International consulting firm in innovation and performance

Our mission: accelerate the innovation and performance of companies and territories for a responsible development and sustainable growth

3 main areas of expertise :

Innovation

Develop innovative programs and projects to accelerate competitiveness and sustainable impacts.

Human Resources

Support HR strategy and challenges from economic performance to social performance.

Taxation

Respond to financial challenges by optimizing energy and local taxation and asset management.

Our sector-based approach, a major asset for our customers

At G.A.C. Group, we have chosen to adopt a sector-based approach to adapt to the specific needs of each customer, whether in terms of regulation, innovation or digital transformation. Our consultants have in-depth knowledge of each sector, enabling them to offer tailor-made solutions that meet our customers' expectations and objectives.

Our latest news

- April 25, 2024

- March 27, 2024

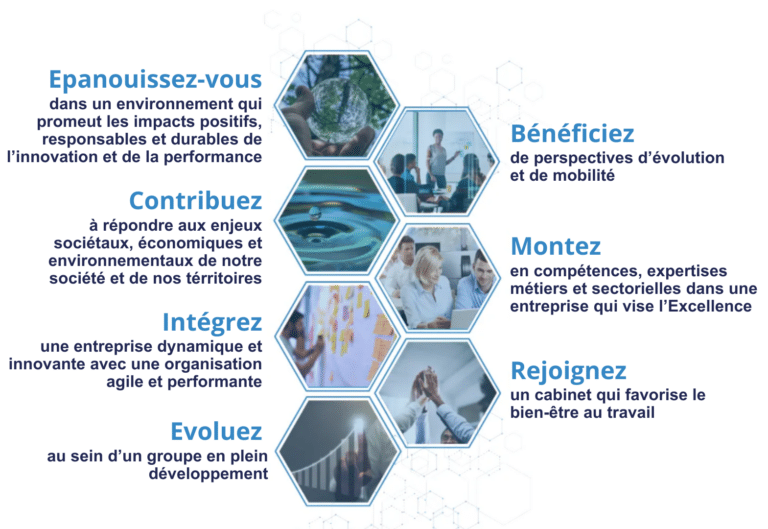

If you too would like to help our customers meet their challenges and contribute to the transformation of their organizations, join us and become part of an exceptional human and professional adventure!

Find out more about ...

Our clients

Our partners

Newsletter

Receive all our expert news by e-mail.

Subscribe to our newsletter.

Contact us

By clicking on send, I consent to the information entered in the form being used by GACGroup to respond to my request. To know the details of the processing or exercise my rights, in particular the withdrawal of my consent to the use of the data collected, I can consult the Privacy policy of GAC Group.