile video games, which have become an important part of the production dynamics of French studios.

In addition, this new scale maintains a heritage criterionIn addition to the criteria relating to the European character of the video game, we also encourage projects with a strong European identity, in terms of content, choice of languages, or the production team.

November 2022 | 2023 FINANCE ACT: Amendment adopted n°II-CF1608: report on the Research Tax Credit

This amendment, adopted by the deputies, asks the Government to submit to Parliament a complete report on the research tax credit (CIR).

https://www.legifrance.gouv.fr/loda/id/LEGITEXT000046511777/2022-11-02/#LEGITEXT000046511777

In terms of cost, this system is the main tax expenditure at 7 billion euros. The purpose of this report is to :

- To bring more clarity to the research tax credit while informing the Parliament about its use, and the public about the comparison of the French system with the European systems;

- Evaluate the impact of the research tax credit on the various sectors, especially services;

- To quantify the share of subcontracting carried out by private laboratories and public and European organizations.

- To judge the effectiveness of the system with companies of different sizes;

- Examine the relevance of the Collection Tax Credit to consider its removal or renewal.

Source: https://www.assemblee-nationale.fr/dyn/16/amendements/0273C/CION_FIN/CF1608.pdf

November 2022 | 2023 FINANCE BILL: Amendment adopted n°II-CF1556: report on the feasibility of a GREEN IRA

This amendment, adopted by parliamentarians, comes after the parliamentary group initially tasked by Economy Minister Bruno Lemaire with investigating the possibility of a green tax credit, came up against the complexity of implementing such a scheme. The difficulties of such a greening had already been the subject of a study in the CPO report of February. The amendment confirms the difficulties encountered in implementing the green CIR for the coming year.

As a reminder, the complexity of its implementation stems from :

- The definition of what is green research and development;

- The assessment of the compatibility of this instrument with European State aid regulations ;

- The capacity of tax auditing to adapt to this new dimension.

This is why the present amendment by the members of the Socialist and Related Groups requests a report to study the "green CIR" and identify the obstacles to its implementation and the means to remove them.

Source: https://www.assemblee-nationale.fr/dyn/16/amendements/0273C/CION_FIN/CF1556.pdf

September 2022 BEYOND THE RTC: The green research tax credit postponed

The parliamentary group charged by the Minister of the Economy Bruno Lemaire with investigating the possibility of a green tax credit has come up against the complexity of implementing such a system.

"Technically and legally, it seems complicated" says a member of the majority. The door opened by the Minister of the Economy thus seems to be closing.

The difficulties of such a greening had already been the subject of a study in the CPO report of February. Moreover, certain sectors of activity seem to be excluded and are therefore concerned about such a reform (e.g. the health sector).

An employer source believes that by adding additional conditions to the eligibility of the CIR, it could be requalified as state aid, and an authorization from Brussels would then be required, which could call into question the entire system.

Jean-René Cazeneuve, deputy of the Gers and rapporteur of the budget indicates that : "We still share the objective of better targeting these tax expenditures towards the ecological transition, but we believe it is essential to give companies time. We want to give a signal to businesses, but we do not want to introduce binding measures as early as the 2023 budget. "

It seems that the green research tax credit will not be introduced in 2023. It will surely be discussed during the parliamentary discussions of this fall to better return in the years to come.

Sources:

https://www.legifrance.gouv.fr/loda/id/LEGITEXT000046511777/2022-11-02/#LEGITEXT000046511777

https://www.lesechos.fr/economie-france/budget-fiscalite/les-pistes-de-la-majorite-pour-verdir-le-budget-2023-1788984

September 2022 BEYOND THE RTC: Denouncing the abuses of the research tax credit

A report by the Conseil d'Analyse Economique condemns the abuses of the research tax credit, and in particular the capture by major groups of this 7 billion euro a year research subsidy. According to the report, this public money should be redirected to the companies that need it: innovative SMEs.

The report measures the impact of the introduction of this system on its beneficiaries over the period 2013-2016. The study of the scientific literature and the various evaluation reports leads them to consider that the Research Tax Credit (RTC) is a potentially effective but poorly targeted measure.

Like the CPO (Conseil des prélèvements obligatoires) report in February, the Conseil d'analyse économique notes that the tax credit "It is not sufficiently focused on small and medium-sized companies, which are the most innovative and for which the return on the RTC is the highest according to our estimates. "

The authors of the report indicate, by way of illustration "that one million euros directed to VSEs is associated with the filing of 1.16 patents, compared to 0.46 when the same million euros is directed to large companies, i.e. a return 2.5 times higher.

The report also indicates that the CIR should benefit work that could not be done without it. Finally, the report makes proposals to optimize the RTC and direct it to the companies that need it most.

To do this, it recommends abolishing the reduced rate of 5% for expenses exceeding 100 million euros, and lowering the said ceiling to 20 million euros.

At the same time, the tax credit rate could be increased to 42%.

Source: https://www.cae-eco.fr/staticfiles/pdf/cae_Note075(3).pdf

- Towards a green research tax credit

French Economy Minister Bruno Lemaire recently defended the research tax credit. He believes that this often-criticized tool "makes our country more attractive" and "helps improve innovation and investment in innovation".

The minister has asked a group of parliamentarians to find ways to save public spending for the 2023 budget, which should be presented on September 26 at the Council of Ministers. This parliamentary group is proposing, among other things, to change the research tax credit in order to encourage spending on the ecological transition.

This proposal is not new, since it was introduced in the February report of the Conseil des prélèvements obligatoires. The CPO proposed several scenarios for the evolution of the CIR (with a variable budgetary impact) in order to improve its efficiency. It suggested the creation of a "green" tax credit to encourage research spending in the environmental field. But 3 difficulties seem to emerge:

- Defining what would be green R&D;

- The compatibility of this instrument with European State Aid Law;

- The adaptation of the tax audit accordingly.

The Council identified two types of mechanism: one, coercive, consisting in making the granting of the CIR conditional on a research project that does not harm the environment. The other, an incentive, consisted in increasing the rate of the CIR for research expenditure in favor of the environment.

At this stage, these are only guidelines, which are likely to meet with some reluctance and complications in their implementation. It will therefore be interesting to follow the parliamentary work on this subject.

- CICO: the Collaborative Tax Credit

- Context :

The implementing decree concerning the Collaborative Tax Credit (hereinafter CICO) was finally published on July 15, 2020.

At this stage, it is an application decree, so we are still awaiting the administrative doctrine on the subject (BOFIP), which should be more complete and which should be published soon.

- Content of the decree :

At the outset, the decree specifies that the tax audit may, like the CIR, be verified by the Ministry of Research.

As a reminder, this tax credit targets collaboration agreements that differ from simple subcontracting, in that their objective is the joint pursuit of research projects by a company and one or more research organizations. This shared management is based in particular on the sharing of risks and results.

Regarding the decree itself, the following information should be noted:

A. Scientific perimeter - operations identical to the CIR :

The scope of eligibility for the operations concerned by the CICO is identical to that of the CIR. Article 49 septies V of the CGI mentions successively: activities having a character of fondamental research, those having the character of Applied research and those having the character of operations of experimental development.

B. Issuance of Approval :

Approval is granted by the ministry responsible for research, on presentation of an application conforming to the model laid down by the administration.

Must be attached to the request:

- Supporting documents attesting that the research organization complies with the definition of a research and knowledge dissemination organization (given by European Commission Communication No. 2014/C 198/01 on the framework for state aid for research, development and innovation) ;

- The approval referred to in II of article 244 quater B of the French General Tax Code : CIR approval ;

- Valid certificateA certificate issued by the Agence nationale de la recherche, recognizing the company's status as an organization dedicated to research and the dissemination of knowledge, or, failing this, a form conforming to a model drawn up by the administration, including information on the nature of its activities.

Renewal requests follow the same procedures and must be sent before the end of the expiry year.

Accreditation is granted for a period of 3 years or for the duration of the CIR approval remaining to run, if it is lower.

Approval may also be withdrawn if the research organization no longer meets one of the qualification criteria.

Calendar The first application for approval in 2022 must be submitted. before September 30, 2022 (article 3). Thereafter, the first application for the current year must be submitted by March 31.

C. Calculation of the 10% threshold of expenses incurred:

As a reminder, the research organization(s) with which the declarant contracts must bear at least 10 % of the research expenditure incurred in carrying out the research operations defined in article 49 septies V, as set out in the collaboration contract.

The decree specifies that the threshold is calculated by the ratio between:

- 1) the research expenses actually incurred by the research organization(s)

- 2) the total research expenditure incurred by all parties for carrying out the research operations provided for in the collaboration contract.

D. Reference period for the calculation of the CICO (idem CIR) :

The CICO is calculated over the calendar year regardless of the closing date of the financial years and regardless of their duration.

If the financial year ends during the year, the amount of the tax credit is calculated on the basis of eligible expenses invoiced for the last calendar year.

E. Utilization of CICO's Claim:

The tax credit for collaborative research is deducted from the tax due after deductions at source and other tax credits.

F. CICO Statement:

Companies subscribe to a special statement which must be filed with the SIE with the balance statement, therefore at the same time as the CIR, for companies subject to corporation tax.

It should be noted that, as for the CIR, the services under the ministry responsible for research also have access to the information contained in these declarations.

The reality of the allocation to research of the expenses taken into account for the calculation of the tax credit can be verified under the same conditions as for the CIR (provided for in article R. 45 B-1 of the Book of Tax Procedures).

- Summary of the most notable details and comments from the tax team:

Unsurprisingly, the implementing decree provides few additional elements compared to the Finance Act for 2022, on the substance of the system.

It is nevertheless specified that the control of the Cico could be carried out by the tax administration but also by the ministry for research, the controls will thus have a “fiscal” aspect and a “scientific” aspect.

The approval procedure already present on the MESRI site is confirmed, and the practical procedures for declaration are specified.

The most interesting details in our view concern:

- the methods for calculating the threshold of 10% which must be borne by the research organization, it is particularly interesting to note that the 10% are assessed on the total sum borne by all the parties, and not only that borne by the taxpayer. There are still some questions about the practical methods of the calculation (What means of proof? Will the contract be sufficient? If not, what information relating to the other contracting parties will have to be provided? What about the commercial margin?).

- Details on the calculation of the Cico over the calendar year and the calculation methods in the event of a staggered exercise.

We are awaiting comments from Bercy on the subject.

Source : DECREE N° 2022-1006 OF JULY 15, 2022

August 2022 | JURISPRUDENCE : Cross-border invoicing of R&D operations, net of the CIR, does not presume a transfer of profits

In this case, the Minister of the Economy, Finance and Recovery argued that the amount of the research tax credit "should not be used to determine the cost price of costs re-invoiced by the beneficiary of this measure to its parent company established outside France".

To this end, the administration claimed that the defendant company had carried out an indirect transfer of profits to its parent company and argued that the selling price of the services invoiced to the latter had been determined after deduction of the sums received in respect of research tax credits and that "this deduction constituted a renunciation of revenue".

The Court considers in this respect that the deduction of subsidies and sums received in respect of a research tax credit, made by a French company, for the determination of the transfer price of the product of its research to be invoiced to a foreign company which is related to it pursuant to a remuneration agreement, "... is not a deduction of the tax credit. cannot be considered as allowing by itself the possibility of and independently of the level of the transfer price to which this deduction leads by application of the contractual calculation method, to presume the existence of a transfer of profits abroad, within the meaning of Article 57 of the General Tax Code, on condition that the French company establishes a counterpart.

Consequently, the Court, noting that "the Minister did not provide proof that the sums reintegrated into the taxpayer's results constituted profits unduly transferred abroad within the meaning and for the application of article 57 of the French General Tax Code", decided that the Minister had no grounds for seeking the annulment of the initial judgment, which held that the reality of the indirect transfer of profits had not been established.

June 2022 JURISPRUDENCE: A reimbursement of an IRC claim may give rise to the payment of interest on arrears

What you must remember :

In this case, the judges of the Administrative Court of Appeal of Paris confirm that the delay in reimbursement of the CIR by the administration, after an explicit or implicit rejection (following the silence kept by the administration in the 6 months following the request for reimbursement) of the complaint entitles the payment, in addition to the legal interest, of default interest.

This decision nourishes a body of case law that has become abundant on this subject.

To analyse :

The judges consider that the payment of default interest is due when the response to the request for reimbursement of CIR occurs beyond 6 months.

Interest begins to accrue from the date of the request for reimbursement.

The Court specifies that if the reimbursement occurs following the admission of such a claim, it does not give rise to the right to the payment of default interest.

This is "just one" Court of Appeal judgment, which confirms a recurring position of judges on the subject.

Source: CAA of Paris, 9th chamber, June 10, 2022, 21PA00181

February 2022 DOCTRINE: Clarification on the companies benefiting from the innovation tax credit - February 2022 of 2023

Bercy clarifies its doctrine by indicating that companies in difficulty and companies subject to an unenforced recovery order are excluded from the CII.

Source: BOI-BIC-RICI-10-10-45-20 no. 245.

April 2022 | BEYOND THE CIR : MESRI presentation of the CICO

• What you must remember

- The application for approval for research and knowledge dissemination organizations (ORDC), under the collaborative tax credit (CICO), must be submitted before September 30, 2022.

- CICO approval will be issued on presentation of CIR approval and recognition as an ORDC.

The content of the application file is not specified and will be the subject of a decree in the coming weeks.

• Context

The Ministry of Higher Education, Research and Innovation (MESRI) has just published a short presentation of CICO on its website.

There is nothing new in relation to the text of the Finance Act, we are still awaiting the administrative doctrine on the subject.

The MESRI only recalls the expenses eligible for the scheme, the rates applied, and provides some details on the approval it will issue to research organisations.

The main information is that, for 2022, applications for approval can be submitted until September 30, 2022, and that CICO approval will be issued on presentation of CIR approval and recognition of ORDC status.

We are awaiting the implementing decree, which should provide details on the terms of the request.

DOCTRINE - Bercy comments on the changes in the regime of JEI and JEU resulting from the Finance Law for 2022.

Bercy recalls on the one hand that article 11 of the 2021 Finance Law for 2022 has extended the condition relating to the age of the Young Innovative Company, but only with regard to the tax advantage.

The benefit related to social exemptions remains limited to 8 years.

The administration thus recalls that "the extension of the age condition only has an impact, where applicable, on income tax and has no effect on exemptions from local taxes and social security contributions, the duration of which is not extended.

In addition, the doctrine specifies that “expenses eligible for the CICO are taken into account in the calculation of the threshold of 15% of R&D expenses that a company must make to be eligible for JEI qualification. »

Source: https://bofip.impots.gouv.fr/bofip/13518-PGP.html/ACTU-2022-00045

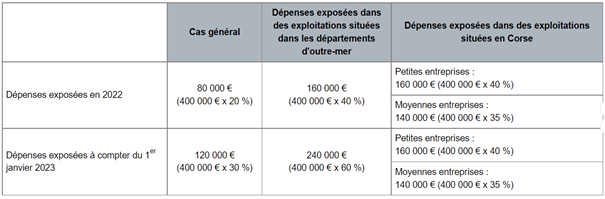

February 2022 | DOCTRINE: BOFIP update on the modification of the ITC rate and the cap from 2023

Bercy updates its administrative doctrine and takes into account the novelties of the Finance Act for 2022, and confirms that the rate of the Innovation Tax Credit (CII) goes from 20 to 30% from 1er January 2023.

For farms located in overseas departments, this rate is increased to 60%.

As the expenditure base is still capped at €400,000, as of January 1, 2023, the increase in the CII rate has the effect of increasing the tax credit ceiling to €120,000.

Source: BOI-BIC-RICI-10-10-45-20 §230

- Extension of the innovation tax credit

The application of the CII is extended for 2 years, until December 31, 2024.

Furthermore, to ensure the system's compliance with Community law, the item corresponding to “other operating expenses” is now excluded from the base of expenses recoverable in the CII.

In order to compensate for this exclusion, the rate of CII (common law) goes from 20 to 30% and the rate applicable to Overseas goes from 40 to 60%.

These changes come into effect from January 1, 2023.

Source : Section 83

- Extension of the duration of JEI status

Until now, the status was granted for the first 8 years of a company's existence.

From now on, companies that are eligible for the scheme can benefit from it until their 11th anniversary.

With regard to this system, it is interesting to note that the expenses retained under the CICO (tax credit in favor of collaborative research) will be taken into account for the calculation of the research expense ratio.

As a reminder, the JEI status was only extended by the 2020 finance law until December 31, 2022

These changes concern companies that will close their financial years on or after December 31, 2021.

Source: Section 11

October 2021 | DOCTRINE: Possible extension of JEI status to 11 years

Until now, the status of Young Innovative Company was reserved for SMEs created less than 8 years ago.

Article 9 of the first part of the Finance Law for 2022, adopted at first reading in the National Assembly, proposes to extend the period by 3 years. The status could therefore apply until the 11th year of creation of the company.

As the FL has not yet been definitively adopted, this measure will have to be confirmed by the definitive adoption of the text.

Source: Amendment No. I-1384 to the draft finances for 2022 (PLF2022)

February 2021 | JURISPRUDENCE : Application of the 40% penalty for unjustified deliberate failure to comply if related solely to the registrant's behavior during the control procedure

The Council of State, in a judgment of February 11, 2021, recalled that the simple behavior of the taxpayer could not serve on its own to justify the 40% penalties.

In this judgment, the tax administration applied a penalty of 40% to a company because of its behavior during the oral and contradictory debate procedure.

However, the Council of State reminds us that the behavior of the taxpayer during the procedure cannot, alone, justify the application of the penalty for willful breach. Indeed, this penalty is to be assessed with regard to the year inspected and not with regard to the year of the inspection.

To justify this penalty, it is up to the administration to prove the presence of a material element and a moral element. The material element will be characterized by a defect in the declaration, and the moral element will be the intentional nature of the act.

As a result, the simple behavior of the taxpayer during the control cannot in itself justify the application of this penalty for willful breach. On the other hand, the tax administration can use the argument of the behavior of the taxpayer to support the implementation of the said penalty.

Source: CE, February 11, 2021, n ° 432960

September 2019 | FISCAL REFORM: French-style IP Box

The 2019 finance law modified the tax regime for income from operations attached to patents and intangible assets (patent assignment, trademark licensing, etc.). The old system provided for the application of a reduced rate of 15% on capital gains on disposal, but the French tax approach did not comply with OECD requirements.

This new provision allows taxpayers receiving income from their intangible assets to benefit under certain conditions from a reduced rate of 10%.

In addition to a lower rate, the new system widens the scope of the system which now applies to capital gains from the sale, concession or sub-concession of software protected by copyright.

The new method consists in deducting R&D expenses from products resulting from the sale, concession or sub-concession of intangible assets. A ratio should then be applied to the net result. The tax advantage is therefore now correlated with the R&D expenses incurred by the company, expenses which are likely to give entitlement under certain conditions to the research tax credit.

Source: Article 37 of the finance law for 2019

November 2018 | PROCEDURE: Deadline for filing a rescript for a JEI

In the update of its Bofip database dated November 7, 2018, the Tax Administration specified the time limit within which the company wishing to file a “Young Innovative Company” rescript must submit its request.

As a reminder, companies claiming JEI status can file a rescript request to ensure that they meet the conditions of the system. Initially, no deadline was mentioned for the filing of this rescript. With this update, the Administration clarified that the rescript must, in any event, be filed before the legal date for filing the company's tax return.

Source: BOI-RES-000014-20181107